Prices

May 2, 2014

Imports & Price Spread = Price Volatility

Written by John Packard

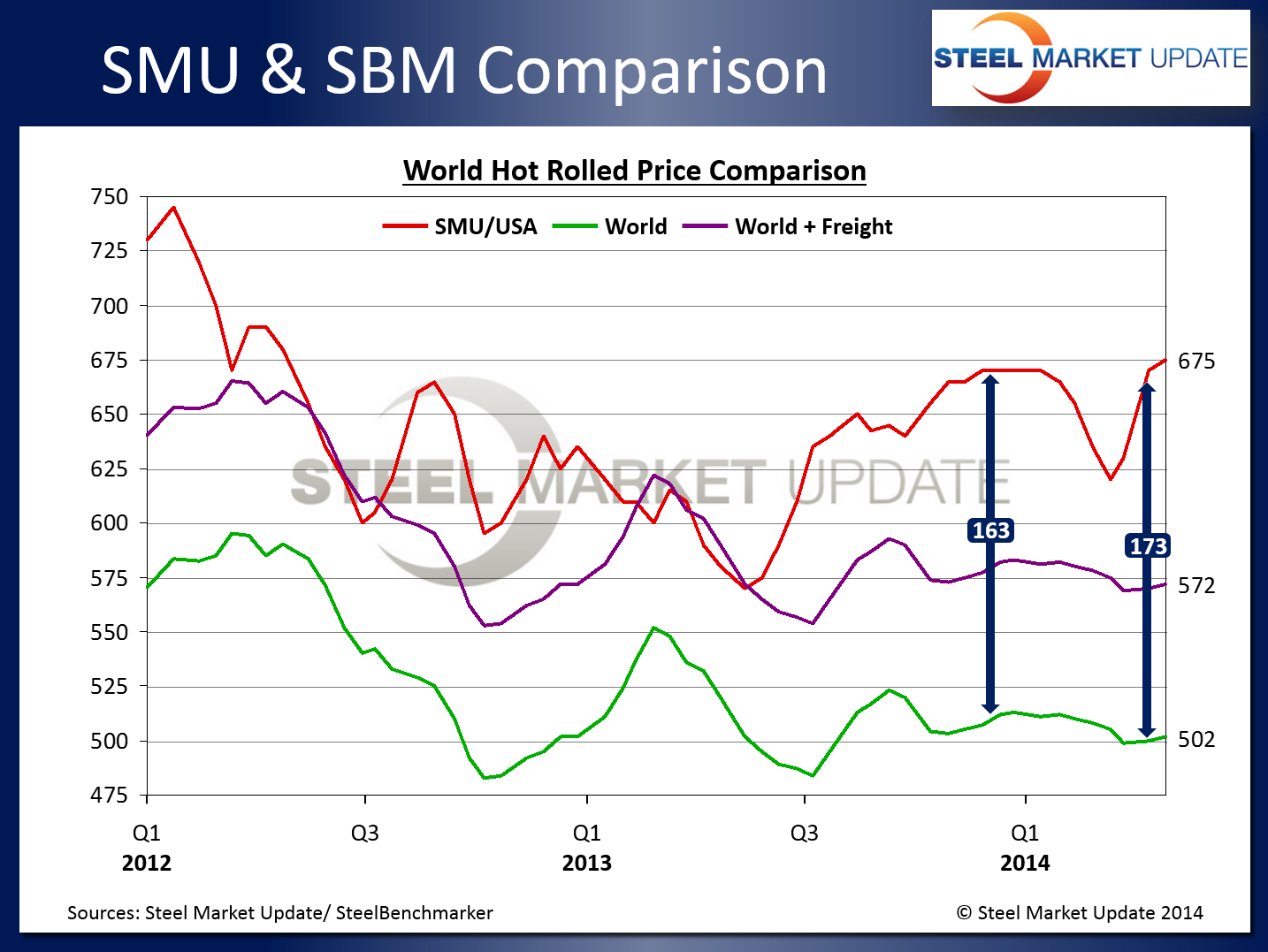

Based on revised domestic and world export pricing on hot rolled coil (SteelBenchmarker), the price spread between the two continues to grow. As you can see by the graphic shown below, the spread has been widening ever since domestic steel production issues began impacting flat rolled steel pricing in the U.S. and Canada. The spread is now $173 per net ton prior to freight, handling and steel trading company profit considerations.

Using $70 per ton as an average to accommodate freight, handling, insurance and something for the trading company the hot rolled spread is $103 per ton which is more than enough to entice virtually any Hot Rolled Coil (HRC) buyer within reasonable distance from a port.

We had a domestic mill confirm the impact of foreign coated products on their business when they reported to SMU, “…In port cities like Houston it is impossible to sell anything other than little fill ins at aforementioned numbers[numbers below $39.00/cwt base pricing].”

The domestic steel mills are not immune to the spread between domestic and foreign prices. SMU Publisher, John Packard, has had a number of conversations with the commercial side of the domestic steel mills and there is real concern regarding the level of imports coming into the United States right now and the expectation that those import levels will not drop anytime soon and, in fact, could increase.

U.S. Steel announced earnings on at the end of April and they held a conference call with the steel analysts. During the call one analyst, Gordon Johnson, asked Mario Longhi, CEO of USS about the price spread between domestic and foreign steel:

Q – Gordon L. Johnson: Thanks for letting me ask a question. I guess just focusing on a prior question that was asked looking at the second half, we’re looking at import licenses into the U.S. and the spread between U.S. and foreign HRC prices and it looks like unfortunately you guys may not get the benefit from the price hikes in 2Q, so looking to the second half and specifically at expectations for your earnings it looks like people are expecting the earnings to increase significantly. Is there potential risk to those earnings if we see an influx of imports onto or into U.S. shores?

A – Mario Longhi Filho: Well, as I was mentioning before, Gordon, these mean cycles, they have so many different levers there that it’s hard to say. But if you look at the recent past, there has been quite an interesting sustainable period where prices have been sustained here regardless of the ups and downs. But I personally feel that it’s going to be volatile. Big-time imports come in, I think it will certainly impact prices.

It is the last two sentences of Mr. Loghi’s response that we believe our readers should concentrate on. Big time imports are coming in and we believe they will impact pricing and create a more volatile market than what we have seen so far this year.