Analysis

December 4, 2016

November US Auto Sales Move Industry Closer to Another Record Year

Written by Sandy Williams

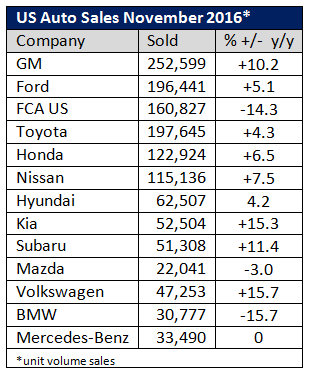

Automotive manufacturers reported strong sales for November with light-vehicle volumes up 3.5 percent year over year. Wards Auto data indicated the seasonally adjusted annual rate reached 17.75 million, in line with their forecast of 17.68 million.

Analysts are unsure if 2016 sales will top last year’s record of 17.47 million but it is likely to be close. Autodata Corp puts the year-to-date total at 15,859,922, up 0.1 percent from last year. Total unit volume in November, according to Autodata, was 1,380,558 units. December is historically a robust month for auto sales and may be enough to push volume to a new record.

Ford Motor Co. is continuing with plans to move small car production to Mexico despite criticism from President-elect Donald Trump and a threat of tariffs on the Mexican produced vehicles.

“We have made the decision to move the Focus out, and we’re making that investment now,” said Ford CEO Mark Fields in an interview with the Wall Street Journal. “When you look at moving the Focus out of our Michigan assembly plant, that’s to make room for new products—zero jobs affected, zero jobs impacted.”

“This isn’t a Carrier situation,” said Fields in the WSJ interview. Fields said production in Mexico will help keep vehicle prices in line with customer expectations. Last year’s labor contract with the United Autoworkers included a commitment to invest $9 billion in U.S. plants which is expected to create or support 8,500 union jobs at Ford facilities.

Fields said in a Bloomberg interview, he wasn’t sure if Trump would follow through on the threat to impose a 35 percent tariff on Ford cars built in Mexico.

“If a tariff was imposed, it would be imposed on the entire industry, not just singling out a single company,” Fields said. “When you look at the production and supply chains and how they’re integrated between the three countries [Mexico, Canada and the U.S.], putting a tariff on that would have a negative impact on all the economies.”