Market Data

October 12, 2015

Shipments and Supply of Sheet Products through August 2015

Written by Peter Wright

This report compares domestic mill shipments and total supply to the market. It quantifies market direction by product and enables a side by side comparison showing the degree to which imports have absorbed demand. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU.

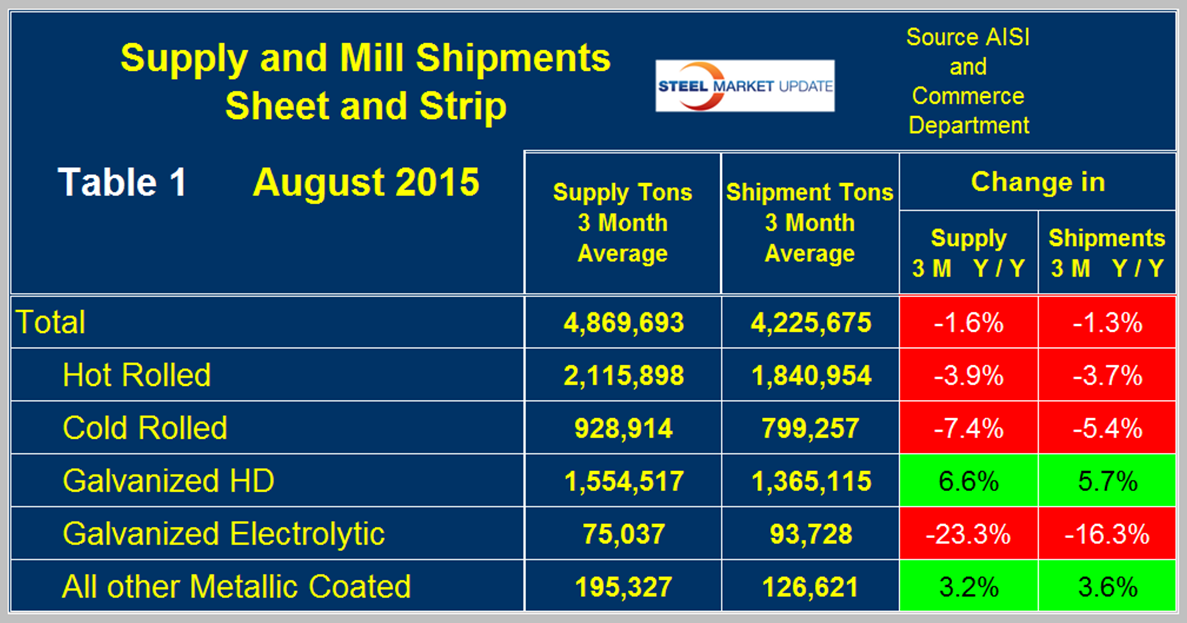

Table 1 shows both supply and mill shipments of sheet products (shipments includes exports) side by side as a three month average for the periods June through August for both 2014 and 2015.

Comparing these two periods total supply to the market was down by 1.6 percent and shipments were down by 1.3 percent. These numbers have come into line after the recent months in which shipments declined much more than supply as imports took an increasing market share. Table 1 breaks down the total into the individual sheet products and it can be seen that there are no longer any significant discrepancies between shipment and supply growth/contraction. Supply of hot rolled was down by 3.9 percent and shipments were down by 3.7 percent, cold rolled supply was down by 7.4 percent as shipments were down by 5.4 percent meaning that imports gave up some ground. HDG continued to enjoy an increase in both supply and mill shipments. Electro-galvanized which enjoys a trade surplus continued to have a greater decline in supply than it did in shipments. Other metallic coated products (mainly Galvalume) continued to have positive growth is both supply and shipments with 3.2 percent and 3.6 percent respectively. A review of supply and shipments separately for individual sheet products is given below.

