Market Data

January 3, 2016

December 2015 Consumer Confidence

Written by Peter Wright

Consumer confidence improved from 92.6 in November to 96.5 in December. The very disappointing November result was revised upwards. The three month moving average (3MMA) declined from 98.1 in November to 96.1 in December. As we have reported in earlier write-ups on this subject, 2015 has been tremendously more variable month to month than 2014.

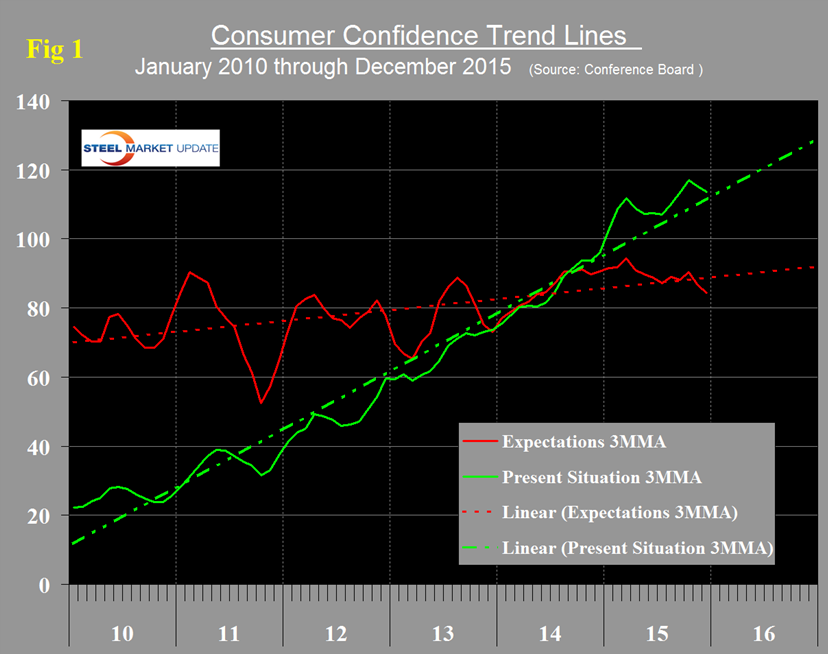

In all of 2014 the monthly change ranged from +5.1 to -4.4, this year the range has been +10.7 to -8.8 points. The 3MMA of the present situation, almost on its five year trend and that of expectations, has now fallen below its 5 year trend (Figure 1).

