Overseas

February 21, 2016

SMU Survey: New Foreign Steel Orders

Written by John Packard

One of the questions being asked in the marketplace is how much foreign steel is being ordered and will there be a flood of imports as we move into the months of May and June. There is a portion of the market who believe there will be a flood while others are of the opinion import levels will remain relatively muted as we move into late spring and the summer months.

We are going to address this subject in a couple of ways this week. First, we are going to share a portion of the data we have been collecting through our flat rolled market trends analysis which we conduct twice per month. Second, we are going to speak with a number of traders this week to see if they are seeing a rise in orders and what their expectations are for imports during the aforementioned time frame.

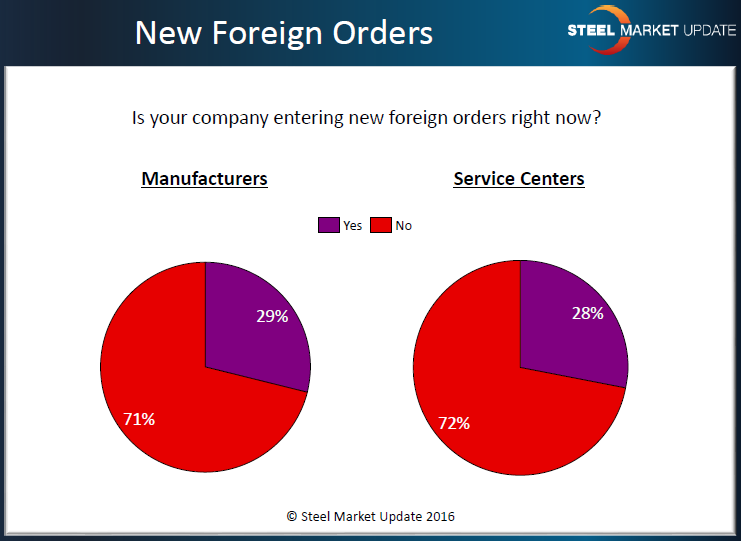

We asked both manufacturing companies and service centers if their company was entering new foreign orders at this time. We saw similar results from both, with 29 percent of manufacturers and 28 percent of distributors reporting their company as entering new foreign orders.

The trend for most of 2015, and again in early 2016, is fewer manufacturing and service centers reporting their company as entering new foreign orders. The trend on the surface does not look like a surge is coming, especially when you look back at 4Q data where both manufacturing companies and service centers were reporting much less interest in foreign that what we saw during that same time period late 2014 and into early 2015 (our Premium level members can review the data on our website under the Analysis tab – remember you need to be logged in to see the survey results links in the drop down menu).

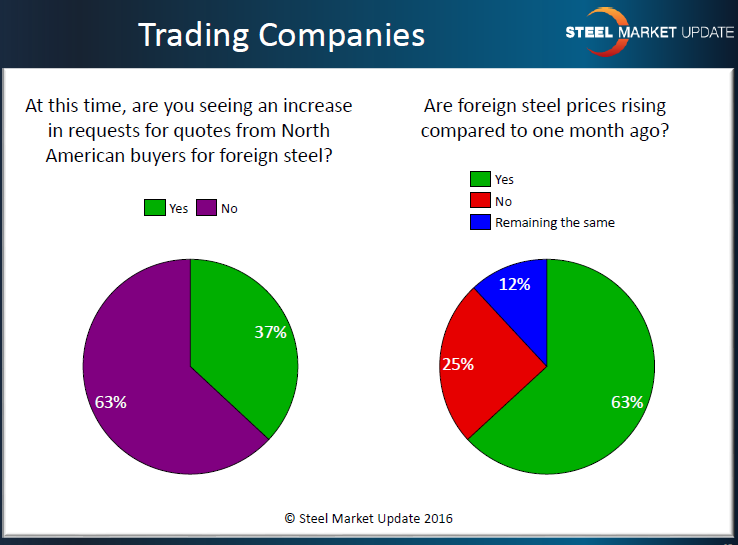

We also looked at the trading companies who participate in our flat rolled market trends analysis to see what they are reporting. As you can see from the graphics below, only 37 percent of the trading company respondents are seeing an increase in quoting activity from North American buyers. At the same time, 63 percent of the traders reported foreign prices as rising compared to just one month earlier.

We asked trading companies if they felt the new foreign offers were at prices where business can be transacted. Eight-eight percent responded yes.

We asked if the trade suits are affecting their ability to quote and service their North American customers. We had a 50/50 split as some felt that the suits were affecting their business while others did not.

Lastly, we asked if the new ENFORCE Act just passed by the U.S. Congress would have any impact on the imports of steel. We had 67 percent of the respondents saying yes, that it would impact imports, while 33 percent did not believe that to be the case.