Market Data

April 20, 2014

SMU Survey: Clear Signs of Improving Demand

Written by John Packard

Steel Market Update (SMU) conducted our mid-April steel market survey this past week. Early in the survey process we approached a subject that we know is near and dear to those within the steel industry – where do our respondents see demand for their products.

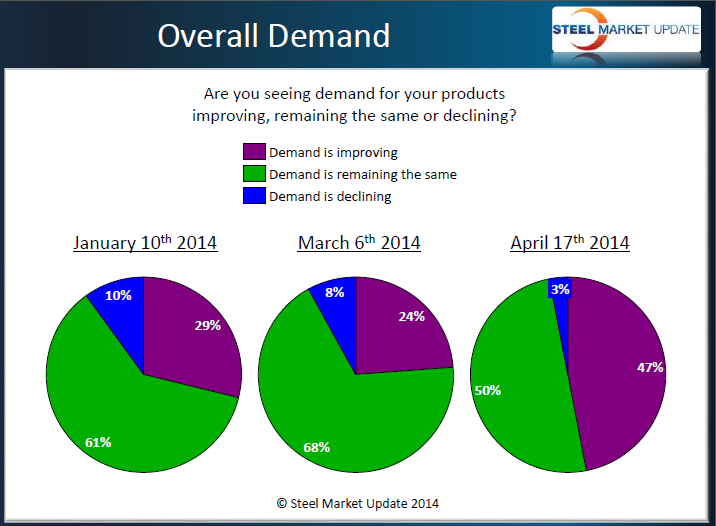

What we found is a clear sign of improving demand. We first polled the group which consisted mainly of manufacturing companies (44 percent) and service centers (43 percent) with a smattering of steel mills (5 percent), trading companies (4 percent), toll processors (3 percent) and other suppliers to the industry (1 percent). What we discovered was a vast improvement in the percentage of our respondents who reported demand as “improving” and a clear reduction in those reporting demand as “declining.”

Premium members can review slide #11 in our survey Power Point presentation to see a longer historical view to the responses to this question. The 47 percent is the most optimistic we have seen since we began conducting our surveys in 2008.

As the survey continued, we broke our respondents into their respective groups in order to drill down and get more details regarding demand and other issues of importance to the steel industry.

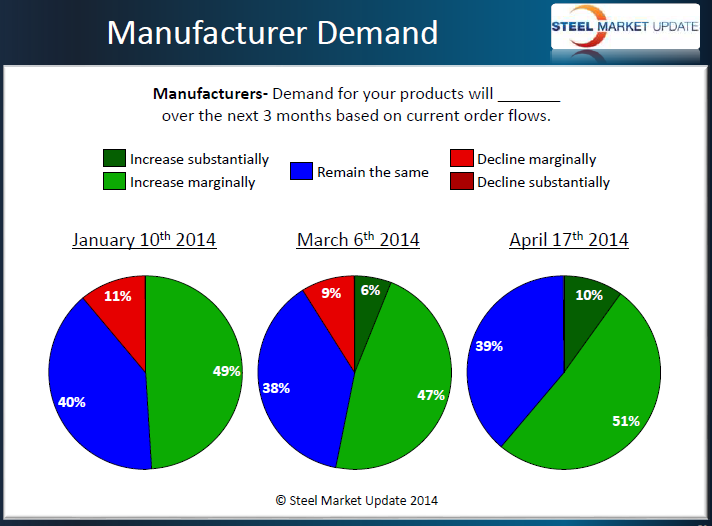

We asked manufacturing companies to comment on demand on their products over the next three months and we found a majority of the respondents (61 percent) reporting demand as either increasing marginally (51 percent) or substantially (10 percent). For the past three months the trend toward reporting demand as growing has been increasing.

Our market analysis also caught signs of manufacturing companies increasing inventories for the first time in quite some time. Service centers reported they were maintaining inventories (82 percent) with the percentage reporting their company as reducing inventories falling from 29 percent in early March, down to 11 percent this past week.

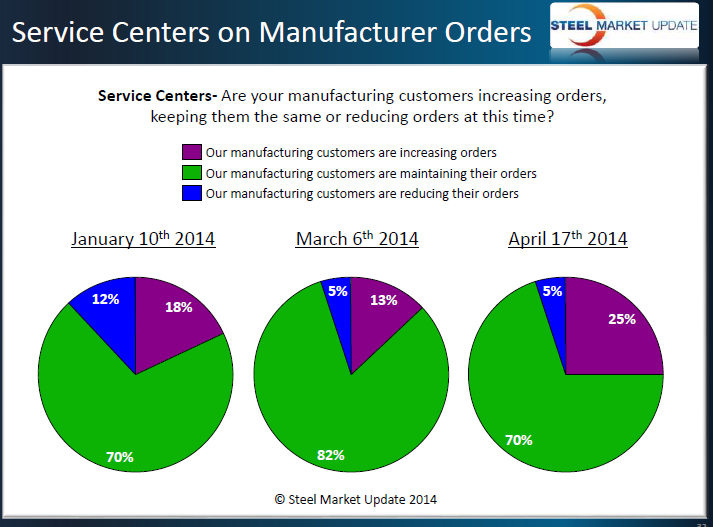

We also saw an improvement in the percentage of service centers reporting their manufacturing customers as increasing their orders. As you can see by the graphic below, at the beginning of March only 13 percent of distributors were reporting their manufacturing customers as increasing orders. This has since improved to 25 percent.

Rising demand is a good sign for the steel industry and will help to keep the market tight, even as the domestic mills begin to bring back capacity due to iron ore and other production related issues.