Market Segment

April 8, 2014

Steel Mills Solidify Grip on Steel Pricing

Written by John Packard

“Mills are stubborn this week. We’ll see what happens when US gets caught back up,” is how one steel executive pegged the market for Steel Market Update earlier today. Many of the steel service centers we spoke to over the past few days are indicating there is strengthening demand in portions of their business. What we have been trying to determine is if the strength in the steel mill order books is related to customers needing to book orders to accommodate the longer lead times or, are the service centers, in particular, reacting to the US Steel situation and protecting and expanding their inventory positions?

The primary focus over the past couple of weeks has been on supply. We are seeing production issues at US Steel Gary Works (ice affecting ore receipts), US Steel Great Lakes (repairs on roof over BOP and collector main services the two vessels), Essar Steel Algoma (ice affecting ore receipts) as well as AK Steel (Ashland furnace backlog). There have also been other minor issues which have affected production and have helped tighten up supply east of the Rocky Mountains.

The domestic mills have used this imbalance between supply and demand to gain the upper hand on pricing and have taken prices, which just a couple of weeks ago averaged $620 per ton on hot rolled coil ($31.00/cwt), to levels now pressing $685 to $700 per ton with expectations that prices could go higher as lead times extend well into June and beyond.

With the exception of Galvalume and especially prepainted Galvalume where foreign imports and behind the line inventories come into play, our sources are telling us that order books are strong at most mills and price offers have firmed at the $680 level and above on hot rolled and $815 and above on cold rolled and galvanized.

The supply situation will not be resolved for a number of weeks. Once US Steel, AK Steel, and Essar Steel Algoma get back to full steelmaking capacity they will have some catching up to do. The first step will be to make sure their contracts are protected before they can even consider going back into the spot markets. It is SMU opinion that this could take a couple of months, and perhaps longer, depending on how many tons per day of steelmaking capacity are actually being lost.

At the moment, our sources are advising SMU that ArcelorMittal USA, US Steel, AK Steel and Essar Steel Algoma have very little to no spot tons to sell. One service center buyer told us that they felt it would be June deliveries before AM would be interested in spot HR. USS will most likely be a month behind that, as well as AK Steel.

Our sources are advising Severstal does have some spot tons to sell with hot rolled, cold rolled and galvanized lead times reported to be late May on all products from both Dearborn and Columbus. We are being told Severstal is controlling their order book in order to keep spot tons available.

We are hearing that Steel Dynamics is essentially sold out through May on all products except Galvalume bare and prepaint. It is unusual for SDI to be sold out that far as they like to sell on short lead times. They have not opened the month of June yet and most likely won’t for at least another week, according to a couple of their customers. The Techs, which are owned by SDI, sent out a note to their customers that their order books were “temporarily suspended.” This would include all three of their mills: MetalTech, Nextech and GalvTech.

The automotive companies have been the first to respond to this supply situation. One of our service center sources who supplies the automotive industry told us this afternoon that all of the auto companies are going through an evaluation process, “There is a little bit of panic or concern on the part of the automotive companies. The auto companies are trying to make sure they have supply. They are asking us if we have steel on the floor, if not where is it and when will it arrive.”

Another automotive supplier told us, “GM has created a team to address their potential issues with USS GL, and is looking at finding replacement sourcing where needed.” This executive went on to tell us, “Service centers in general are doing the same. USS and AK should be, more or less, short term. Essar is unknown.”

Service centers associated with other market segments are telling us there are some concerns but most customers are not in a panic. The biggest issue is with end users who like to procrastinate and when lead times moved out lost their chance to book orders.

The interesting part of this scenario is where is current demand level and is demand actually beginning to rise just as these production issues are hitting the mills?

Going back and taking a look at our SMU steel survey results from last week, we are seeing signs of improving demand complimenting our SMU Steel Sentiment Index which at +43 is well ensconced in the optimistic range of our Index.

