Market Data

March 31, 2015

March at a Glance

Written by John Packard

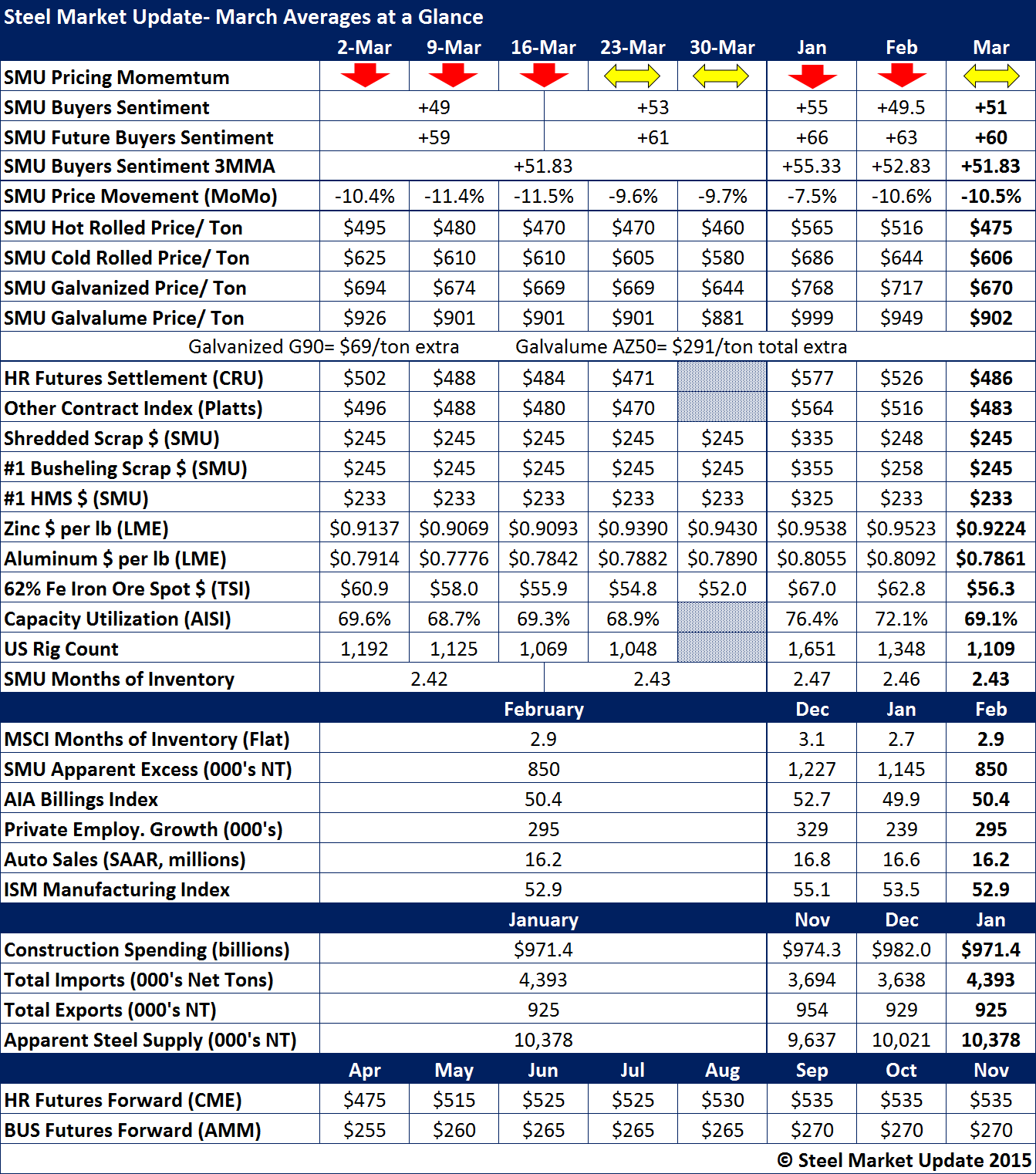

In the table below, Steel Market Update provides a snapshot look at various flat rolled steel pricing, commodities which impact steel prices and economic data of importance to the flat rolled steel industry.

One of the first items you will notice on the end of month table provided is we moved our Price Momentum indicator from Lower to Neutral during the third week of the month. As we explained at the time of our adjustment SMU does not think the slide has stopped only that conditions suggest that over the next 30 days we should begin to see prices change and perhaps move sideways instead of falling.

SMU Steel Buyers Sentiment Index remained well within the optimistic parameters of for our index. The month ended at Sentiment at +53 while the average of the two data points for the month was +51.

Future Sentiment at +61 is also well within the optimistic range of our index. The average of the two data points was +60 which is lower than the +63 average in February and +66 in January of this year.

The 3 month moving average (3MMA) for Sentiment also is showing an optimistic bunch of flat rolled steel buyers and sellers, albeit at a slightly lower level when compared to the two previous months’ data.

SMU hot rolled average for the month was $470 per ton versus $483 for Platts and $486 per ton for CRU.

Our cold rolled average for the month was $613 per ton, galvanized .060” G90 was $677 per ton and Galvalume .0142” AZ 50, Grade 80 averaged $907 per ton for the month of March.

The MSCI ended the month of February with 2.9 months of flat rolled steel inventories which we calculated to be in excess of where inventories should be by 850,000 tons (this is part of our Premium level products). Although not shown here we forecast flat rolled inventories as not coming back into balance until June or July of this year based on our model and making assumptions regarding shipments and receipts.

We have a number of other economic data points which we feel are important for our readers to take into consideration on a monthly basis. Tomorrow, we will report our Key Market Indicators to our Premium level members which goes into more detail and can be used for forecasting future movements in the steel markets.