Market Data

September 29, 2013

Oil and Gas Drilling a Game Changer for the Steel Industry

Written by Peter Wright

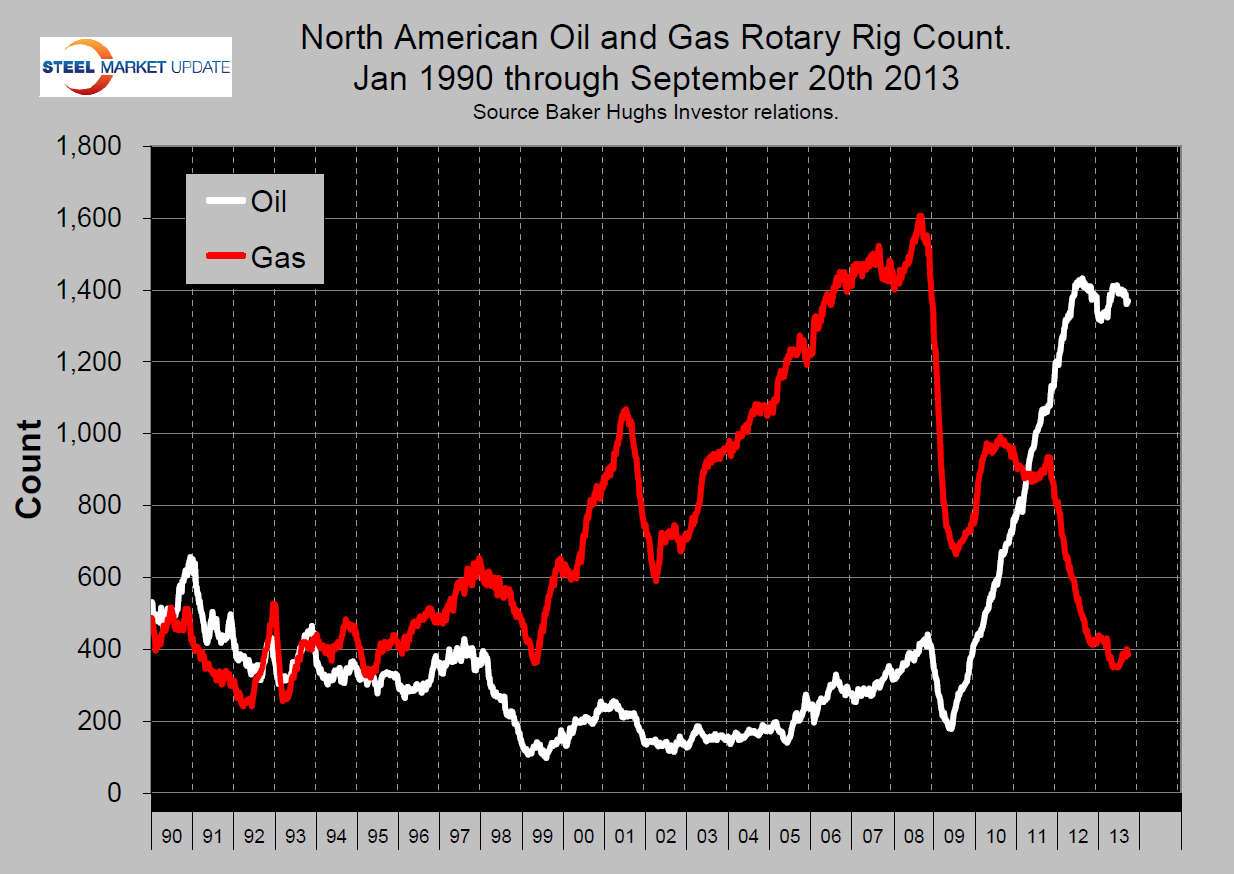

The Baker Hughes North American Rotary Rig Count is a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States and Canada. Rigs are considered active from the time they break ground until the time they reach their target depth and may be establishing a new well or sidetracking an existing one. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies. The number of rigs operating has a significant impact on the steel market especially for hot rolled coils.

