Market Data

March 23, 2013

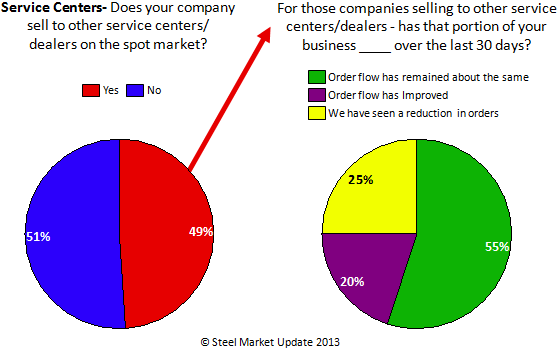

Survey Results: Service Centers & Spot Warehouse/ Dealer Sales

Written by John Packard

SMU was following up on an article we did earlier this week regarding service center spot sales to other warehouses/dealers during our survey process. We wanted to go out to a larger audience and see what kind of impact distributors were seeing in their sales to other distributors. What we found through our survey is most service centers reporting that their spot sales either remained about the same (55 percent) or has actually improved (20 percent). Only 25 percent of those responding to this question reported a reduction in orders from their service center/dealer customers.