Market Data

May 22, 2014

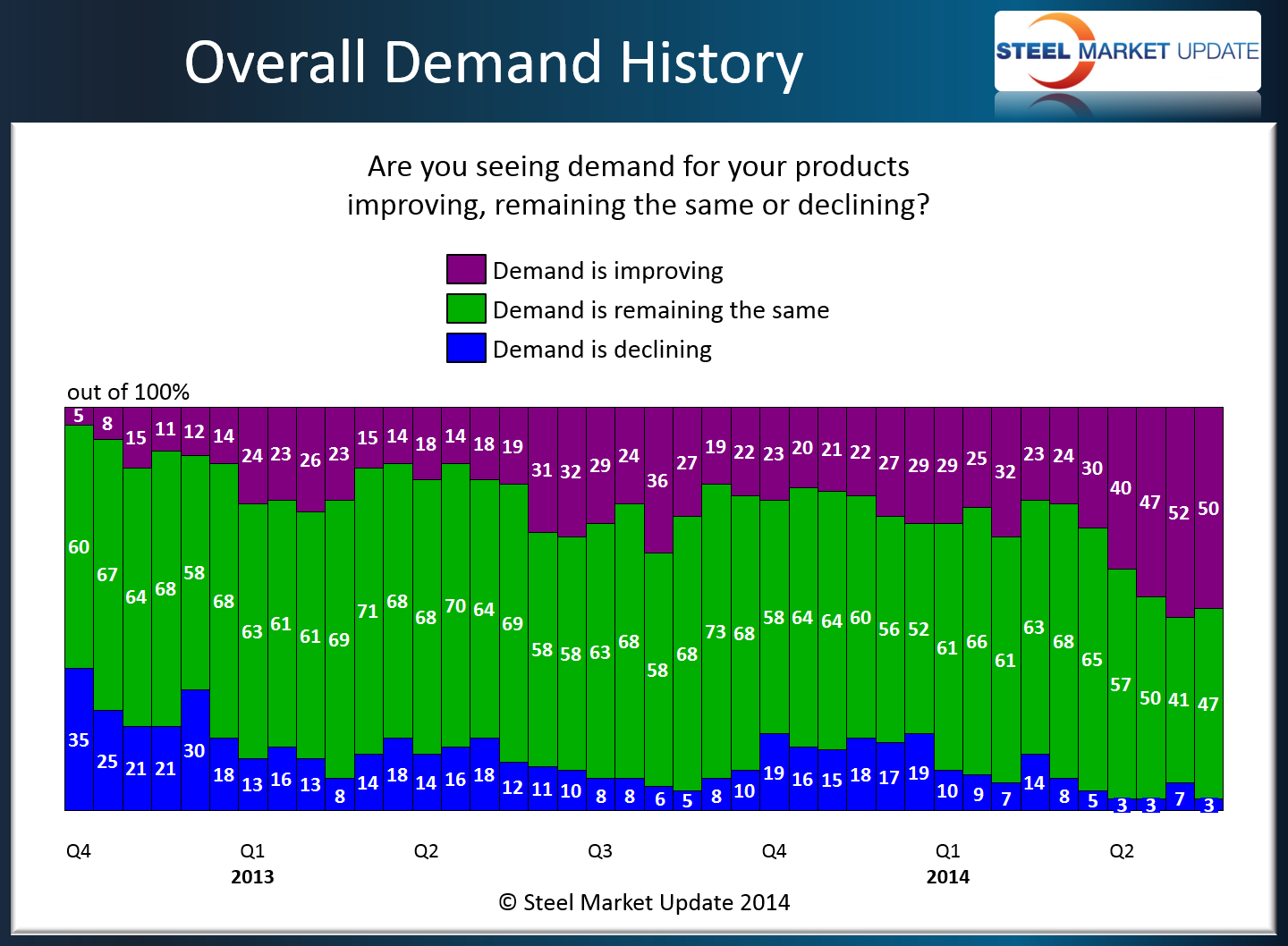

SMU Survey: Demand Continues to Improve

Written by Sandy Williams

Demand is continuing to improve according to participants in our Steel Market Update (SMU) mid-May Steel Market Survey. Just over half of our respondents, 50.49 percent, said steel demand is improving, up from 47 percent in mid-April and less than one quarter in mid-March.

This month we polled a group consisting mainly of manufacturing companies (45 percent) and service centers (42 percent).

Those surveyed are still seeing soft conditions in residential construction. Although demand, in general is increasing, some respondents said it is not as much as expected following the long winter.

One manufacturer said product demand had improved: “We have seen a spike in May but I feel they will quiet down a bit and settle in at a decent increase year over year.”

Another manufacturer concurred with the slower pace of growth: “Stronger than marginally, but not strong enough to call it substantial either.”

Most of our steel mill respondents said new orders are about normal for this time of year.

A service center reported seeing variations in demand: “Again it is somewhat mixed but on balance improving.”