Prices

June 15, 2014

Investigation into the Accuracy of Licensed Import Data

Written by Peter Wright

Industry and economic data is always subject to inaccuracies so we at SMU try to compare different data sources to get the best handle on a situation. Housing and non-residential construction starts are examples that come to mind. In the case of steel imports we have three reports produced by the US Department of Commerce: licensed, preliminary and final tonnages for each product.

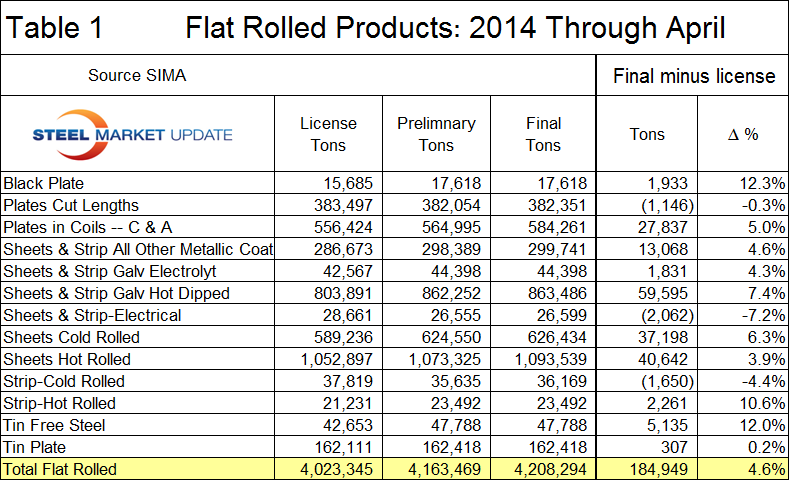

The Steel Import Monitoring system has been a widely used tool to provide an advanced look at import volumes using data compiled from steel import licenses. These licenses can be applied for at any time between when the vessel ships to ten days after it arrives. The total licensed tonnage for any product in a given month is available on the first Tuesday on the following month which is about three weeks before the preliminary numbers and about five weeks before the final numbers are released. We decided to review and publish our findings on the degree to which the license numbers for flat rolled steel products accurately predict the final volume using data for the first four months of 2014, (Table 1).

Our first observation was how close the preliminary and final numbers are. Sometimes they are identical over large volumes. Moving on to examine the licensed data we can see that in the period January through April 2014, the total final tonnage of flat rolled products was 4.6 percent greater than the licensed volume. We assume that actual can be more than licenses because permits can be obtained after the steel has arrived in the US.

In a study such as this, the problem is that the date of the license can vary by weeks but the date of arrival is a fact. In the first four months of 2014 the discrepancy between licensed and final has alternated from positive to negative each month, however we expect that as we examine longer time periods in the course of 2014 that the total year to date discrepancy will shrink. The variation between products was quite significant, ranging from black plate for which actual exceeded licensed tonnage by 12.3 percent to electrical sheet and strip for which actual was 7.2 percent less than licensed tonnage. These are both small volume items, for hot rolled sheet and hot dipped galvanized, final exceeded licensed tonnage by 3.9 percent and 7.4 percent respectively. Our conclusion is that the ability of the licensed data to predict the final volume is in the ball park in most cases but we expect the difference to shrink as we continue this analysis to include subsequent months of 2014.