Market Data

November 11, 2014

Freight Industry in Turmoil

Written by Sandy Williams

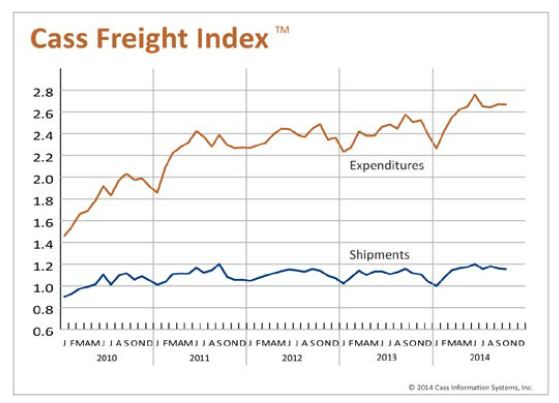

Freight shipments, especially imports, are on the climb as the nation looks toward an economically stronger holiday season. The Cass Freight Index, which follows freight expenditures and shipment volumes, showed shipments increased in October by 3.3 percent year over year but fell 0.9 percent on a monthly basis. The slide, says Cass Information Systems, is due to port congestion and fewer new orders for manufactured goods.

The Cass Freight Index is published by Cass Information Systems, a leading provider of transportation, utility, waste and telecom expense management and related business intelligence services. The following is an excerpt from the Cass Freight Index October 2014 report:

“The best description for much of our freight transportation system is turmoil. The congestion and slowdown at the ports deteriorated over the month of October and has reached crisis proportions, particularly at the Port of LA/Long Beach, which handles more than 40 percent of all U.S. ocean imports and a disproportionately large percent of consumer goods – the very goods that are supposed to be stocking shelves for the upcoming holiday buying season. Toy retailers, in particular, have been hard hit and everyone is feeling the effect of a three-week delay now at the Port of LA/Long Beach.

“The underlying problem is primarily supply issues. Trucks, especially drayage trucks, are in short supply as the profitability of that segment continues to fall. But perhaps an even larger problem is a serious lack of chassis on which to move the containers from the ports to DCs and stores. The ports of NY/NJ, Houston and Norfolk are also experiencing congestion problems, though not as severe as LA/Long Beach. A contributing issue is the larger TEU ships that bring more containers in a condensed time frame this time of year, as the current level of handling equipment is unable to keep pace. These larger vessels can be up to one-third larger than the vessels that arrived at Los Angeles and Long Beach just a few years ago. Drayage carriers are also reporting that they can make fewer turns because of the congestion. Truckers have reported waiting hours in line to pick up a container, only to find that no chassis is available to move the container out of the port. The lack of an ILWU contract is contributing to the slowdowns on the West Coast as communication between parties has degenerated to trading barbs in the media.

“The economy is still strengthening, with growth in areas that are good for the freight community such as residential construction (which was up 6.3 percent in September). Consumer sentiment has also reached a seven-year high due to drops in gas prices and labor market gains. The unemployment rate, which was 7.2 percent at this time last year, is now at 5.9 percent. Strong orders for factory goods in October, combined with increased exports, should ensure that 2014 will not end with the severe drops we have seen in the past couple of years. The economics of supply and demand are finally coming back into play as chassis, trucks and drivers become scarce commodities and rates rise. Expect rates to continue to move up more quickly in the coming months.”