Overseas

February 25, 2016

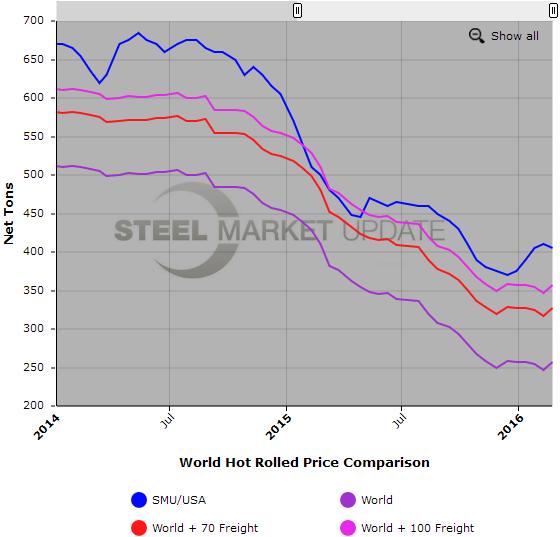

Analysis of World Export vs. Domestic Hot Rolled Coil Price Spread

Written by Brett Linton

The following calculation is used by Steel Market Update to identify the spread between world hot rolled export prices as determined by SteelBenchmarker and domestic (US) hot rolled prices as published by SMU. Steel Market Update compares the world hot rolled export price to which dollars are added for freight, handling, trader margin, etc. The number generated is then compared to the spot (FOB Mill) domestic hot rolled price using the SMU Hot Rolled Index average for this week, with the result being the spread between domestic and world hot rolled coil prices. This is a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate ultimately influencing the true market spread.

This theoretical price spread analysis is based on our review of world export prices and the hot rolled steel price index produced by SMU earlier this week. As the spread narrows, the competitiveness of imported steel into the United States is reduced. If it widens then foreign steel becomes more attractive to U.S. flat rolled steel buyers.

![]() The world export price for hot rolled bands is $257 per net ton ($283 per metric ton) FOB the port of export according to data released by SteelBenchmarker earlier this week. This is up $10 from the previous release on February 8th and up $2 per ton compared to the late-January price.

The world export price for hot rolled bands is $257 per net ton ($283 per metric ton) FOB the port of export according to data released by SteelBenchmarker earlier this week. This is up $10 from the previous release on February 8th and up $2 per ton compared to the late-January price.

SMU uses a minimum of $70 to as much as $100 per ton for freight, handling, and trader margin, which is then added to the export number in order to get the steel to ports in the United States. This puts the “theoretical” selling price for hot rolled coil exported to the United States as ranging from $327 to $357 per ton CIF USA Port.

The latest Steel Market Update hot rolled price average is $405 per ton for domestic steel, down $5 per ton compared to the last time we did an update on world prices and unchanged over late-January. The theoretical spread between the world HR export price and the SMU HR price is $48 to $78 per ton ($148 prior to import costs), down $15 from our previous analysis and down $2 from late-January.

The $48 to $78 spread is around $10-15 per ton more than the average spread over the last few months. Our previous spread in early February of $63 to $93 per ton was the highest spread seen since late-November 2014 when the spread was $66 to $96 per ton ($166 prior to import costs). In January through May 2015 we had more narrow spreads, some negative (meaning theoretically that domestic steel was cheaper than foreign steel); this time last year, it was -$11 to $19 ($89 prior to import costs). In early February 2015 the spread was -$19 to $11 ($81 prior to import costs), the lowest seen since late-May 2013. The widest spread seen between foreign and domestic HRC in 2015 was in mid-August at $42 to $72 per ton ($142 prior to import costs).

SMU did a quick check of foreign import offers into the port of Houston and we were told there were approximately $330-$340 per ton FOB the port. This is in line with the lower end of the range we have suggested above.

Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel.

Below is a graph comparing world HR export prices against the SMU domestic HR average price. We also have included a comparison with freight and traders’ costs added which gives you a better indication of the true price spread. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at 800-432-3475 or info@SteelMarketUpdate.com.