Prices

March 25, 2014

Steel Buyers Upset Over Early Move by Price Index

Written by John Packard

Usually the news about price increase announcements is regarding the ability of the steel mills to collect all, or a portion, of the announced flat rolled price increases. With the latest announcements made last week led by ArcelorMittal on Monday and then followed by the rest of the industry as the week progressed, the question has become at what point did actual transaction prices begin moving higher? According to Platts Steel Markets Daily, flat rolled prices began moving prior to the end of this past week and have continued to move higher this week. Platts now has their Hot Rolled Coil index at $655 per ton as of Monday of this week.

Steel buyers, who have contacted Steel Market Update on the subject, are questioning the timing and motives behind the quick move higher by Platts. What makes the movement by Platts of much more interest this year than last, is due to a number of mills moving to Platts for the basis of their 2014 contract adjustments.

Has Platts HRC Index Decoupled from Other Indices?

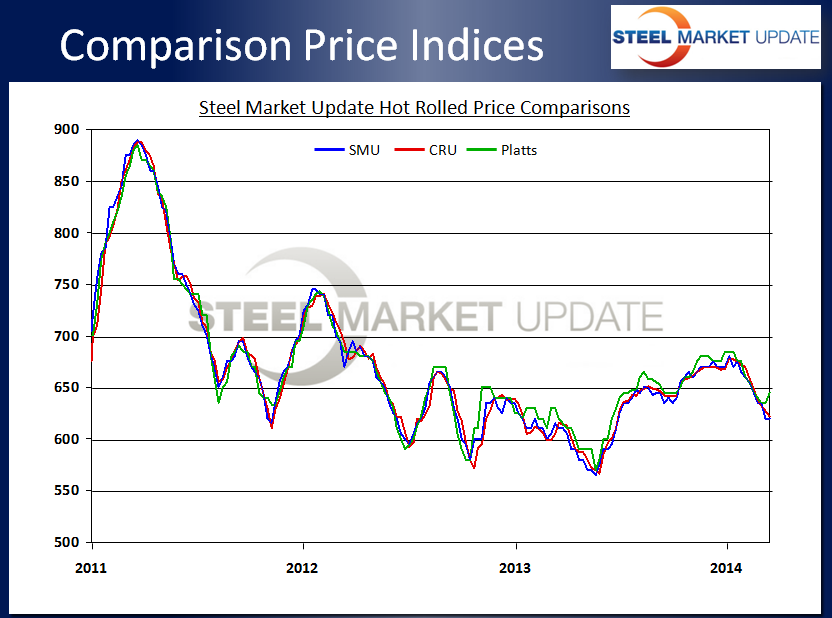

The issue has become more about the decoupling of the Platts HRC pricing from the other indices. You can view the history of Platts, CRU and SMU over the past few years and come to your own conclusion if there has been a decoupling or only minor gyrations which are related to slight variations in methodologies used by each index. The green line is Platts, red CRU and blue for SMU. By the way, Steel Market Update has placed an interactive graphic on the website for our Comparison Price Indices (CPI). The interactive graph will allow readers to drill in on specific price movements (weekly basis). You do need to be logged into the website to see and use the interactive graphic.

We had two large companies contact us with specific issues related to the price movements by Platts since the announcements were made early last week. One large manufacturing company steel buyer sent us these comments:

“I find the timing of the latest price increase announcements for spot steel pricing to be curious and more than a little bit of a coincidence. The lack of coincidence is most apparent when considering that forward contract pricing based on Platts Index deals are reset based on index pricing posted right around the first of the month.

“Last week, price announcements came…….Next week, pricing on Platts metrics all reset for contract pricing deals……justifiable coincidence, not likely…….

“Like the CRU deals of the past, Platts based deals establish contract pricing on presumably auditable movements of the spot market. So, does it or doesn’t it make sense for the mills to manipulate (sorry, I mean “adjust”) the spot market in time to re-set contract pricing, even if they don’t have spot tons to sell?

“If the spot price increases, the PO for it becomes a matter of record and auditable by consequence. If every mill plays Follow the Leader, which in this case the leader is AM, and raises spot pricing in tandem, is this good and creative marketing or is it something a little less clean, like the Big C (collusion)?

