Prices

October 11, 2015

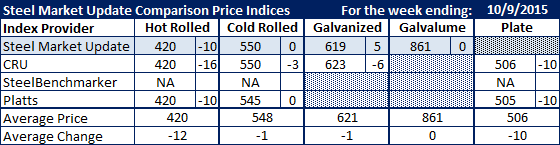

Comparion Price Indices: Stable to Down for the Week

Written by John Packard

Flat rolled steel prices continued their slide according to the various flat rolled steel market indexes followed by Steel Market Update. The greatest movement was found with benchmark hot rolled which was down double digits on all of the indexes reporting last week. We saw mixed results when reviewing cold rolled, galvanized, Galvalume and plate price movements.

Benchmark hot rolled coil (HRC) dropped $10 per ton on both the SMU and Platts indexes and $16 per ton on the CRU index. By the end of last week all three indexes agreed on the average price for HRC being $420 per ton ($21.00/cwt). This is not to say that this is the lowest price available in the marketplace. SMU has been reporting prices as low as $400 per ton and we are aware of larger offers below $400 per ton. We anticipate further downward pressure on HRC prices even though the domestic mills don’t want the indexes to report the average below the $400 threshold. With a $50 per ton move in scrap pricing and potentially more weakness to come, SMU Price Momentum is for prices to move lower over the next 30 days.

Cold rolled prices barely moved this past week with both SMU and Platts remaining at the previous week’s numbers of $550 per ton (SMU) and $545 per ton (Platts). CRU has joined the group lowering their CRC index number by $3 per ton to match SMU’s $550 per ton.

Galvanized saw SMU pricing rise by $5 per ton to $619 per ton for .060” G90 while CRU dropped theirs by $6 per ton to $623 per ton.

Galvalume remained the same as the prior week at $861 per ton for .0142 AZ50 Grade 80 material.

Plate dropped $10 per ton on both the CRU and Platts indexes and ended up at $506 (CRU) and $505 (Platts) per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.