Prices

September 10, 2015

Scrap Exports Down 11.6% for First 7 Months 2015

Written by Peter Wright

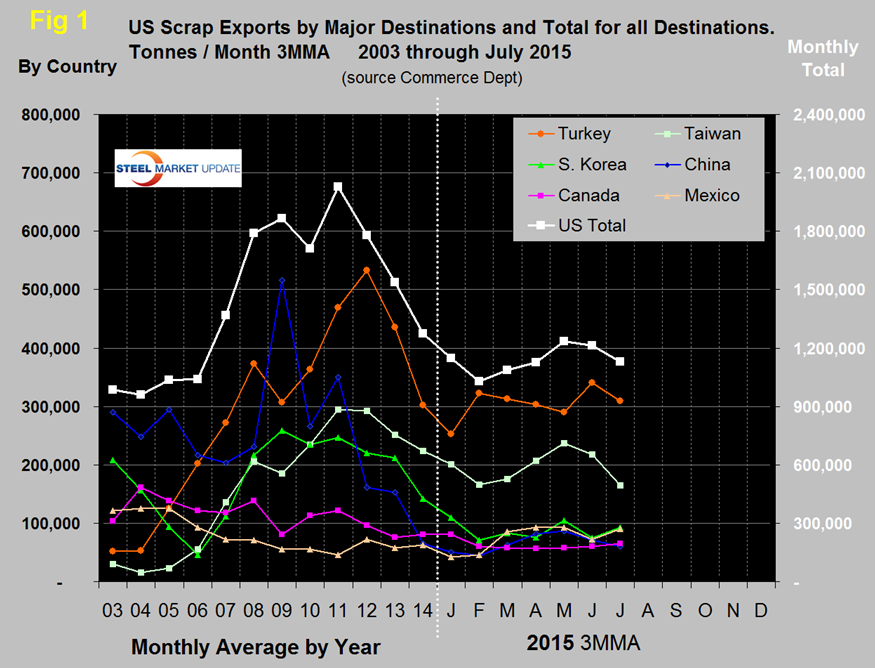

In the first seven months of this year bulk scrap exports were 7,809,000 tonnes for an annual rate of 13,387,000 tonnes, down by 11.6 percent from the first seven months of last year. The tonnages shown in Figure 1 are based on three month moving averages for 2015 and on the twelve month monthly average for previous years.

The graph shows that exports declined for three consecutive years, 2012 through 2014 and continued through January and February this year. March saw a trend reversal that continued through May with a small decline in June and a larger decline in July. In the twelve months of 2014, scrap exports totaled 15,308,000 tonnes, down by 17.1 percent from the same period in 2013.

In the single month of July, Turkey was the major destination with 208,000 tonnes, followed by South Korea with 154,000 tonnes. Turkey has been the major destination in six out of seven months this year but by all accounts the purchase of scrap by Turkish mills is being reduced by billet purchases out of China. Billet imports from China have offered a lifeline to struggling Turkish producers, despite it being at the expense of production from their own steelmaking facilities. In the short term at least, unless scrap prices fall to a level acceptable to Turkish steel mills, Chinese billet will remain an increasingly favored means of supplying semi-finished steel to their rolling mills. This will mean that downward pressure on scrap prices will remain and will tend to level the advantage currently being enjoyed by global integrated mills whose major source of iron units is iron ore.

Scrap exports to the Far East through the first seven months were up by 13.8 percent from last year. YTD through July exports to Canada were down by 17.6 percent and to Mexico were up by 34.6 percent. Exports to India were up by 62.0 percent YTD and to South Korea and Taiwan were down by 34.4 percent and 21.9 percent respectively. Shipments to China YTD through July were 460,000 tonnes, up 2.5 percent from last year.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. The price on the East coast collapsed by $36 per gross ton on July 1st to $235, continued to decline to $209 on July 22nd and has since recovered to $223 on September 2nd. The West coast price declined from $243 on July 1st to $198.5 on August 5th where it has remained through September 2nd. The price of Chicago shredded was unchanged on September 4th at $230 but #1 busheling in Chicago declined by $10 to $240.