Market Data

January 28, 2015

The Chicago Federal Reserve National Activity Index and Steel Supply

Written by Peter Wright

The following is the Chicago Federal Reserve statement followed by our own graphical analysis. The CFNAI is an excellent reality check for much of the economic analysis that we routinely provide in The Steel Market Update. An explanation of the Index is provided at the end of this piece.

Led by declines in production-related indicators, the Chicago Fed National Activity Index’s three-month moving average, (3MMA) moved down to +0.39 in December from +0.54 in November. December’s 3MMA suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the index suggests modest inflationary pressure from economic activity over the coming year.

Forty of the 85 individual indicators made positive contributions to the CFNAI in the single month of December, while 45 made negative contributions. Thirty-three indicators improved from November to December, while 52 indicators deteriorated. Of the indicators that improved, 14 made negative contributions.

Production-related indicators made a contribution of –0.12 to the CFNAI in December, down from +0.71 in November. Industrial production decreased 0.1 percent in December after moving up 1.3 percent in November, and manufacturing production increased 0.3 percent in December after a gain of 1.3 percent in November. However, manufacturing capacity utilization remained at 78.4 percent in December.

Employment-related indicators contributed +0.16 to the CFNAI in December, down somewhat from +0.21 in November. Non-farm payrolls increased by 252,000 in December, down from a gain of 353,000 in the previous month. However, the unemployment rate decreased to 5.6 percent in December from 5.8 percent in November. The contribution of the sales, orders, and inventories category to the CFNAI remained at +0.03 in December. The contribution of the consumption and housing category to the CFNAI decreased to –0.12 in December from –0.03 in November. Housing permits decreased to 1,032,000 annualized units in December from 1,052,000 in November. However, housing starts increased to 1,089,000 annualized units in December from 1,043,000 in the previous month.

The CFNAI was constructed using data available as of January 21, 2015. At that time, December data for 49 of the 85 indicators had been published. For all missing data, estimates were used in constructing the index. The November monthly index was revised to +0.92 from an initial estimate of +0.73.

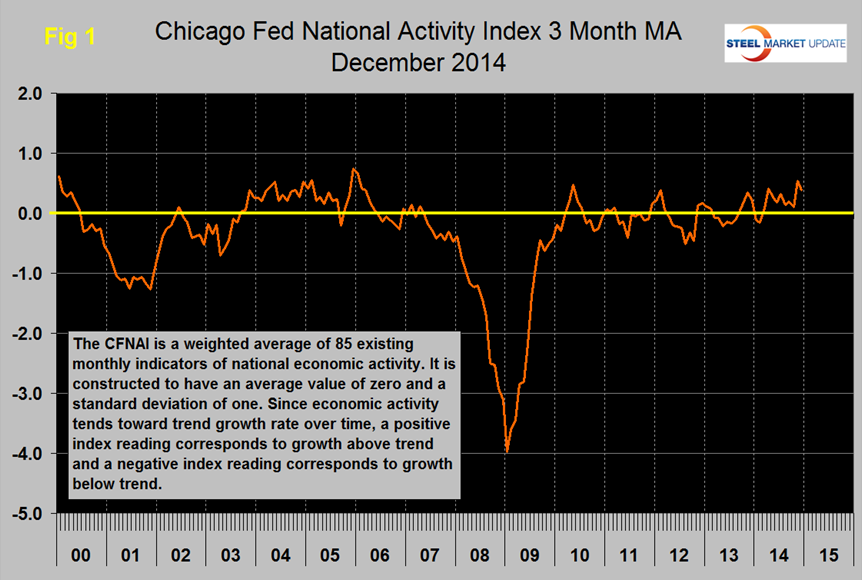

Figure 1 shows the 3MMA of the CFNAI through December. There has been an erratic though sustained improvement since mid-2012. By this measure the economy is expanding faster than its historical trend which is represented by the zero line, (see explanation below). The December result at 0.39 was a decline from 0.54 in November.

