Prices

December 11, 2014

Foreign Steel Taking Large Percentage of Rise in Apparent Steel Usage

Written by Peter Wright

The following article is by Peter Wright for our Premium level members. We decided to share the article with all of our readers this evening as a way of providing an example of Premium level content and analysis to our Executive readers.

![]() Following the post-recession recovery, shipments of hot band from US mills to domestic locations trended in a range for three years but have now broken out on the upside. Shipments of hot dipped galvanized sheet and strip declined strongly in Q2 through Q4 2012 and have climbed steadily in 2014. Cold rolled shipments have shown no direction for two years after declining in 2012, (Figure 1). This analysis is based on shipments to domestic locations plus exports and uses the AISI AIS10 monthly report and Commerce Department trade data.

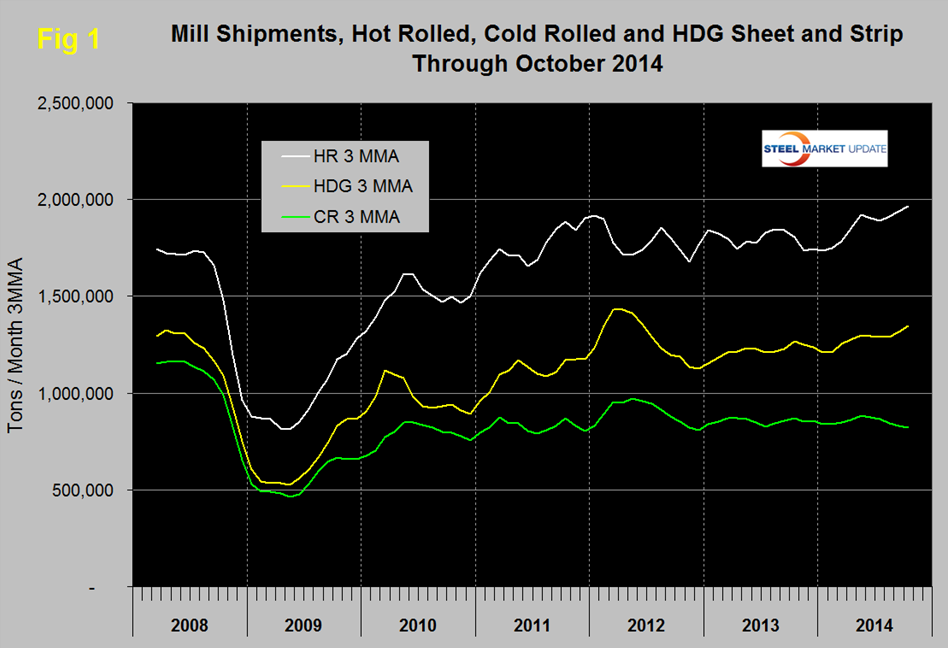

Following the post-recession recovery, shipments of hot band from US mills to domestic locations trended in a range for three years but have now broken out on the upside. Shipments of hot dipped galvanized sheet and strip declined strongly in Q2 through Q4 2012 and have climbed steadily in 2014. Cold rolled shipments have shown no direction for two years after declining in 2012, (Figure 1). This analysis is based on shipments to domestic locations plus exports and uses the AISI AIS10 monthly report and Commerce Department trade data.

