Prices

March 24, 2015

February Foreign Steel Imports at 3.6 Million Tons

Written by John Packard

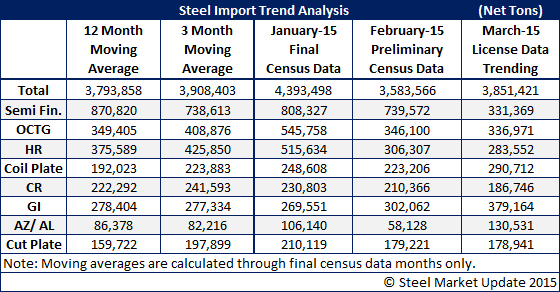

The U.S. Department of Commerce released Preliminary Census data for February 2015 foreign steel imports into the United States. Based on the latest release imports for the month of February, 3,583,566 net tons were imported (note: the US DOC releases the data in metric tons and SMU converts to net tons for our readers).

Foreign steel imports have been rising as the value of the dollar increases making exporting steel to the U.S. attractive to other countries. With market prices dropping faster than the foreign steel can arrive we are finding many customers saddled with high priced foreign steel which needs to be worked off.

The 3.6 million ton mark for February 2015 is 9.1 percent higher than the February 2014 total but is well below the 4.4 million tons received in January 2015 and is below both the 3 month and 12 month moving averages (see table below).

Semi-finished imports (slabs) were sliced by more than 50 percent with only 331,369 tons arriving in February. Another sign of how poor the U.S. steel mill order books have become as they adjust to changing market conditions.

One product which bucked the down trend during February was galvanized coated products (an item on the mill trade case hit list): galvanized tonnage increased to 302,062 tons, above the prior month and the 3MMA and 12MMA.

Another item above the product’s 3MMA and equal to its 12 month moving averages was coiled plate at 223,206 net tons.

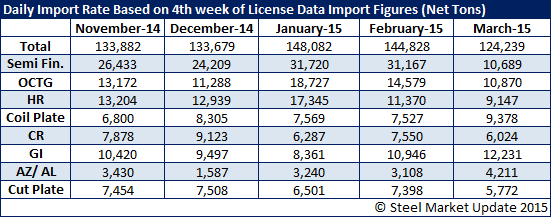

Preliminary Census Data is much more reliable than the license data we share with you on an almost weekly basis. Just for your edification, the license data for the month of February was pointing to a 3.8 million ton month or, 200,000+ tons more than where the month actually came in.