Market Data

November 7, 2013

GDP Growth 3rd Q 2013 First Estimate

Written by Peter Wright

This morning’s report from the Bureau of Economic Analysis surprised on the upside with a growth of 0.7 percent from Q2 and 2.82 percent annualized. GDP in Q3 2013 was 1.65 percent higher than in Q3 2012. This data is the first estimate for the third quarter; revisions have often been substantial recently.

The following is an extract from this morning’s BEA report.

“Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 2.8 percent in the third quarter of 2013 (that is, from the second quarter to the third quarter), according to the “advance” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.5 percent.

The Bureau emphasized that the third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the third quarter, based on more complete data, will be released on December 5, 2013.

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP growth in the third quarter primarily reflected a deceleration in imports and accelerations in private inventory investment and in state and local government spending that were partly offset by decelerations in exports, in nonresidential fixed investment, and in PCE.”

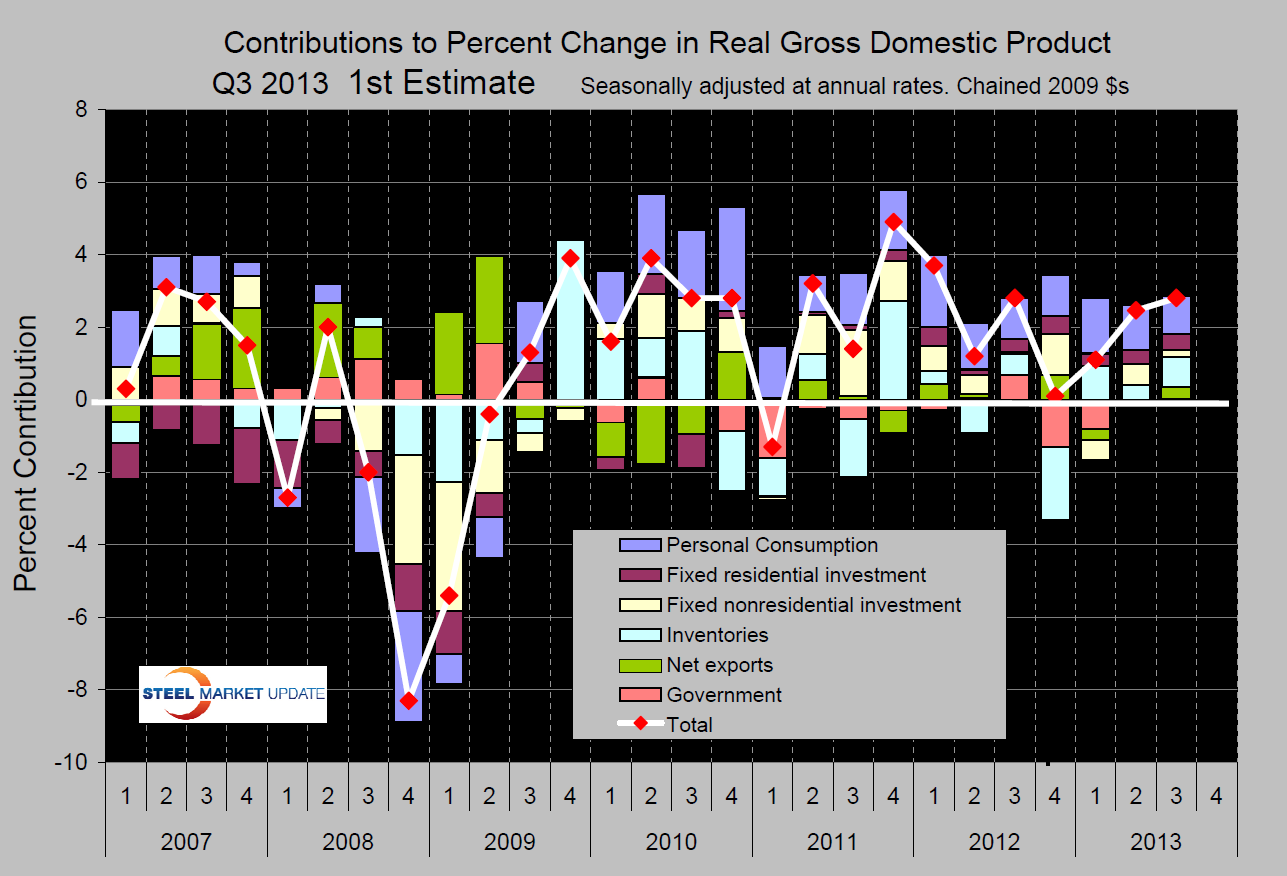

Figure 1 shows the SMU graphical analysis of contributors to GDP quarterly since Q1 2007. Compared to Q2 the major changes were that the contribution of fixed non residential investment declined from 0.56 percent to 0.2 percent. Personal consumption fell from a contribution of 1.24 percent to 1.04 percent. On the upside the contribution of inventories grew from 0.41 percent to 0.83 percent. It seems counter intuitive that rising inventories causes the calculated value of GDP to increase but that is how it is done. The contribution of fixed residential investment has been in the range 0.35 percent to 0.5 percent for the last five quarters suggesting a healthy housing market. Another way of looking at this is that comparing Q on Q, residential investment has been reported to have double digit growth for the last five quarters. This seems to totally contradict the data on housing starts.

Figure 1 shows the SMU graphical analysis of contributors to GDP quarterly since Q1 2007. Compared to Q2 the major changes were that the contribution of fixed non residential investment declined from 0.56 percent to 0.2 percent. Personal consumption fell from a contribution of 1.24 percent to 1.04 percent. On the upside the contribution of inventories grew from 0.41 percent to 0.83 percent. It seems counter intuitive that rising inventories causes the calculated value of GDP to increase but that is how it is done. The contribution of fixed residential investment has been in the range 0.35 percent to 0.5 percent for the last five quarters suggesting a healthy housing market. Another way of looking at this is that comparing Q on Q, residential investment has been reported to have double digit growth for the last five quarters. This seems to totally contradict the data on housing starts.