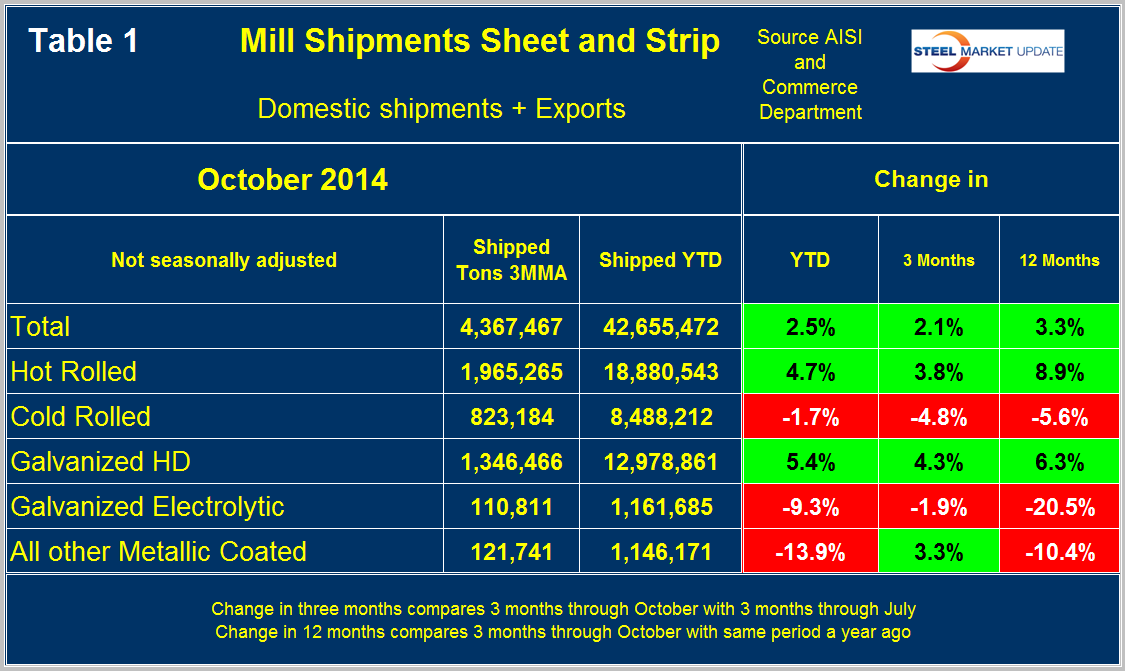

Table 1 shows that total shipments of sheet and strip products including hot rolled, cold rolled and all coated products were up by 2.5 percent YTD through October compared to the same period last year. In the three months through October compared to three months through July, the total tonnage was up by 2.1 percent and comparing three months October with the same period a year ago, the tonnage of sheet and strip products was up by 3.3 percent. Comparing YTD shipments for 2014 and 2013 for individual products, hot band was up by 4.7 percent and HDG by 5.4 percent. Cold rolled was down by 1.7 percent, electro-galvanized down by 9.3 percent and other metallic coated (mainly Galvalume) down by 13.9 percent.

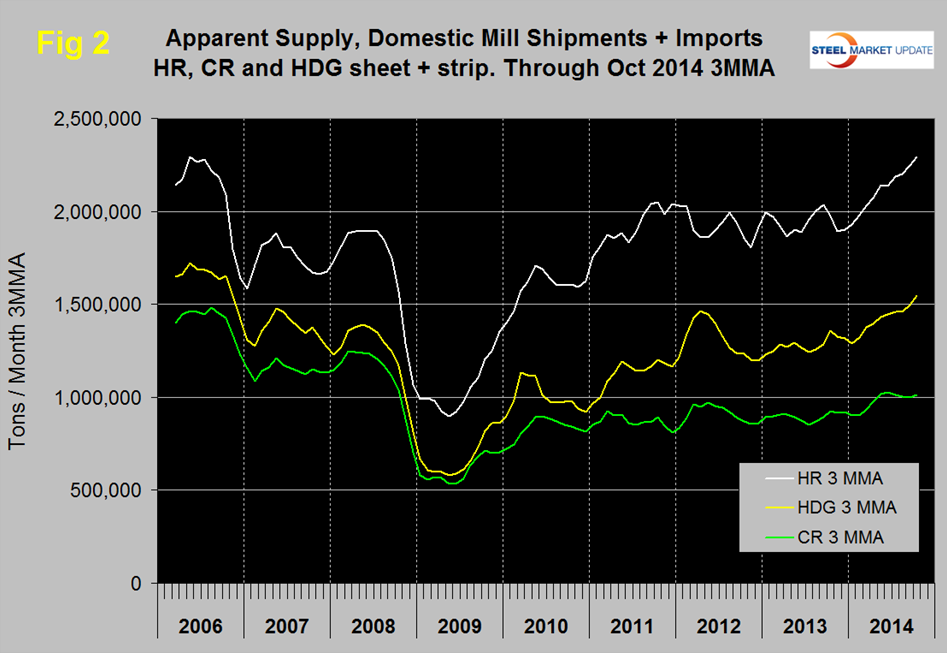

The situation with the supply of sheet products to the US market is quite different to that of mill shipments as imports have taken an increasing market share. In the three months through October, imports of sheet and strip products were up by 60.2 percent year over year which compares to the increase of domestic mill shipments of 3.3 percent mentioned above. Figure 2 shows the supply situation by product since January 2008. Of the three major product groups in, HR, CR and HDG in 2014, hot band is performing best and cold rolled the worst.

