Market Data

August 20, 2015

SMU Steel Buyers Sentiment Index: Trending Sideways & Below Last Year

Written by John Packard

The people who buy and sell flat rolled steel for a living continue to be optimistic about their company’s ability to be successful both now and three to six months into the future. However, the year over year weakening (or less optimistic) trend that we have seen for most, if not all of this calendar year, is continuing as all of our indices generated numbers below what we saw at this same point in time last year.

We heard from some of the respondents that they were concerned about the upcoming expiration of the labor contracts with the USW and US Steel as well as ArcelorMittal. The combination of trade suits and the labor situation was introduced a level of “uncertainty” into the market which we believe is being picked up in our Sentiment indices.

The Steel Market Update (SMU) Steel Buyers Sentiment Index is +53 according to our latest flat rolled steel market survey, a decline of three points from both the early-August and mid-July levels. This time last year the SMU Steel Buyers Sentiment Index was +59. This index measures how buyers and sellers of steel feel about their company’s ability to be successful in the current market environment.

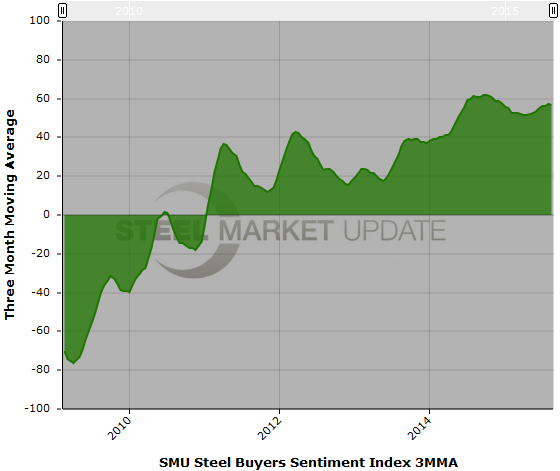

The three month moving average (3MMA) of the SMU Steel Buyers Sentiment Index (below) is +56.83, down from +57.33 in early-August but up from +56.33 in mid-July. One year ago the 3MMA was at +60.83. Our 3MMA trend line is beginning to flatten out.

The SMU Steel Buyers Future Sentiment Index (our respondents looking 3 to six months into the future) came in at +58 in our latest market analysis. This is one point lower than our last survey from early-August and down two points from one month ago. One year ago the SMU Steel Buyers Future Sentiment Index was at +67.

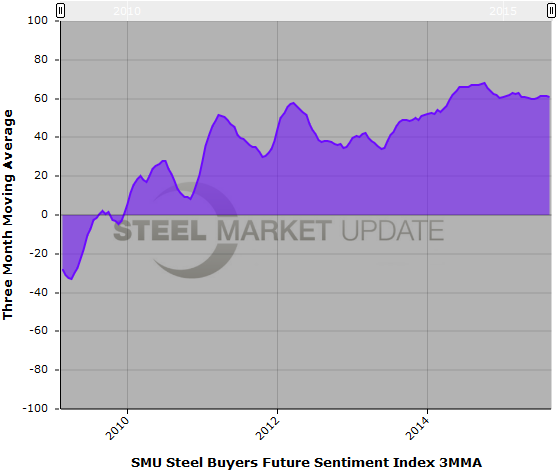

The 3MMA of the SMU Steel Buyers Future Sentiment Index is +60.67, down from the early-August reading of +61.17. One year ago it was +67.00. According to the 3MMA graphic (below) Sentiment has been moving sideways from the mild peak made earlier this year.

What Our Respondents Had To Say

“Lots of uncertainty in the next 60 days with labor contracts in steel and automotive” Service center

“Continued depressed steel prices with no end in sight.” Manufacturing company

“Our mill supplier has kept us competitive in our market which reflects in sustained orders.” Manufacturing company

“August is not good.” Manufacturing company

“large inventory over hang – no signs that the future is any brighter. ” Service center

“A lot of Q3 and Q4 success weighs on the prospect of a labor disruption between AM/USS and the USW…and also the final rulings in the recent Trade Case filings.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 49 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.