Prices

October 3, 2013

Iron Ore, Scrap Futures - Ore Quiet Due to Holiday – Scrap Climbs

Written by Bradley Clark

TSI Iron Ore: Market Quiet During Chinese Golden Week…

Iron ore prices have remained steady over the past week as the Chinese have been off for their Golden Week holiday. Demand while steady appears to be seen as fragile by many. The market remains in backwardation with prices down the curve continuing to trade at a discount to current spot pricing. The current spot price is around $131/ton with the q4 trading at $126, q1 ’14 at 122 and cal 14 at $110. Market participants await the return of their Chinese counterparts to give renewed impetus and direction to the market. Volumes have been down this week understandably but remain very robust.

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Prices Climb

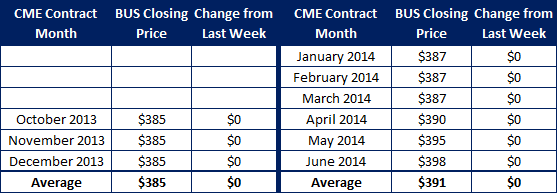

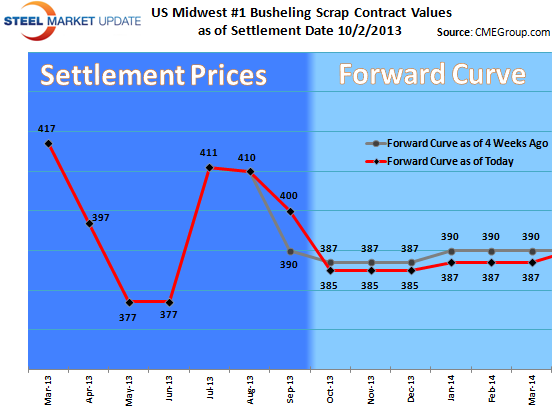

The busheling market has shown unexpected strength this week after early signs the market would soften in October. Initially sentiment suggested the market would settle around $10 down this month, but recent mill price hikes and steady mill buying has caused the market to do a complete 180 with most deals being concluded sideways at worst from last month’s pricing. The physical market strength has filtered into the futures market with bids returning to the market looking for offers around $390-400 for q4 periods. No trades have been reported but there has been a definite resumption of interest particularly from buyers this week as the physical market begins to price.

Expectations are for the index to be relatively unchanged from last month’s print of $400.07 when it comes out next Thursday the 10th.

Again, there have been no reported trades this past week.