The oil rig count peaked in August last year at 1,432 and by the September 20th count was down by 4.6 percent since then. This is still close to a high point for the last 2 ½ decades. Gas rig activity in contrast is down by 76 percent from its recent high point in September 2008, (Fig 1).

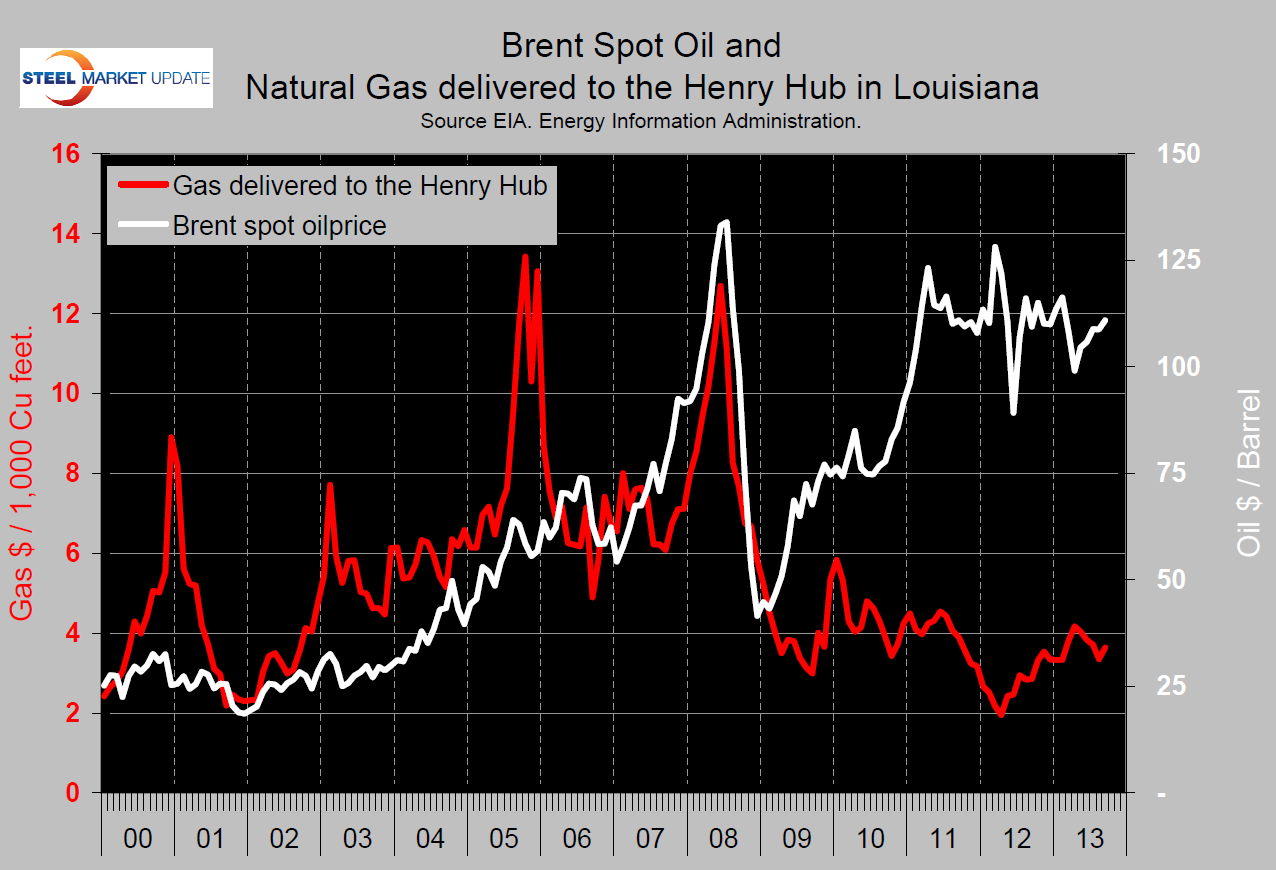

Drilling activity is obviously closely related to return on investment as determined by prevailing prices. The US Energy Information Administration publishes oil and gas prices daily. For the purpose of analysis SMU tracks the Brent spot price Europe FOB and the natural gas price delivered Henry Hub Louisiana. Oil prices have been high by historical standards for 2 ½ years which has driven oil exploration and production in North America. Activity in the Bakken shale formation illustrates recent developments.