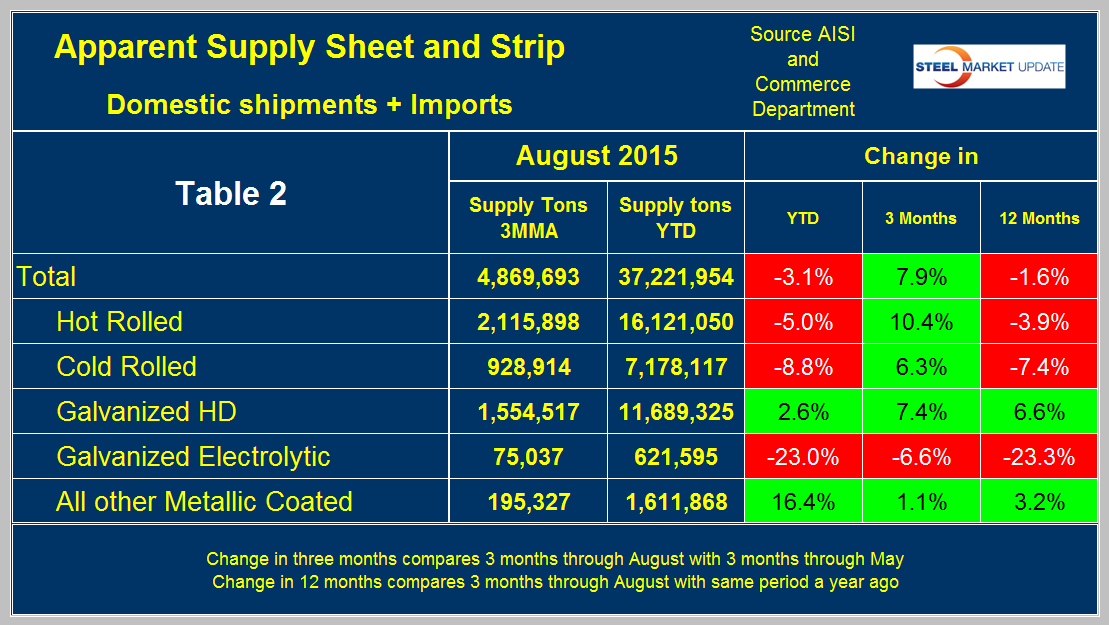

Apparent Supply is a proxy for market demand and is defined as domestic mill shipments to domestic locations plus imports. In the three months through August 2015 average monthly supply of sheet and strip was 4,869,693 tons, up by 7.9 percent from the previous three month period, March through May (3M/3M), down by 1.6 percent from the same period last year and down by 3.1 percent YTD compared to the first eight months of 2014. Table 2 shows the change in supply by product on the same basis through August.

There is a big difference between products. HDG and Galvalume enjoyed positive growth in all three time comparisons. Hot rolled and cold rolled followed the overall trend with an improvement in the 3M/3M comparison and a deterioration Y/Y and YTD. Electro-galvanized had negative growth in all three time comparisons.

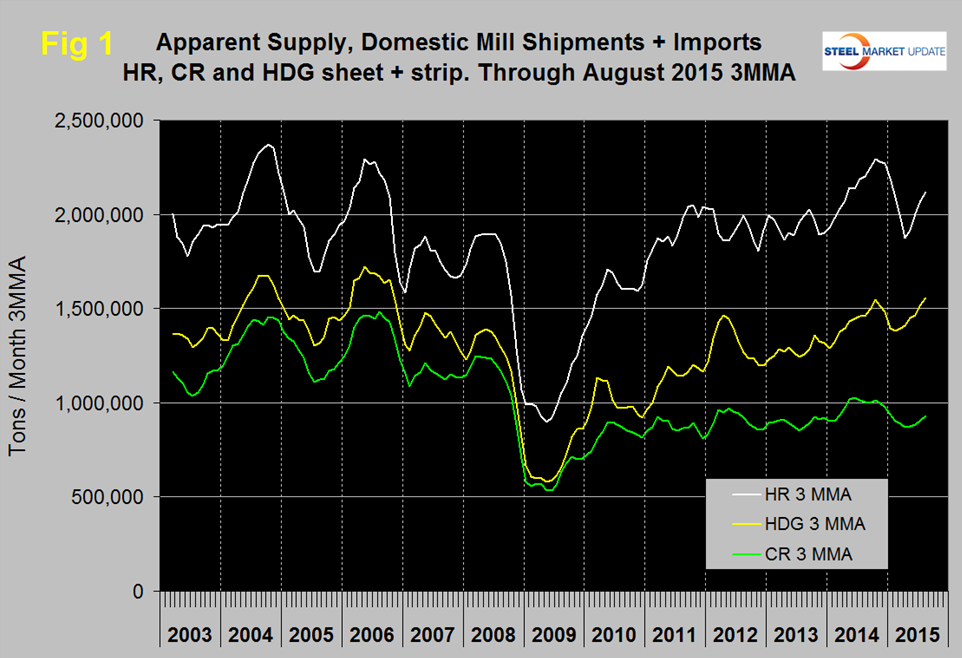

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2003 as three month moving averages.