“You [Steel Market Update] yourself reported last Thursday evening: ‘With the exception of AK Steel, who this evening came out with an increase on hot rolled but nothing on cold rolled or coated (where they have nothing to sell into the spot market anyway), just about all of the domestic mills that make pubic or semi-public announcements have followed the ArcelorMittal lead and have come out with price increases. The numbers are all either exactly the same or very similar with hot rolled base prices being referenced at $660 per ton ($33.00/cwt) and cold rolled and coated steels being referenced at $790 base ($39.50/cwt) plus applicable extras.’

“When entering into these agreements, there was substantial history showing that CRU and Platts pricing were both very similar over a long period of time.

“Now that the mills have determined CRU to be the scourge of the earth and elected it as the common scapegoat for their own poor management of spot market pricing, CRU and Platts index prices are no longer closely aligned with each other…..justifiable coincidence, not likely….. The spreads have clearly decoupled and by most accounts, Platts deals set for 2014 are quite upside down when compared to CRU deals of the past.

“A reasonable person observing the US steel market from anywhere on the planet might truly be inclined to think that Platts pricing may actually be an instrument of the mills, as opposed to the independent, transparent and auditable entity that it’s purported to be.

“This buyer might be willing to lay wager that the coincidence is not likely, but to be fair, this may also just be a self serving and misguided rant…..you be the judge.”

The head of purchasing for a large service center group also contacted Steel Market Update on Monday asking SMU not to be influenced by what Platts reports as market pricing (As a quick note to our readers Steel Market Update does not take into consideration what the other indices are reporting prior to conducting our own market research and providing our members with where we see market prices each week).

“John, I encourage SMU to stay consistent with its survey methodology, and not be influenced by Platts.

“Today’s price move is the example of why their credibility is too shallow to permit their index to be used to set prices.

“We know they exclude any order greater than 500t in their unstructured initiated survey, but they give the false impression that they’re collecting lots of small market transactions every day. If Platts reported that they picked up some small transactions at 660, it would be just fine. In fact, small buyers needing 72 wide in April and having to order last week may have had to pay the full asking price if they didn’t earn a grace period from their supplier.

“But there were very few transactions last week, and Platts considers offer prices when giving its price impression. It is unlikely they get feedback on more than 500tons total on Friday. Adding just 10, and therefore indicating that mills are already discounting the 660 is nonsense. It is hard to believe that Platts collected actual transactions that guided them to 640-650, rather it is editorial messaging.

“I don’t know where prices are going this week, but Platts is creating its own hype. I’d prefer to have meaningful information about the market.”

Steel Market Update reached out to Platts and asked them to comment on their methodology and why they were moving prices higher so quickly (Platts has moved their number twice within the past 3 working days and now have benchmark hot rolled at $655 per ton).

Platts Response from Joe Innance, Editorial Director/Metals

“We had more than enough repeatable, confirmed deals to assess the price higher in line with the Platts steel HRC methodology. Inputs came from both the sell- and buy-sides. In fact, we even received some actual POs and invoices as verification. Your readers are welcome to contribute such documentation, or to engage us in the conversation. Each day, we work to discover where true market value is. We have no interest in timing, nor in whether the price moves higher or lower. We are neutral, as are our assessments. They reflect the reality of the marketplace at a defined point in time.

“As you know, from having attended our Forums, here are some more points:

• Raising or lowering prices is not what Platts does. What Platts does is to conduct an all-day market monitoring and price assessment process for the purposes of open, transparent price discovery.

• The price assessments published by Platts reflect the transactions, bids, and offers as determined between buyer and seller in the open physical spot markets.

• The prices reported by Platts reflect true market value. Platts is an independent price reporting organization and as such, is impartial and has no vested interest in the actual value of the commodities it covers.

• Platts’ assessments reflect value in the open markets. Use of Platts assessments is voluntary, as is participation in the price assessment processes themselves.

• Your reference to “timing” has no bearing, as Platts publishes prices on a daily basis all year around.

“Overall, as you know, Platts’ price assessment processes are governed by rigorous methodology. The methodology we use in assessing hot-rolled coil is designed to operate in liquid and illiquid markets. Platts’ price assessment process in hot-rolled coil includes trades, as well as firm, verifiable, transactable bids and offers, all of which must be reflective of the market. Any data out of line with the market will not be considered in Platts’ final assessment. “

In the past, Platts has spoken in forums and said that their indices are fully transparent. If there are specific questions or concerns Steel Market Update recommends our readers contact Joe Innance at Platts. He can be reached at: joseph.innance@platts.com or by phone at: 212-904-3484.

Steel Market Update also has a free white paper on our website regarding the methodologies of Platts and other indices. The white paper can be found on the Home Page of our website (below the fold in the left hand column).