Overseas

December 15, 2016

Analysis of Foreign vs. Domestic Hot Rolled Coil Prices

Written by Brett Linton

The following calculation is used by Steel Market Update to identify the theoretical spread between foreign hot rolled export prices and domestic (USA) hot rolled prices. We want our readers to note that we have made a decision to replace SteelBenchmarker as the primary data provider of foreign hot rolled coil prices. We were finding the comparison between Platts European (Ruhr) number (as well as other Platts foreign export numbers) to be much closer to the actual quotes we are seeing on HRC out of various steel trading companies than using the SteelBenchmarker “world export” number. We will continue to use SteelBenchmarker as a secondary number provider which we will note further down in our articles about HRC price spreads.

Our new primary numbers for this exercise are from Platts, with a comparison of European HRC (FOB Ruhr), Turkey HRC export pricing (FOB Turkey), and Chinese HRC export prices (FOB Chinese port). Be aware that Chinese hot rolled is not available to the U.S. market so the Chinese spread is nothing more than an exercise of what if…

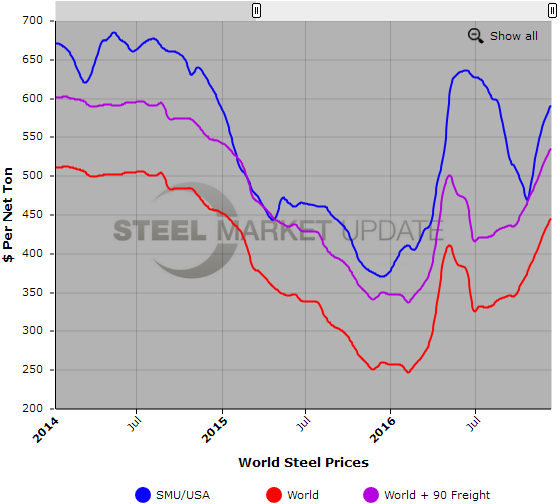

![]() SMU uses the Platts foreign HRC prices referenced above and then we add $90 per ton to these prices in consideration of freight costs, handling, trader margin, etc. This provides an approximate “to the US ports price” that we then compared against the SMU US hot rolled price average (FOB Mill), with the result being the spread (difference) between domestic and foreign hot rolled prices. As the spread narrows, the competitiveness of imported steel into the United States is reduced. If it widens, then foreign steel becomes more attractive to U.S. flat rolled steel buyers.

SMU uses the Platts foreign HRC prices referenced above and then we add $90 per ton to these prices in consideration of freight costs, handling, trader margin, etc. This provides an approximate “to the US ports price” that we then compared against the SMU US hot rolled price average (FOB Mill), with the result being the spread (difference) between domestic and foreign hot rolled prices. As the spread narrows, the competitiveness of imported steel into the United States is reduced. If it widens, then foreign steel becomes more attractive to U.S. flat rolled steel buyers.

As of today (Thursday, December 15) Platts published European HRC prices is referenced as being $564 per net ton ($552.50 Euros per metric ton), up $69 from one month ago. Calculating in $90 per ton for import costs, that puts prices at $654 per net ton from Europe delivered to the US. The latest Steel Market Update hot rolled price average is $590 per ton for domestic steel, up $50 per ton compared to the last time we did an update on world prices on November 17th. This puts the theoretical spread between European and US HR prices at -$64 per ton, following a -$45 per ton spread one month ago. This means that currently US sourced HR is theoretically $64 per ton cheaper to buy than getting HR steel imported from Europe.

Chinese HRC prices were reported at $460 per net ton ($507.50 per metric ton), up $58 from one month ago. Using the Platts price and adding $90 in estimated import costs, that puts prices around $550 per ton delivered from China (if China were able to ship to the United States, which they are not). The theoretical spread between the Chinese and US HR price is +$40 per ton, down from +$48 per ton one month ago. Meaning that if Chinese HR were able to be shipped to the US, it would be $40 per ton cheaper than buying domestic steel.

Platts published Turkish export prices at $476 per net ton FOB Turkish port ($525 per metric ton), up $50 from one month ago. Adding $90 in import costs, the Turkish HRC “to the US ports” price is $566 per ton. This puts the theoretical spread between the Turkish and US HR price at +$24 per ton, unchanged from one month ago. This means that HR from the US is theoretically $24 per ton more expensive than importing HR from Turkey.

Please note that this is a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate ultimately influencing the true market spread. And again, the Chinese spread is nothing more than an exercise of what if…

SteelBenchmarker World Export Price

The SteelBenchmarker world export price for hot rolled bands is $445 per net ton ($490 per metric ton) FOB the port of export according to data released by SteelBenchmarker on Monday December 12th. This is up $39 per ton from the previous release on November 14th. Adding in $90 in estimated import costs, that puts prices around $535 per ton delivered to the US.

Therefore, the theoretical spread between the SteelBenchmarker world HR export price and the SMU HR price is +$55 per ton, meaning foreign steel imported into the US is theoretically now $55 per ton cheaper than domestic steel. This spread is up from +$44 from our previous analysis.

This $55 spread is about $15-30 per ton higher than the average spread we have seen over the last few months. This past summer, we had record high spreads, with the June 27th 2016 spread of $210 being the record high in our 7+ year recorded history, and the July 14th 2016 spread of $204 being the second highest. Prior to 2016, the previous highest spread was $94 in May 2014. The lowest spread in our history was -$70 in August 2011 (meaning domestic steel was theoretically $70 per ton cheaper than foreign steel). This time last year, the spread was $21 per ton.

Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel.

Below is a graph comparing SteelBenchmarker world HR export prices against the SMU domestic HR average price (we will build new data using Platts and replace the SteelBenchmarker data in the months ahead). We also have included a comparison with freight and traders’ costs added which gives you a better indication of the true price spread. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at 800-432-3475 or info@SteelMarketUpdate.com.