Market Data

November 30, 2016

SMU Survey Results: Demand from 2 Points of View

Written by John Packard

During the process of completing our questionnaire all of those invited first get to respond to a number of questions aimed at all of our respondents. Then we segregate the respondents into their appropriate groups where they respond to questions specifically designed for each group. The two largest groups are manufacturing companies and steel service centers. Approximately 85 to 90 percent of the respondents are from these two groups.

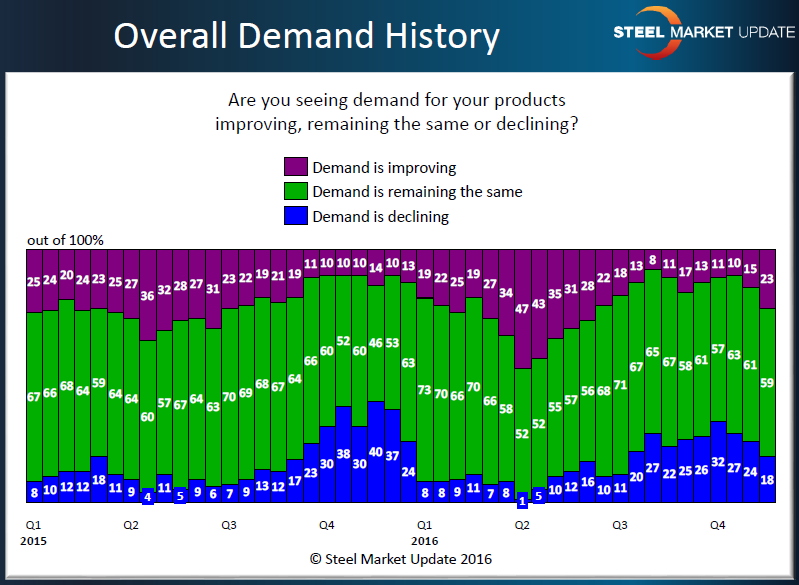

One of the key items we track is demand which we look at in a couple of different ways. First, we want to know if demand for all of our respondents products is improving, declining or remaining the same? In our most recent survey 59 percent of our respondents reported demand as remaining the same while 23 percent reported demand as improving and 18 percent said it was declining.

When we prepare our overall analysis for our Premium level subscribers we put the responses into a historical perspective. This is what that looks like:

We receive a number of comments during the survey process pertaining to our questions about demand:

“This is a supply push upturn based on inputs. Additional demand is developing as buyers want to beat the next increase. Statistically the industry is consuming less product than last year.” Steel mill

“Some hurricane demand in certain SE markets.” Service center

“People are hedge buying,” said one Service center who went on to say, “Fearful greedy mills will create a stall or lull in market as people will buy heavy in December at lower prices for 60-120 days worth of inventory.”

“Demand has softened over past 4 weeks.” Manufacturing company

“Decline is seasonal.” Manufacturing company

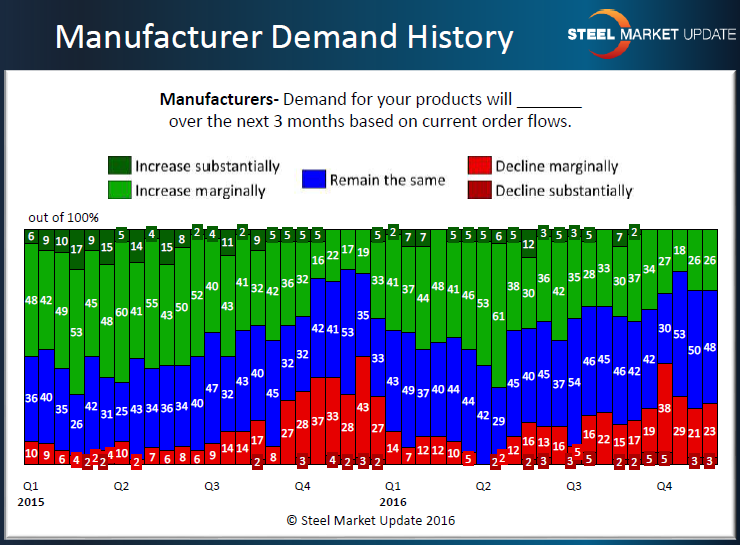

We also break out specific inquiries regarding demand by group. The manufacturing segment is asked two questions: one about generic demand: Demand for your products will (increase substantially, increase marginally, remain the same, decline marginally or decline substantially) over the next 3 months based on current order flows.