Hot rolled declined every month November through April then picked up in May, June, July and August. Cold rolled also declined in November through April and picked up more slowly in May through August. Hot dipped galvanized declined in the period November through February and has picked back up in each of the last six months. In Q4 2014 all three were in higher demand than at any time since the recession. That is no longer the case for hot and cold rolled but the supply of HDG in August exceeded the pre-recession level of 2007.

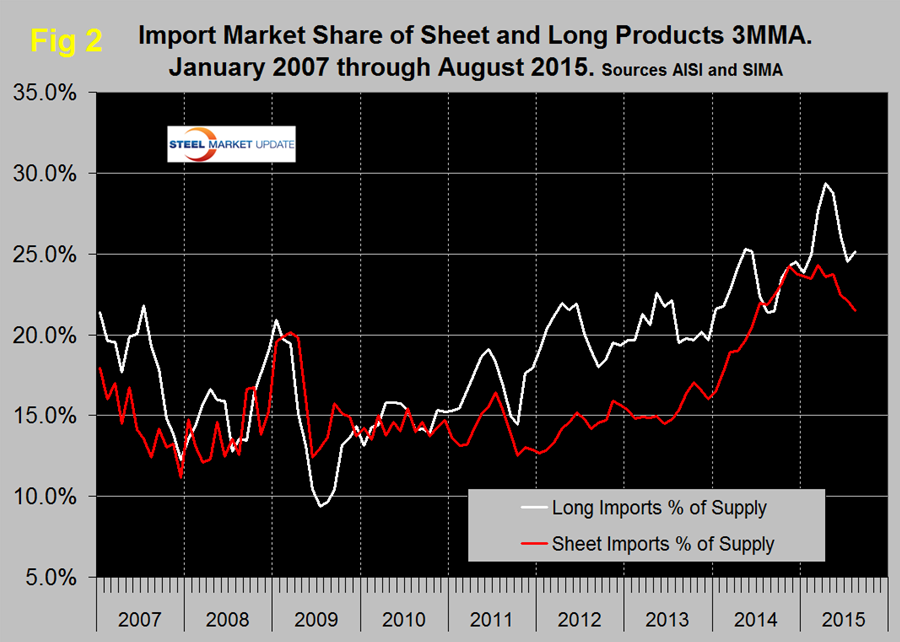

Figure 2 shows import market share of sheet products and includes long products for comparison.

Based on a 3MMA the import market share of sheet products was 21.5 percent in August, down from 24.3 percent in March and the lowest share since August last year. The months March and November had the highest import market share since the beginning of the recovery. Import market share of long products in August was 25.1 percent, down from the peak of 29.4 percent in April this year but up from 24.5 percent in July.

