Market Data

April 25, 2017

Service Center Spot Prices in Transition

Written by John Packard

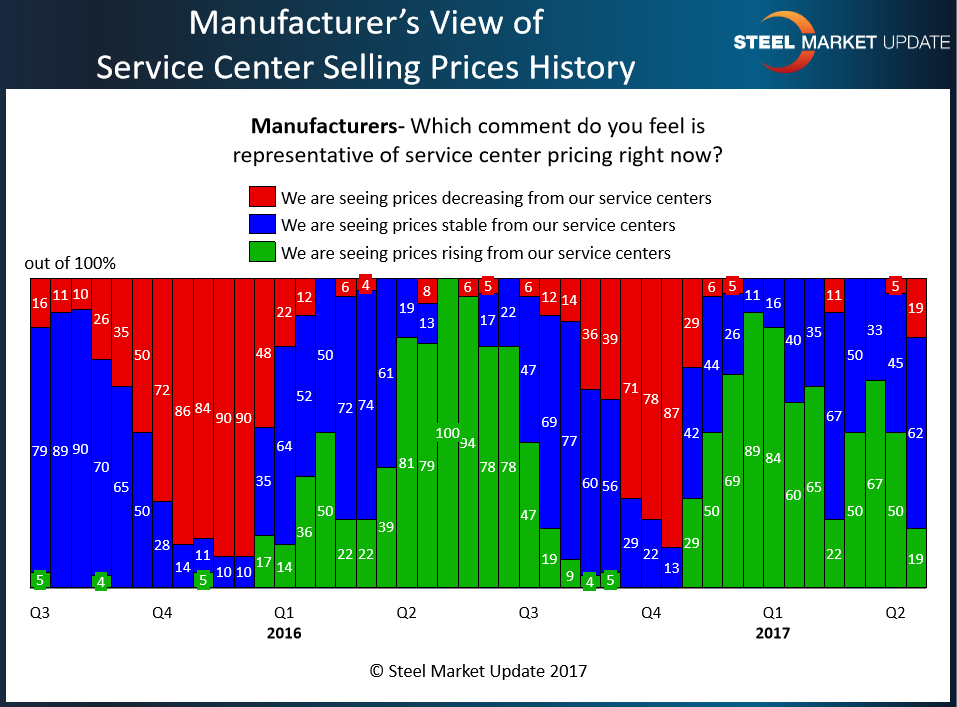

Both manufacturing companies and service centers are reporting distributor spot prices as being in a state of transition. The percentage of manufacturing companies reporting service centers as raising spot flat rolled steel prices has dropped from 50 percent at the beginning of April to 19 percent. At the same time 19 percent of the manufacturing respondents are now reporting distributors as offer spot prices lower than one month ago when no one (0%) reported spot prices as dropping.

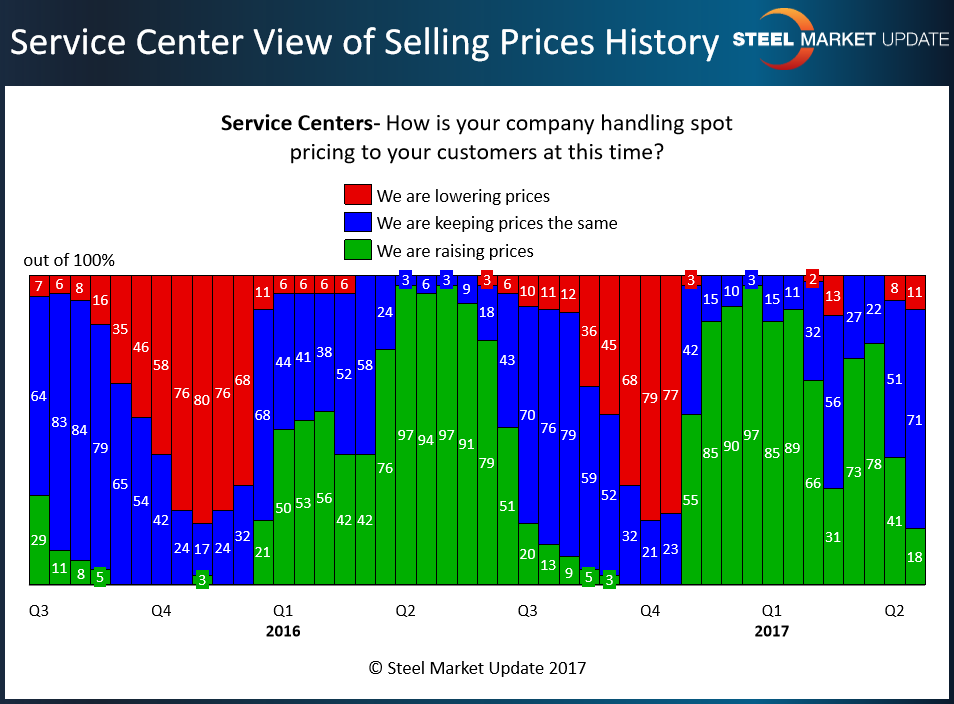

Service centers reported similar results as the manufacturers with 18 percent reporting their company as raising spot prices. The vast majority of our service center respondents (71%) reported spot flat rolled prices coming out of their company as remaining the same. Only 11 percent reported their company as dropping prices.

As you can see by the two graphics the market has been a little topsy-turvy over the past couple of months. Due to this instability Steel Market Update has our Price Momentum Indicator at Neutral. A Neutral indicator means prices are in transition and could move in either direction as we wait for a strong push on supply or demand that will result in prices moving in concert in one direction.