Prices

January 16, 2014

Will January Imports be the First “Surge” Month?

Written by John Packard

There has been much written and said about the projected “surge” of imported steel expected to hit the United States over the next few months. Many of the steel analysts believe the incoming foreign steel will help dampened flat rolled steel prices which peaked during the first week of January at $680 per ton ($34.00/cwt) according to the hot rolled average price index produced by Steel Market Update. Bank of America metals and mining analyst, Timna Tanners in a note to clients said, “…Aggressive price premiums to global prices and contract negotiations helped encourage U.S. buyers to order import, which should pressure U.S. prices from as high as $700/st…Imports have reportedly been arriving into Houston and Chicago at a $100-$120/st discount to mill sheet price offers on a delivered basis….”

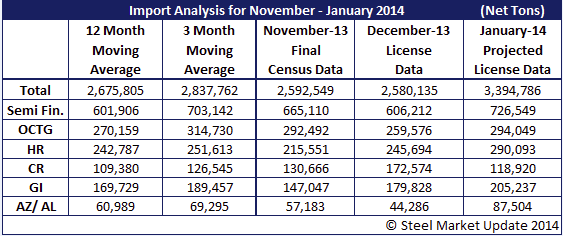

Based on U.S. government import data, November and December total imports were fairly tepid, coming in below both the 3 month and 12 month moving averages (see table below). However, based on the first 14 days of license data (we have linked to a recent article written by David Phelps regarding the licenses data numbers and what they really mean), if the rate of inbound license requests continues and all of the steel indeed shows up during the month of January – the U.S. would receive 3.3 million net tons of foreign steel.

Hot rolled imports for November were less than the 12 month moving average while December license data has imports at 245,694 tons –only 3,000 tons above the 12MMA. The initial forecast is for hot rolled imports to total 290,093 tons during January.

Cold rolled imports rose significantly during the month of December totaling 172,574 based on license data collected through the end of the month. The 12 month moving average for CR is 109,380 tons. The December surge was due to increased exports of CR out of China. At the moment, based on incomplete license data through the 14th of January, cold rolled imports are forecast to be 118,920 tons.

Based on 14 days worth of data, galvanized imports are forecast to exceed 200,000 tons above the 169,729 tons 12MMA.

Gavalume imports is forecast to be significantly higher in January if the license trend continues for the entire month. Based on the first 14 days of data it appears Galvalume could be as high as 87,000 tons in January. December licenses suggest Galvalume imports will total 44,286 tons which is below the 12MMA of 60,989 tons.

Again, we remind our readers that preliminary license data – especially data which represents only the first 14 days of the month – can be very misleading and the ultimate final census numbers can be much different than the forecasts we have outlined above.