Prices

December 12, 2015

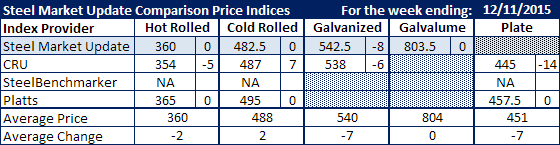

Comparison Price Indices: Bottom's Up...

Written by John Packard

We are already seeing some signs of the “turn” as the flat rolled steel indexes followed by Steel Market Update saw very little movement this past week. Both SMU and Platts saw hot rolled pricing as stable while CRU was down $5 per ton (SteelBenchmarker did not report prices this past week). Our average was down $2 per ton to $360 per ton.

Cold rolled also saw SMU and Platts holding prices the same as they were the week before last. CRU saw CR prices as being up $7 per ton. Our average increased by $2 per ton to $488 per ton.

Galvanized pricing was seen as lower by both SMU and CRU while Galvalume remained the same.

When it came to plate prices Platts did not move pricing this past week while CRU saw the market as being down $14 per ton.

A reminder to our readers that we will be discontinuing showing CRU prices as CRU has decided not to renew our agreement. For those of you with contract agreements you have options to use a variety of indices to tie to your contracts. You should tie to the index that provides the most transparency for the product you are purchasing.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.