Market Segment

May 16, 2017

Service Centers Saw Strong Daily Shipment Rate of Flat Rolled in April

Written by John Packard

The Metal Service Center Institute (MSCI) released their April 2017 shipment and inventories data for the United States and Canada. The following is a recap of the U.S. data.

Total steel shipments (all products) were reported to be 3,110,500 tons which was 4.2 percent lower than year ago levels (19 days vs. 21 day month last year). The daily shipment rate was 163,700 tons which was the largest daily shipment rate seen since May 2015 (164,000 tons per day).

Shipments for the first four months 2017 are 13,234,900 tons which is 3.3 percent better than 2016 shipment levels.

Inventories were reported to be 6.0 percent below year ago levels with the month of April ending at 7,191,400 tons. The number of months on hand now stands at 2.3 months up from 2.0 months reported at the end of March.

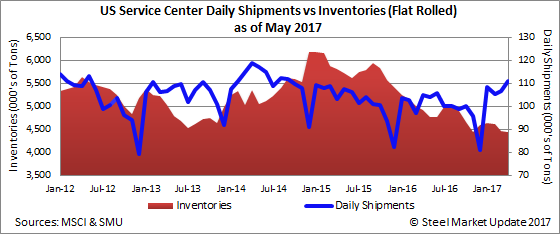

Carbon Flat Rolled

U.S. service centers shipped a total of 2,111,300 tons flat rolled steel which was 4.0 percent below the tonnage shipped in April 2016 (again, April 2017 had two fewer shipping days). The daily shipment rate was 111,100 tons per day. The last time we saw flat rolled shipments above 111,100 tons per day was September 2014 (111,700).

For the first four months 2017 flat rolled shipments totaled 8,942,400 tons which is 3.3 percent above year ago levels.

Inventories of sheet products stood at 4,432,900 tons, according to the MSCI data. Flat rolled inventories are 9.7 percent below year ago levels. Based on the April shipment rate the number of months supply stands at 2.1 months up from the 1.8 months reported at the end of March.

Plate shipments totaled 273,700 tons in April which was 4.7 percent below year ago levels. The daily shipment rate was 14,400 tons per day which was the same as March 2017 and an improvement over the 13,700 ton per day rate reported at the end of April 2016.

Year-to-date plate shipments total 1,186,200 tons which is 3.7 percent better than one year ago.

Inventories of plate stood at 745,400 tons as of the end of April. Plate inventories are 1.4 percent above year ago levels. The number of month’s supply is 2.7 up from 2.3 as of the end of March.

Carbon Pipe & Tube

The MSCI reported pipe & tube shipments of 171,700 tons during the month of April. This was 17.1 percent below year ago levels. The daily shipment rate was 9,000 ton per day. This was lower than the prior month and lower than levels seen in April 2016 (9,900 tons per day).

Total shipments for the first 4 months are 774,800 tons which is 5.3 percent below year ago levels.

Pipe and tube inventories stood at 490,600 tons essentially unchanged from the prior month and 11.7 percent below year ago levels. The number of month’s supply on hand at the end of April was 2.9 months up from 2.2 months reported by the MSCI at the end of March.