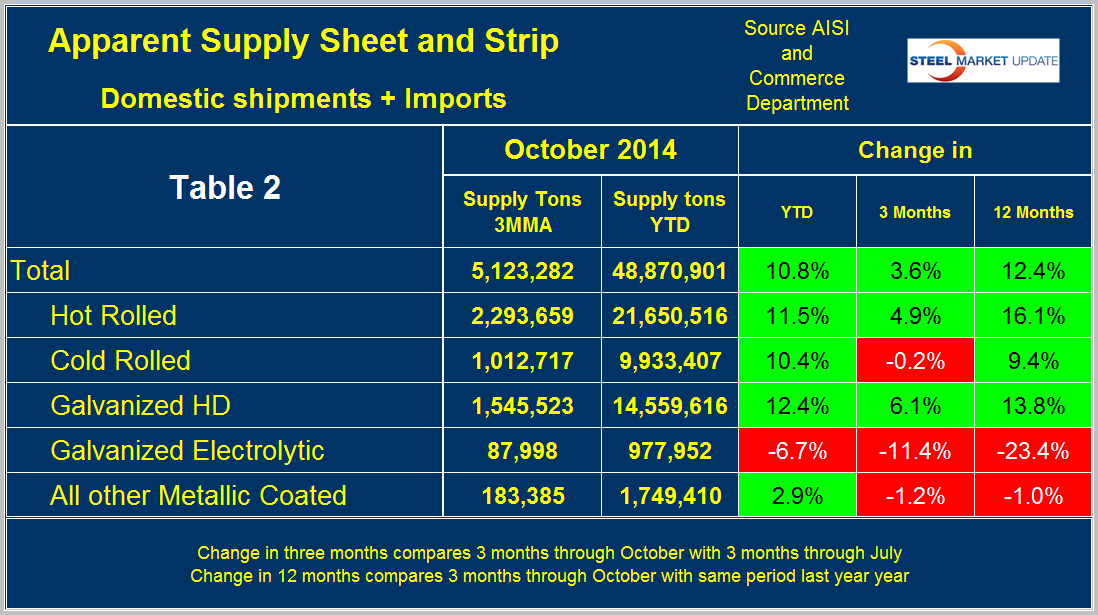

Table 2 shows the supply and performance by product and has been modified this month to make it a direct comparison cell by cell with Table 1. YTD supply of total sheet and strip products through October was up by 10.8 percent, which is four times the increase in domestic shipments. Electro-galvanized is the only product having a bad year in 2014, down by 6.7 percent on a YTD basis year over year. The performance by product of shipments and supply can be clearly seen by flicking between tables 1 and 2.

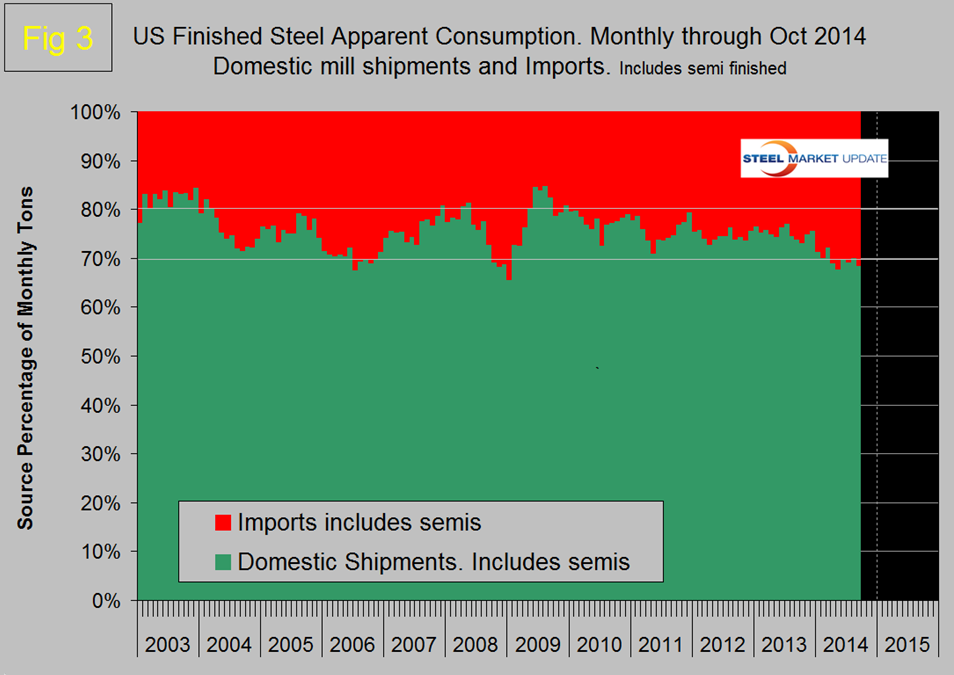

Figure 3 shows import market share of all steel products including semi-finished. There have been only three periods since 2003 when the domestic mills have commanded less than 70 percent of the market and of those three periods the current one is the most sustained with no sign of a break. Apparent consumption is back to its pre-recession level but mill shipments are still down by about 800,000 tons per month.

If you would like more information regarding upgrading your account to Premium please contact us at: 800-432-3475 or by email: info@SteelMarketUpdate.com.