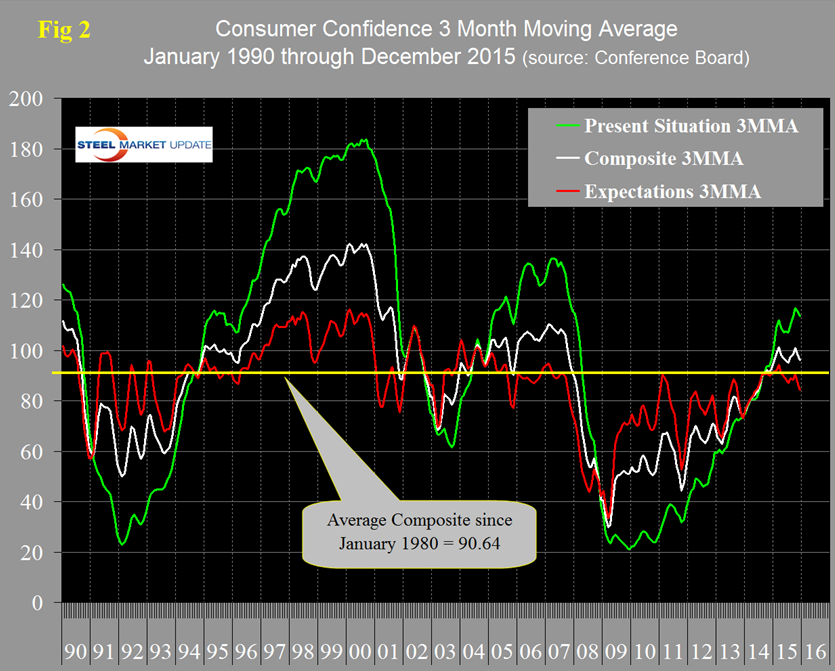

The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

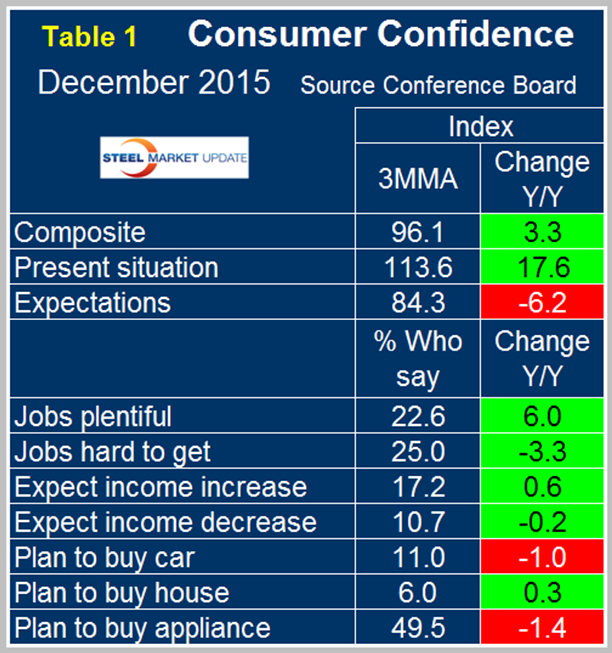

The consistency of the recovery of the composite is looking better than the turn around after the recession in 2003 but has not yet reached the level attained before the recession. The present situation component has been much more volatile over each multiyear time span than expectations since our data began 35 years ago with higher highs and lower lows. The view of the present situation moved ahead of that for expectations in November last year for the first time since the recovery began in 2009. If history repeats itself, the view of the present situation will continue to move ahead and widen the differential between it and expectations. On a year over year basis using a 3MMA, the composite at 96.1 is up by 3.3 led by consumer’s view of the present situation which is up by 17.6. Expectations at 84.3 are down 6.2 points year over year (Table 1).

All four of the employment sub-indexes which describe job availability and wage expectations have strengthened for five consecutive month’s year over year as indicated by the color code green. The year over year trends for auto, home and appliance purchase intentions were the same as in November with autos and appliances deteriorating and house purchase intentions improving. The year over year intentions to buy a car became negative in August and remained negative through December. Automotive sales are still extremely strong, therefore the negative reading in the consumer confidence report is probably a reflection of pent up demand being relieved. Intentions to buy an appliance became negative y/y in November for the first time since March and remained negative in December. Overall in 2015, the Conference Board index has maintained the strongest value since Q3 2007.

The official news release from the Conference Board reads as follows and is entirely based on monthly changes.

The Conference Board Consumer Confidence Index Improves in December

The Conference Board Consumer Confidence Index, which had decreased moderately in November, improved in December. The Index now stands at 96.5 (1985=100), up from 92.6 in November. The Present Situation Index increased from 110.9 last month to 115.3 in December, while the Expectations Index improved to 83.9 from 80.4 in November.

“Consumer confidence improved in December, following a moderate decrease in November,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “As 2015 draws to a close, consumers’ assessment of the current state of the economy remains positive, particularly their assessment of the job market. Looking ahead to 2016, consumers are expecting little change in both business conditions and the labor market. Expectations regarding their financial outlook are mixed, but the optimists continue to outweigh the pessimists.”

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was December 15.

Consumers’ appraisal of current conditions was mixed in December. Those saying business conditions are “good” increased from 25.0 percent to 27.3 percent. However, those saying business conditions are “bad” also increased from 16.9 percent to 19.8 percent. Consumers, however, were more positive about the labor market. The proportion claiming jobs are “plentiful” increased from 21.0 percent to 24.1 percent, while those claiming jobs are “hard to get” decreased to 24.7 percent from 25.8 percent.

Consumers’ optimism about the short-term outlook was somewhat mixed in December. Those expecting business conditions to improve over the next six months decreased slightly to 15.2 percent from 15.7 percent. However, those expecting business conditions to worsen increased slightly to 11.0 percent from 10.6 percent.

Consumers’ outlook for the labor market was more optimistic. Those anticipating more jobs in the months ahead increased slightly to 12.9 percent from 12.0 percent, while those anticipating fewer jobs decreased from 18.5 percent to 16.6 percent. The proportion of consumers expecting their incomes to increase declined from 17.3 percent to 16.3 percent. However, the proportion expecting a reduction in income decreased from 11.8 percent to 9.7 percent.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months. The Conference Board is a non-advocacy, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States.

(Sources: The Conference Board and SMU Analysis)