Prices

September 12, 2013

Iron Ore and Scrap Futures

Written by John Packard

Iron Ore

The spot price is still $135/MT zone with the forward curve still in a healthy backwardation. Most expect Iron Ore to retrace, difference of opinion lies in whether it will see a big sell off or a modest one. The recent positive economic data out of China along with not terrible inventory levels at mills and more modest production rates have likely stalled any decline in Iron Ore as the market waits to see if this might be the beginning of a growth trend. However, rebar prices are declining at a time when demand should be decent and this has some worried for where rebar prices go in China so go all ferrous markets. This story should sort itself out in the pretty near future. Let’s Call Oct ’13 either side of $129.50/MT, Q4 ’13 either side of $127/MT, Q1 ’14 either side of $125.50/MT and Cal ’14 either side of $116.50/MT. Markets are all down about $0.50-1.00/MT in the week.

Scrap

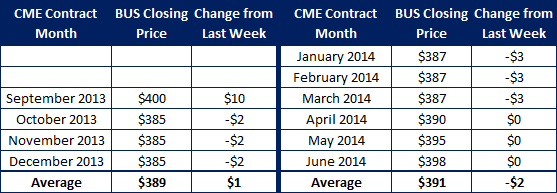

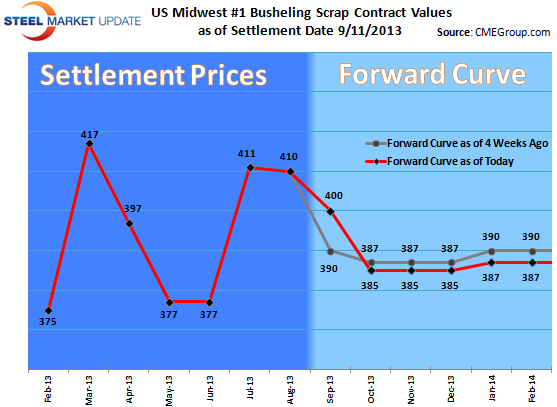

On the domestic front, the September levels were off more than expected with Shred down $15-20/GT in many zones and Bush down $10/GT in the MW to print the AMM Index for September at $400.07/GT. Export interest remains quiet and provides little support and expectations are that scrap will be under further pressure in October as the mix of production swings back away from EAF as BOF problems resolve.

On the export front, the market is quiet as demand from Turkish mills is non-existent for now. Their demand picture is not good with turmoil in Egypt and Syria causing disruptions in various markets in MENA. Scrap inventories by some had also been built up in anticipation of better demand that didn’t materialize. The CFR index is now down to $368/MT. There continues to be no real bid interest on the futures contract. The situation for the world scrap market is not expected to improve as these demand factors prevail, Russia supply is likely to increase, and currency rates keep buying channels localized.