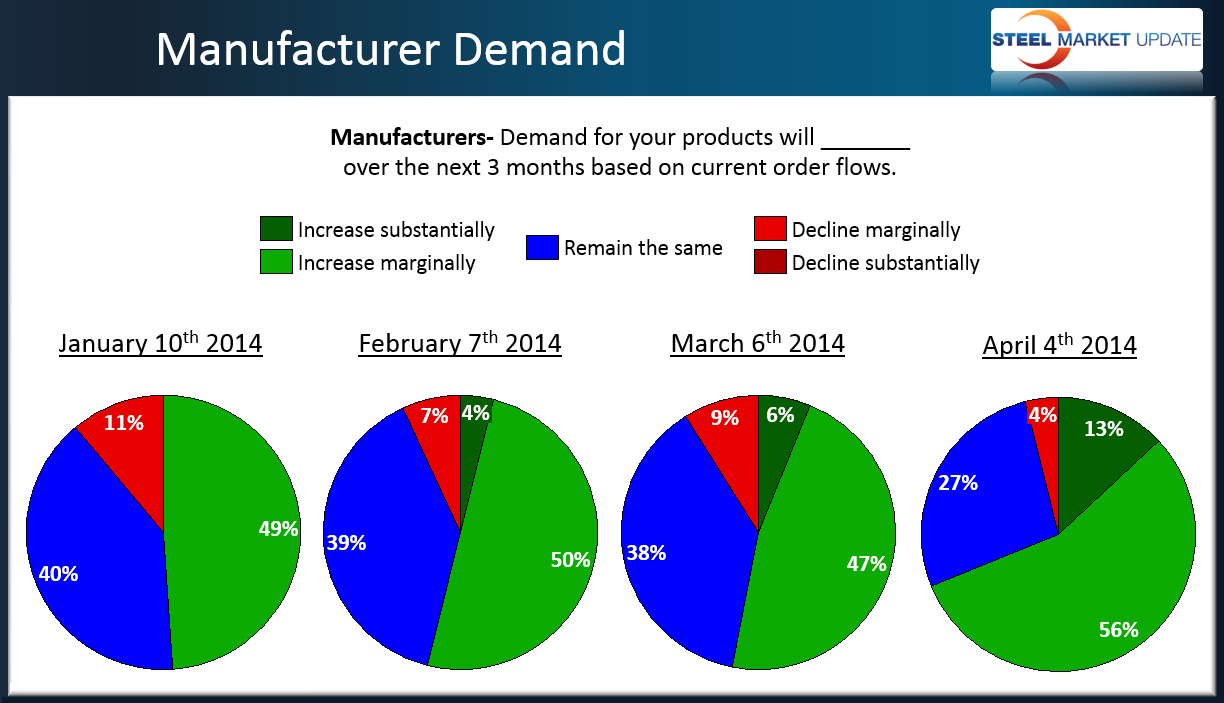

As you can see by the graphic provided, manufacturing companies responding to our early April questionnaire reported expanding demand for their products. This has been a steady ongoing story which we have been following for months. As of this past week, 69 percent of the manufacturing companies reported demand as “increasing” either marginally (56 per cent) or substantially (13 percent) while the percentage responding that demand for their products will remain the same over the next 3 months has consistently dropped over the four months referenced in our graph. The same can be said for those reporting business as in decline, having dropped from 9 percent in early March to 4 percent this past week.

We also asked the service centers to weigh in on releases from their customer base to see if they are also seeing rising demand at the end users. What we saw in the results from last week’s market analysis was an improvement in the percentage of service centers reporting their customers as releasing more steel (35 percent vs. 24 percent one and two months earlier) and a reduction in those reporting their customers were releasing less steel (17 percent vs. 22 percent the prior month).

However, we caution our readers as we do not believe demand is more than a couple of percentage points higher than at this time last year. One of the large national brand service centers confirmed that when they told SMU, “Demand is steady – running a couple of percent ahead of last year.”

Another large service center told us,“Between landed/arriving imports, and domestic orders placed through May everywhere, I believe we’re now into a “quiet” period where nobody knows what happens next. Obviously, if the mills continue to receive June orders at any kind of clip, the lead-times will keep extending and increases will continue. I don’t expect that to occur unless some other disruption occurs and/or USS were to come out and advise the GL outage will last 4+ weeks or more. It’s obvious in talking to buyers that they, in fact, double/pre-booked orders pretty quickly as an insurance premium on the unknowns due to outages.”

The president of a smaller Midwest service center told us, “I don’t want to be long when this ends.” He told us they were advising their customers not to panic and don’t double up on orders.

I spoke with many distributors who advised that they were comfortable with their inventory levels and, combined with heavier than normal foreign bookings a few months back, it’s making many service center buyers look pretty smart right now…

So, where are prices this week and where do we think they are headed? More on that in our article entitled: SMU Price Ranges & Indices: Mills Get What They Want.