Prices

February 20, 2014

OCTG Trade Case – The Big Picture

Written by Paul Lowrey

The following article was written by steel industry consultant and contributor to Steel Market Update, Paul Lowrey. Mr. Lowrey owns a consulting company called Steel Research Associated, LLC which works with steel mills and large distributors or manufacturing companies involved with steel and steel products. More information about Mr. Lowrey can be found in the About Us section of our website.

There is a lot of buzz about the unfavorable preliminary ruling in the OCTG trade case. By now, you have seen the individual country import volumes and preliminary duties, so I am not going to repeat them here. Instead, I am going to describe the big picture because the issues are more significant than some of you may think.

First and foremost, let’s remember the ruling is preliminary and not final. As recently as 2009, a preliminary duty of 0% on a large Chinese OCTG producer was later changed to 99% in the final ruling. This trade case is not over yet. We will have to until early July when the final ruling is expected.

So, how big is the market and why is it important? I am going to address two products in this article which are collectively referred to as energy tubular products. Oil Country Tubular Goods (OCTG) are used in energy drilling and Line Pipe is used in energy transportation. Line Pipe was not included in the trade case, but it carries the same import penetration rate of 50% +/- as OCTG.

According to data from the Preston Pipe & Tube Report, domestic energy tubular consumption will average 11.5 million short tons (MT) per year for the years 2012 through 2014 (total shipment basis excluding inventory changes). This includes about 7.0 MT for OCTG and about 4.5 MT for Line Pipe. Energy tubular products represent 11% of total current steel demand of 107 MT. It is one of the largest domestic market sectors for steel.

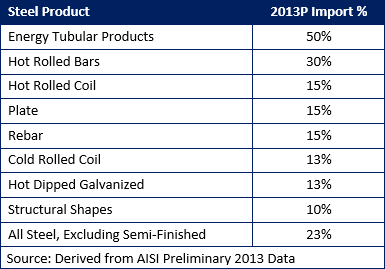

Now, let’s take a look at the import levels. The following table shows the current import penetration rate of major steel products.

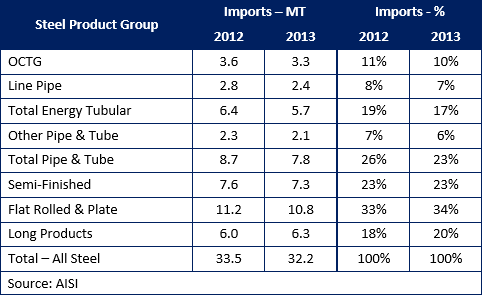

As shown, the import penetration rate of energy tubular products is by far the highest of any steel product of significant volume. In fact, it weights the total of all steel products excluding semi-finished. The following table shows that imports of energy tubular products are nearly 20% of all steel products including semi-finished.

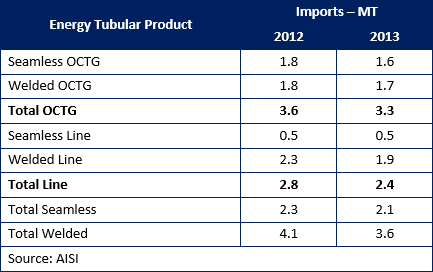

There is one more import analysis to look at. It includes the split of welded & seamless on energy tubular imports as shown in the following table.

There are several important considerations here. First, welded energy tubular imports in total imply a hot band equivalent of about 4.0 MT. That is equal to one or two hot strip mills. When you consider welded OCTG imports alone, the nine trade case countries accounted for 80% of all imports. That is equal to about 1.5 MT of hot band equivalent.

Finally, as many of you are aware, there is significant new domestic capacity in various stages of construction, development and planning. I’m not going to list all the individual companies here, but it adds up to 2.1 MT of seamless and 1.3 MT of welded for the years 2013 through 2016.

Let’s review the key points of this analysis

• One of the largest domestic markets for steel

• Highest import penetrated product, by far

• Accounts for nearly 20% of all steel imports

• 3.4 MT of new domestic capacity being added

The OCTG trade case is not just a domestic OCTG producer issue. It is a domestic steel industry issue as well.