Prices

March 26, 2015

Dan DiMicco Calls for Quotas on Foreign Steel Imports

Written by John Packard

With the steel executives testifying before the U.S. Congress today about foreign steel imports we thought it might be interesting to ask Dan DiMicco former CEO of Nucor Steel about the subject. Mr. DiMicco responded to our request with the following:

Where do I start???? First let me say this is Dan DiMicco responding not Nucor.

Our industry, our teammates and their Families and our customers are under attack by a tsunami of steel imports.

Steel is the one that sees this behavior the most severely and most often, but it happens to many others, with more to come. There are many reasons for steel to be affected like this but suffice to say it is driven by ‘non-profit motive’ State Owned Industries. Case in point; today’s articles on the largest Chinese Steel Companies (SOE’s) having large losses for the first quarter of this year yet they continue to over produce and flood world markets—all SOE’s!

The only way to effectively deal with this mercantilist/predatory behavior is to do the following:

1- For the US Dept. of Commerce(working with the USTR and the President) to ‘Self Initiate’ trade action against the many perpetrating countries

2- Place quotas that limit imports to 50% of the last 15 months finished steel imports by country (and contains wording to prevent it coming in through countries other than the guilty producing countries)

3- Enter immediately into negotiations that result in voluntary limits on steel coming in from the offending countries (and any others that might try to do the same)

4- Leave the quotas in place for 5 years to be gradually phased out as the voluntary agreements kick in

5- Analyze to see if something similar needs to be done on semi-finished Slabs, Billets, etc.

Those that protest against such a plan being implemented immediately, particularly those clamoring that steel customers and consumers will pay more for their steel and that’s not fair, I have one and only one thing to say— No consumer has a right to stolen or illegally traded products just because if they don’t have access their costs will go up….NO ONE not Nucor, Not anyone. If we don’t enforce the rules of law and trade agreements then we have a system that will soon self-destruct. That is not in anyone’s best interest.

And for those who say….higher costs for steel will cause the guilty countries to just ship in steel bearing products at lower cost and put them out of business, I say stand up and fight the trade cheaters as we are. You can count on the Steel Industry and our teammates to fight with you.

Dan

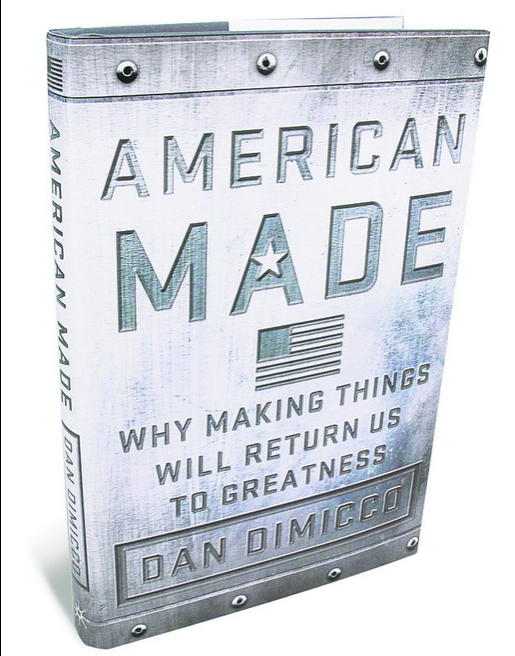

SMU Note: Dan DiMicco recently released his new book entitled: American Made: Why Making Things will Return Us to Greatness