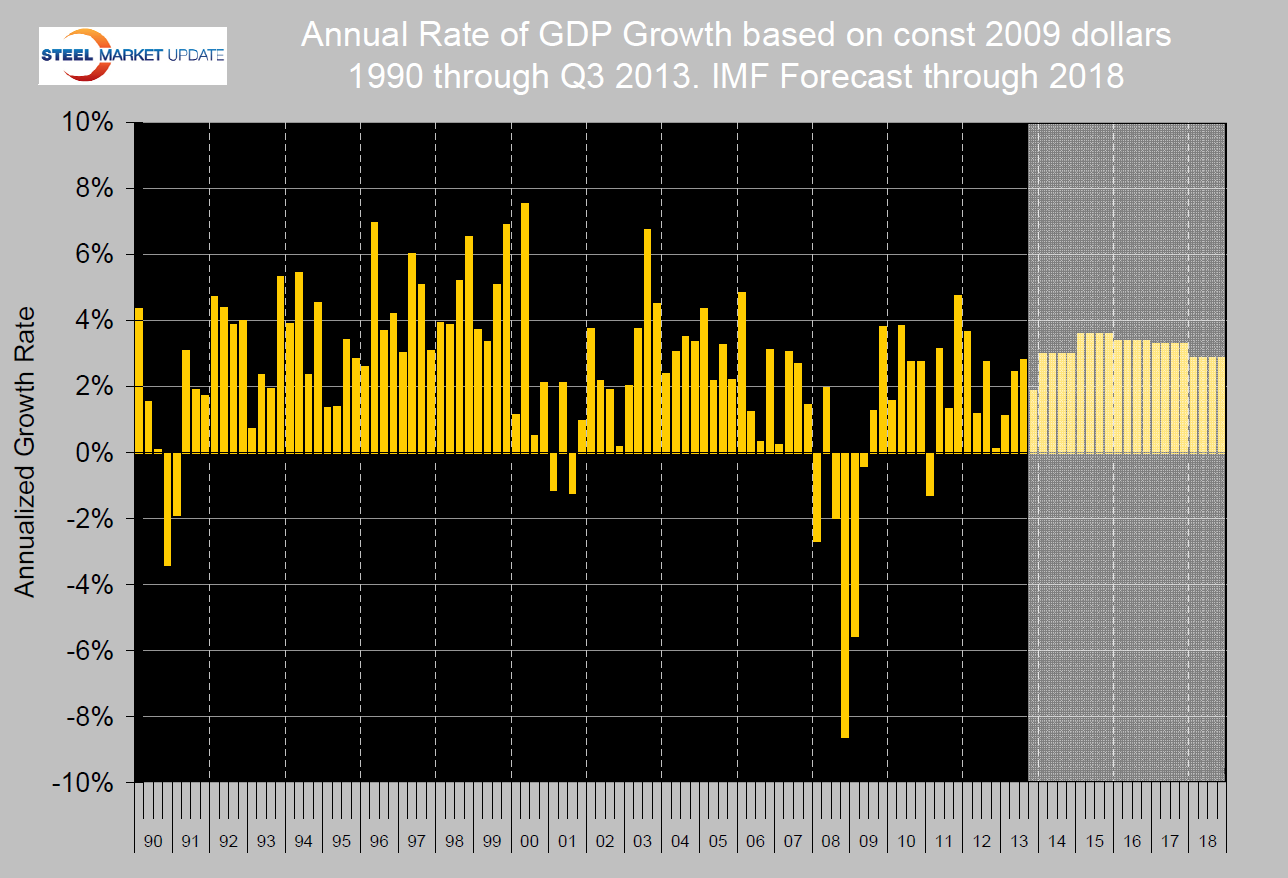

Figure 2 shows the growth of GDP quarterly since Q1 1990 with the IMF forecast through Q4 2018. The 1st estimate of Q3 GDP growth beat the IMF expectation which was 1.9 percent.

Figure 2 shows the growth of GDP quarterly since Q1 1990 with the IMF forecast through Q4 2018. The 1st estimate of Q3 GDP growth beat the IMF expectation which was 1.9 percent.

Moody’s forward looking conclusion published by Economy.com today is as follows; “The federal shutdown and political brinkmanship around the Treasury debt ceiling hurt the economy, but in the fourth quarter, not the third. The hit to fourth quarter real GDP is estimated at $20 billion, equal to half a percentage point of growth. Instead of picking up pace as previously expected, U.S. growth will remain stuck near a lackluster 2%. Lawmakers’ agreement to extend funding for the government and suspend the debt limit into early next year forestalled worse economic damage for now, but as long as lawmakers stay deadlocked over the direction of the federal budget, the economic recovery will not gain momentum. Consumers and businesses will remain on edge, holding back spending, investment and hiring. Although global investors continue to view the U.S. as the safest place to put their money, their confidence is being shaken.

Despite this, the economic recovery is four years old and counting, and the private economy has made enormous strides in correcting the problems that triggered the Great Recession. Business balance sheets are about as strong as they have ever been, the banking system is well-capitalized, and households have significantly reduced their debt loads. The private economy is on the verge of stronger growth, more jobs and lower unemployment. Homebuilding is set to accelerate as rapidly rising prices demonstrate that demand is rising faster than supply. More homebuilding means more jobs and income. Every new single-family home supports more than four jobs in construction, manufacturing, transportation, financial services, retail, and a range of other services in the year the home is put up. Each multifamily unit supports slightly more than one job.”

SMU conclusion, this is an OK report, particularly considering the continued strong performance of durable goods which have grown in the range 5.8 percent to 10.5 percent in the last five quarters confirming the separate report on durable goods orders put out by the Department of Commerce.