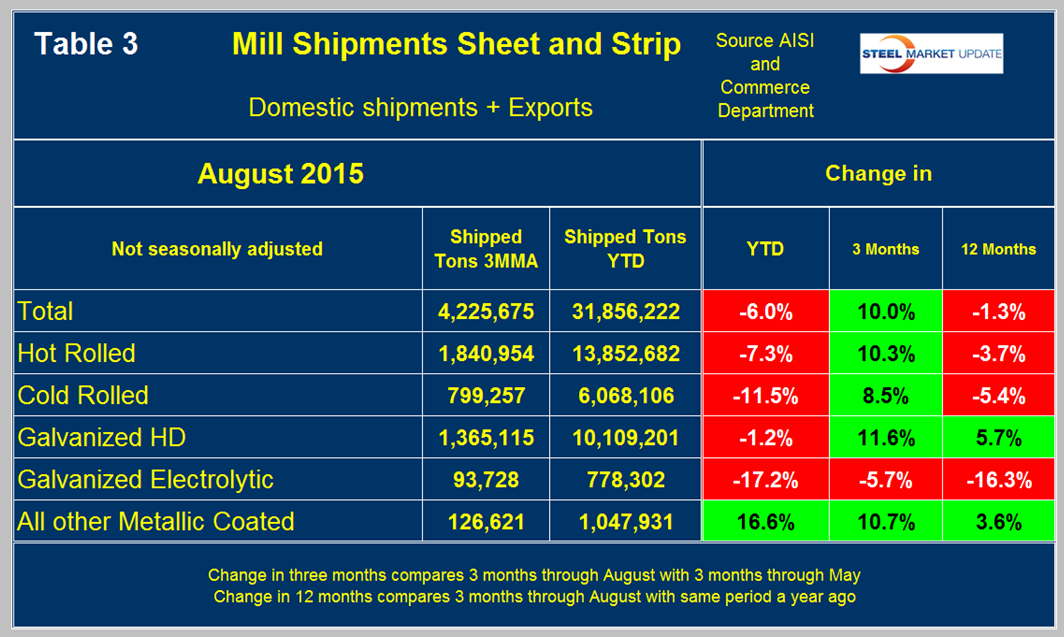

Mill Shipments Table 3 shows that total shipments of sheet and strip products including hot rolled, cold rolled and all coated products were down by 6.0 percent YTD year over year but up by 10.0 percent in 3 months through August compared to 3 months through May.

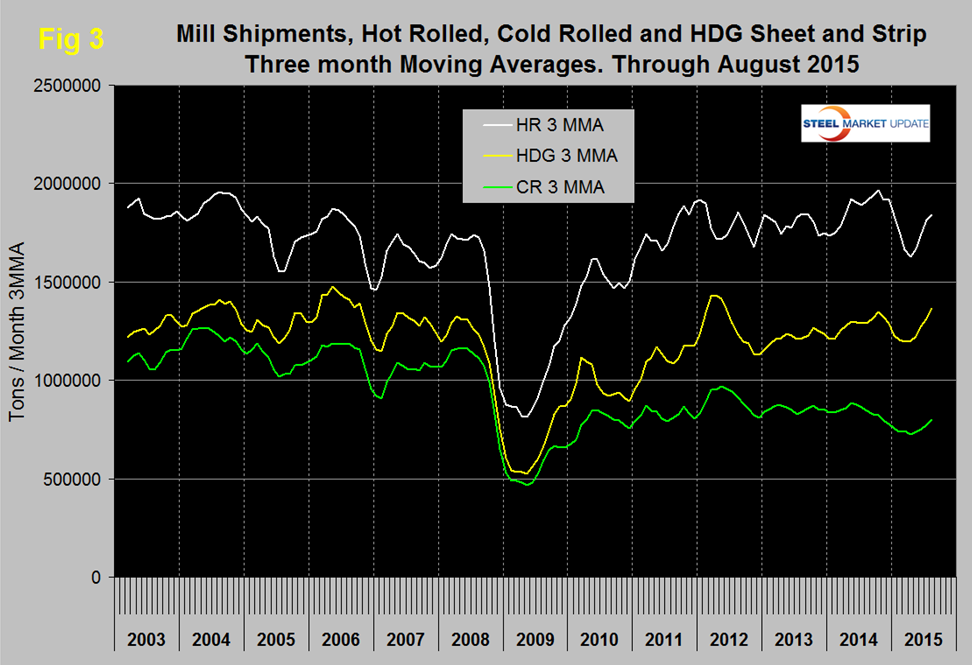

Three months through August year over year was down by 1.3 percent. These numbers illustrate why it’s necessary to look at different time periods to get the whole picture. Hot rolled and cold rolled followed the same pattern in all three time comparisons. HDG had a positive Y/Y growth in 3 months through August. Other metallic coated had positive growth in all three time comparisons and electro-galvanized contracted across the board. Figure 3 puts these results into the long term contextsince January 2003.

SMU Comment: Import market share is still very high, longs being even worse than sheet products. However imports are no longer in the driver’s seat when it comes to absorbing market share. We believe that manufacturing accounts for about 60 percent of steel consumption in the US and that figure is higher for sheet products than for longs. Steel demand at present is bucking the trend of a slowing manufacturing sector therefore the recent demand improvement may be short lived. It is evident as we write many of the reports for publication in the Steel Market Update newsletters that it’s possible to slant an analysis anyway we want based on the time periods being examined. For that reason we always provide tabular data with short time period comparisons as well as graphical analysis of a much longer time frame. We hope this gives you the reader the best picture of what is going on though as we write, sometimes our comments can sound contradictory even to ourselves.