Prices

December 23, 2013

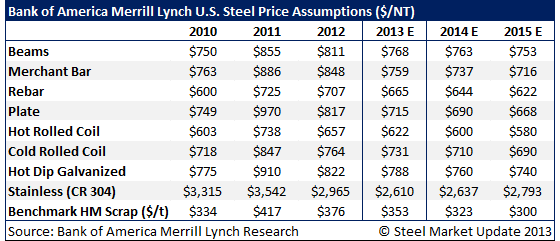

Bank of America Price Forecasts for 2014 & 2015

Written by John Packard

I thought our Premium Level readers might appreciate the latest forecast from Timna Tanners, Bank of America Merrill Lynch metals and mining analyst. Timna was a little “light” in her price forecast for 2013 hot rolled coil which was originally $555 average and was upgraded during the year to $622.

Tanners believes some of the big themes for 2014 will be:

“While China’s appetite for steel in 2013 surprised us, signs are pointing to slower growth into 2014, with concern over pollution a renewed focus that could dampen demand for raw material inputs but help balance global steel markets. We’ve been skeptical of excess supply containment in China in the past, but a new regime maybe less tolerant of smog. For aluminum, nickel (and by association stainless) and coal, we expect potential further capacity closures to continue to play an important role, with a lower cost curve a risk to determining where commodity values gravitate eventually. We think specialty metals move beyond aerospace-driven demand to better activity in the energy and chemical processing space More spot and less contract selling in 2014 promises to keep steel prices volatile. We expect restarts and imports contribute to a choppy start with the timing of non-residential construction recovery a key factor for better steel and aluminum volume into 2014E….”

“In our U.S. steel supply and demand forecasts… we anticipate utilization can average ~78% in 2013E and 79.5% in 2014E. We expect better utilization in 2014 will largely reflect construction-focused long products mills ramping up. Sheet mill utilization should remain stagnant in the low 80% level, in our view, as incremental demand is absorbed by new capacity.”

It is this view – that any additional demand will be absorbed by new capacity which is coming back online in the U.S. along with higher flows of imported steels that drives BoA price forecasts for 2014 (especially during the first 6 months 2014). This is why you see price averages below those of 2013.

The BoA long range forecast also calls for iron ore prices to be much lower than the $130+ per dry metric tonne level we are seeing for 63% Fe fines delivered to China at this time. Of course, the forecasts for 2013 also called for ore to be closer to $100/dmt (or below) and that never materialized.