Prices

May 1, 2014

Why There Are Variations in Flat Rolled Price Indices

Written by John Packard

Steel Market Update is aware that many buyers and sellers of steel have been keyed in on the variations between various flat rolled steel indexes. In the past, Steel Market Update found the spread between our steel index and those of Platts and CRU to generally be negligible ($1-$10 per ton at any one time). As of this week (April 11), the spread between hot rolled price averages calculated by CRU and those of Platts are at $16 per ton and the spread between SMU and CRU is $1 per ton, and when SMU is compared to Platts the difference is $15 per ton. Recent spreads have gone out as wide as $35 per ton (CRU vs. Platts).

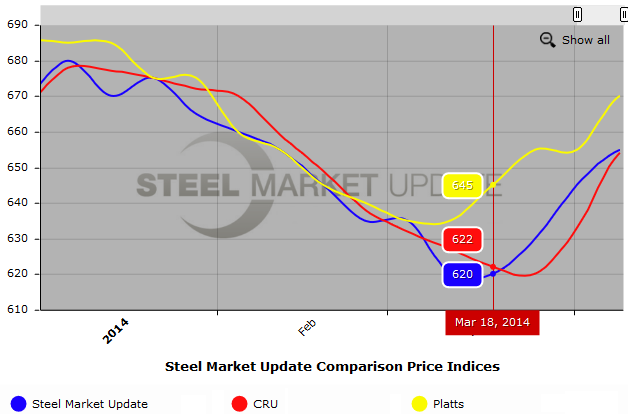

Below is a static view of one of our interactive graphs which can be found in our website (must be logged in to use interactive graph). The graph shows SMU (blue), CRU (red) and Platts (yellow) indices on hot rolled coil from the beginning of the year through today.

On March 17th ArcelorMittal began the current “up” cycle by announcing a price increase taking hot rolled to $660 per ton. As you can see we hovered our mouse over the graphic for that week and the results are shown below. The spread, which just a few weeks earlier were only a few dollars apart, had widened to $25 per ton (SMU vs. Platts) and $23 per ton (CRU vs. Platts).

The following week (SMU March 25, 2014), Joseph Innace, editorial director–metals at Platts, responded to our request to comment on their collection process and how they determined their hot rolled coil range and average pricing. He responded with:

“We had more than enough repeatable, confirmed deals to assess the price higher in line with the Platts steel HRC methodology. Inputs came from both the sell- and buy-sides. In fact, we even received some actual POs and invoices as verification. Your readers are welcome to contribute such documentation, or to engage us in the conversation. Each day, we work to discover where true market value is. We have no interest in timing, nor in whether the price moves higher or lower. We are neutral, as are our assessments. They reflect the reality of the marketplace at a defined point in time.

“As you know, from having attended our Forums, here are some more points:

• Raising or lowering prices is not what Platts does. What Platts does is to conduct an all-day market monitoring and price assessment process for the purposes of open, transparent price discovery.

• The price assessments published by Platts reflect the transactions, bids, and offers as determined between buyer and seller in the open physical spot markets.

• The prices reported by Platts reflect true market value. Platts is an independent price reporting organization and as such, is impartial and has no vested interest in the actual value of the commodities it covers.

• Platts’ assessments reflect value in the open markets. Use of Platts assessments is voluntary, as is participation in the price assessment processes themselves.

• Your reference to “timing” has no bearing, as Platts publishes prices on a daily basis all year around.

“Overall, as you know, Platts’ price assessment processes are governed by rigorous methodology. The methodology we use in assessing hot-rolled coil is designed to operate in liquid and illiquid markets. Platts’ price assessment process in hot-rolled coil includes trades, as well as firm, verifiable, transactable bids and offers, all of which must be reflective of the market. Any data out of line with the market will not be considered in Platts’ final assessment.“

There is a difference between the collection techniques (price discovery) conducted by Platts to that of the CRU Indices.

Earlier this week we asked Josh Spoores, CRU Principle Consultant – Steel, to provide us a look at the way their company calculates market pricing.

“In discussing the current market with numerous participants this past week, I heard from a few that CRU prices have accurately represented their recent transactions in light of the initial price increase attempts by the mills. Our prices reflect actual transactions recorded in the prior week between mills and mill-direct buyers. We do screen contributors to our indices to be sure that buyers are mill-direct buyers with consistent order entry. Therefore, as long as a qualified mill-direct transaction occurs, we will record it, and ask that it be submitted as a volume-weighted price, based on overall volume booked.

“The typical buyer transaction submitted to CRU is between 1,000 and 3,000 short tons, while mills submit all their spot orders for the week. Our volume is fairly balanced between mills and buyers at nearly 50% each. So with that make-up, we are able to detail an actual transaction on a volume-weighted price, rather than estimate what the price of steel is for only a marginal volume.

“In addition, the CME uses CRU prices to settle their HRC futures contract knowing that only actual transactions between mills and buyers make up the price, so they can be sure that prices are not adjusted to represent a specific, marginal volume, nor will offers ever have a role in determining a market price.“

The variations between the various indexes are based on methodologies not on the gathering of inaccurate data.

It is key for market participants to understand that CRU Indices are based on “…actual transactions recorded in the prior week between mills and mill-direct buyers.”

Platts price assessments are done “daily” and, “The price assessments published by Platts reflect the transactions, bids, and offers as determined between buyer and seller in the open physical spot markets.”

Steel Market Update methodology is more similar to that of Platts than CRU. However, SMU does not collect transaction prices from the domestic steel mills (Platts & CRU do). We prefer to gather our pricing information directly from buyers. We do take into consideration mill offers as well as the flexibility in the negotiation process at any point in time (Similar to Platts, CRU does not do this).

Methodologies are important and we have published a White Paper on the subject which can be found on the Home Page of our website. You are welcome to download the White Paper in order to gather more detailed information about a number of the indices and not just CRU, Platts and SMU. If you are having issues in being able to download the White Paper please send us an email request and we will send it to you – info@SteelMarketUpdate.com.

A note to our readers: SMU does not want our indices to be used to adjust any form of contracts – steel or financial in nature.