The Bakken is a monster oil and gas deposit covering almost 15,000 square miles across North Dakota, Montana, Saskatchewan and Alberta. An April 2013 estimate by the USGS projects that 7.4 billion barrels of undiscovered oil can be recovered from the Bakken and Three Forks formations and 6.7 trillion cubic feet of natural gas as well as 530 million barrels of natural gas liquids using current technology. An executive of a company deeply involved in the Bakken recently estimated that the basin will ultimately yield 20 billion barrels.

Until 2005, the Bakken had been largely written off as uneconomic. Then leapfrogging advances in horizontal drilling technologies unlocked these reserves and other huge oil deposits previously considered uneconomic across the country. Porosities in the Bakken averages about 5 percent, and permeability is much lower than typical oil reservoirs.

The presence of vertical to sub-vertical natural fractures makes the Bakken an excellent candidate for horizontal drilling techniques in which a well is drilled horizontally along bedding planes, rather than vertically through them. In this way, a borehole can contact many thousands of feet of oil reservoir rock in a unit with a maximum thickness of only about 140 feet. Production is enhanced by artificially fracturing the rock to allow oil to seep to the oil well. As a result of the Bakken, North Dakota as of 2013 is the second oil-producing state in the U.S., behind only Texas.

The U.S. Energy Information Administration estimated in 2013 that there were 1.6 billion barrels and 2.2 trillion cubic feet of technically recoverable oil and natural gas in the Canadian portion of the Bakken formation where since the 2004 discovery of the Viewfield deposit in Saskatchewan production has increased to a lesser degree than in the US. (Source Casey Research and Wikipedia.)

Developments such as this have been a game-changer for North American energy supplies. Both oil and gas prices crashed during the recession but the price of natural gas has not since recovered, in fact it has drifted down slightly for the last 2 ½ years, (Fig 2). Expanded domestic oil production simply substitutes for imports but gas has to make its own market. The success of shale production has caused the supply of natural gas to exceed demand in spite of the recent trend of gas replacing coal for power generation.

Exports of LNG are increasing and its use as a vehicle fuel is becoming more viable. Oil and gas are both hydrocarbons but the hydrogen content of gas is much higher than that of oil which means that the ratio of CO2 production to the BTU output is much lower. Another example of how natural gas will make its own market is the current investments in gas based DRI production facilities in Convent Louisiana and Corpus Christi Texas. These developments will restore the supply demand balance of natural gas and will escalate the gas rig count; the probability given the political emphasis on global warming is that this change will occur rapidly.

Impact for the Steel Industry

The increase in shale drilling means a boom for the steel industry, especially producers of OCTG steel. An average rig operation uses around 300 tons of OCTG per rig per month, or approximately 6.4 million tons (short) per year. According to EIA, there are more than 300,000 miles of natural gas pipeline crisscrossing the United States with several new construction projects underway. Pipeline used for natural gas transmission varies in size from 20 to 42 inches in diameter, adding up to serious steel tonnage. For example, Access Midstream is currently laying 35 miles of 24” pipeline in Carroll County, Ohio. At 24” diameter and one half inch thick, it would weigh 125 lbs per foot or 330 tons per mile—11,550 tons for 35 miles. Access Midstream has plans to lay 250 miles of pipeline in 2013.

Over 2000 miles of new natural gas transmission lines are expected to be added annually over the next 25 years in the U.S. and Canada, according to a study completed by INGAA and ICF International, at an investment of over $205 billion. In addition, 1,300 miles of oil and natural gas liquid (NGL) transmission pipeline and infrastructure will be constructed annually at an investment cost of $46 billion.