Prices

September 19, 2013

HRC Futures Weakens on Low Volumes

Written by Bradley Clark

The Futures market has continued to be characterized by limit trading and a touch softer pricing. The lack of volatility in the physical market over the past few months has not given futures traders an impetus to put on (or close out) positions. Overall, the market has been quite boring with the expectations that better days are around the corner if we see prices breakout in one direction or the other as we move into the last quarter of the year.

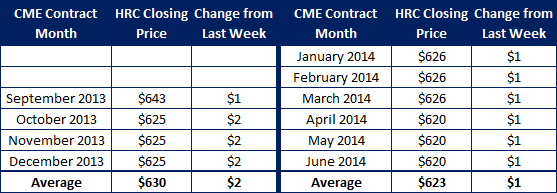

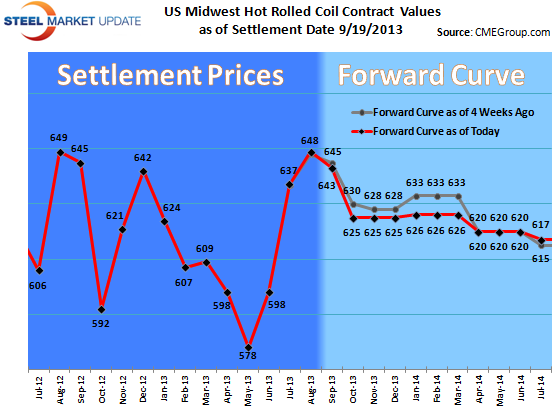

Prices have remained relatively unchanged over the past few weeks, with a slight downside bias. Month on month the forward curve has experienced about a $5-10 dollar erosion in all periods in line with the same decrease in physical spot pricing over the same period. The market remains backwardated with Q4 trading around $623, Q1 $627 and cal 14 $625.

Supply and demand seemingly remains fairly balanced in the physical market, bulls and bears alike have enough ammo right now to argue their case, giving a muddled picture as to which direction prices will move next.

Open interest remains stable around 14,000 lots indicating that market participants are not exiting the market even though traded volumes have remained light. The market needs a catalyst one way or the other to increase trading.