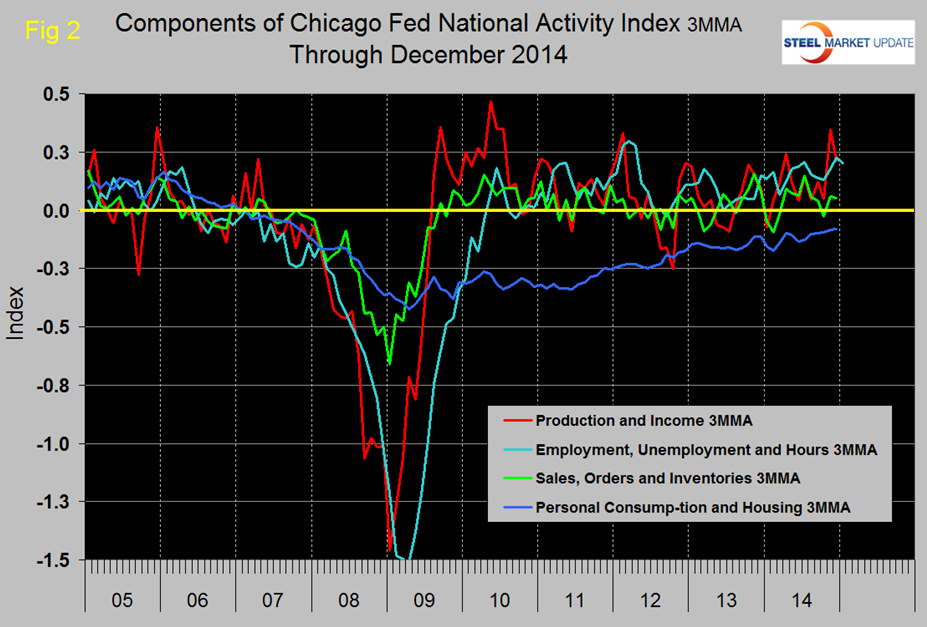

Figure 2 shows the trends of the four main sub-components. The sub-component “Production and Income” was the main cause of the December decline. P&I increased strongly in November but gave up all that gain in December, pulling down the 3MMA. The only negative of the four main sub-components at present continues to be personal consumption and housing which had been gradually trending up since Q2 2009.

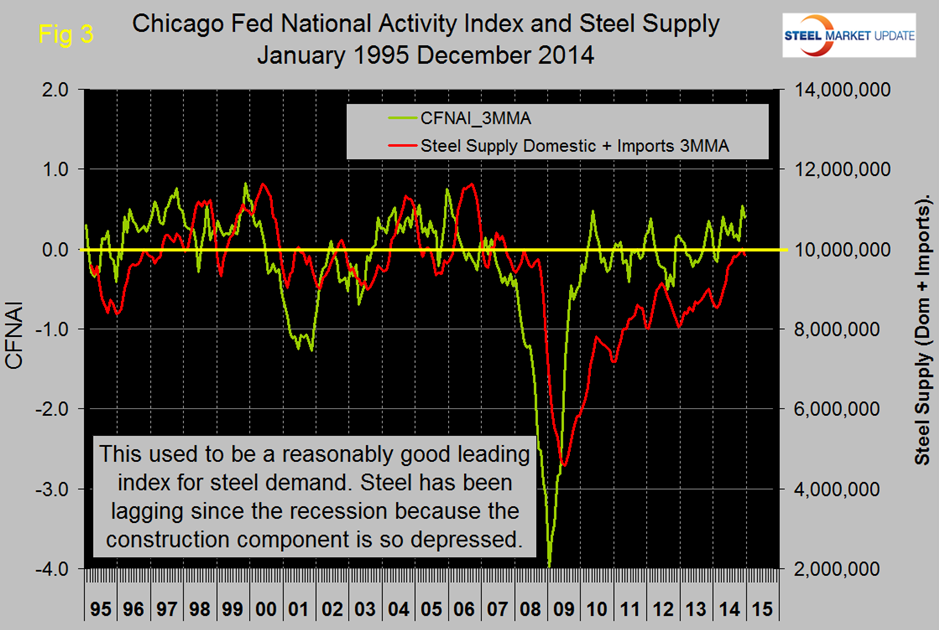

Figure 3 shows that the CFNAI has historically been a reasonably accurate leading indicator of steel demand, (apparent supply) with a lead time of about six months. This is one of several benchmark indicator that shows steel demand has not recovered to its traditional level since the recession. Steel demand is closing the gap but is still below the CFNAI benchmark. We believe this delayed response to be a measure of the extent to which construction, (or lack there-of) is still a drag on steel demand. The good news is that steel supply has been accelerating in the last few months, the bad news as we have reported elsewhere is that imports have taken most or all of that improvement.

Explanation: the index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories. A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth. When the CFNAI-MA3, (three month moving average) value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above –0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended. When the CFNAI-MA3 value moves above /+0.70 more than two years into an economic expansion, there is an increasing likelihood that a period of sustained increasing inflation has begun.