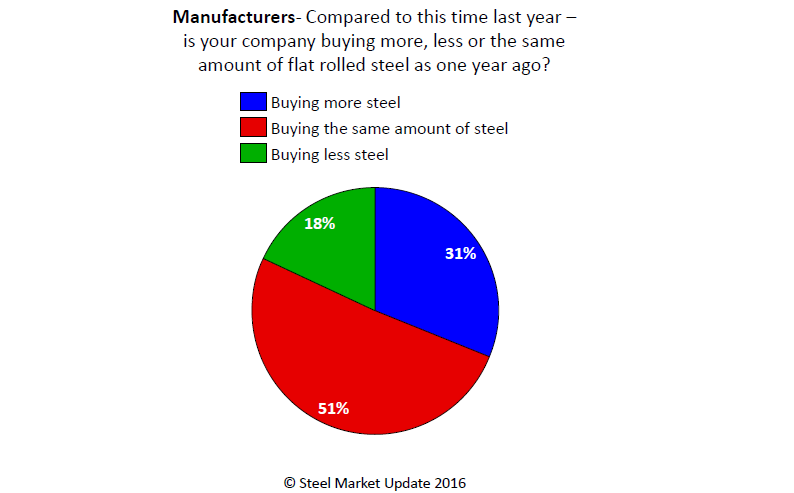

The second about steel demand: Compared to this time last year is your company buying (more steel, same amount of steel, less steel) as last year?

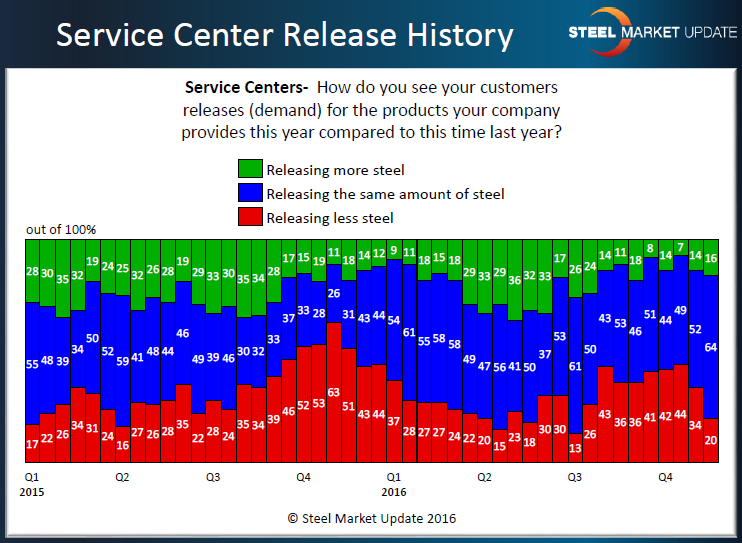

We also ask the service centers about their customers’ release history as a way of gauging demand from their customers. We did see a bump in the numbers this past week as only 20 percent of the distributors reported their customers as releasing less steel than year ago levels. As you can see by the graphic below, this is half what was being reported one month ago. It is also one third of what we saw at this point in time last year.

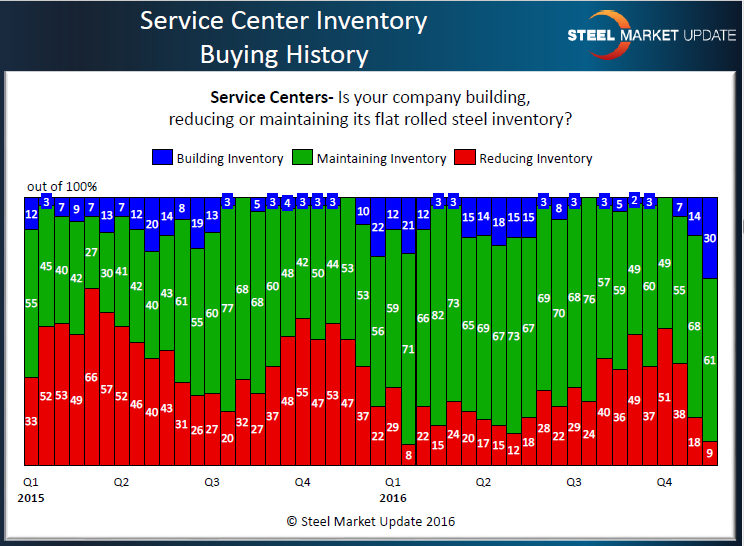

In the graphic below you can clearly see the service centers have been reacting to the higher prices by building some inventory back into their systems. The first price increase was announced about the same time we reported 38 percent of the distributors as reducing inventories of flat rolled. Since then that number has dropped to 9 percent with 30 percent reporting they are trying to build inventories.

What the Service Centers had to say during the survey process:

“Order rush from our customers who are shipping product by years’ end. A screeching halt is around the corner.”

“[Their customers are placing order now ]To take advantage of beating the price increase.”

“[Customers will release steel] Will increase though for December with hedge buying.”