Market Segment

June 27, 2017

Schnitzer Steel Expects Increased Scrap Demand from EAF Trend

Written by Sandy Williams

Schnitzer Steel, a metals recycler and steel bar producer, reported its best third quarter since FY 2012. Total revenue increased 36 percent sequentially and 25 percent year-over-year to $477 million. Net income was up 50 percent from second quarter and 51 percent from Q3 2016 to $17 million.

The improvement was primarily in the company’s Auto and Metals Recycling segment. Operating income in the segment increased 13 percent quarter-over-quarter to $30 million, driven by higher sales volumes and pricing, increased supply flows and better market conditions.

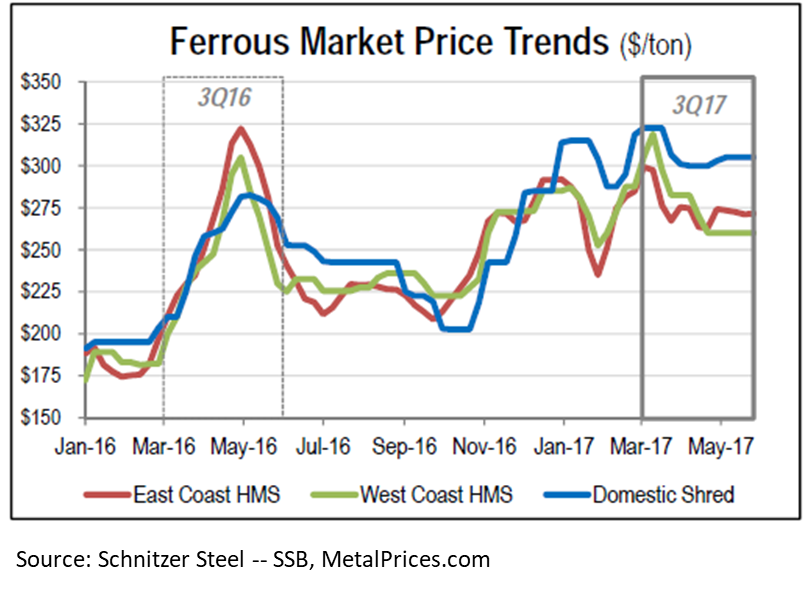

Prices in the ferrous market stabilized in May after softening by $25/ton in April from February’s peak levels. During the same period, iron ore prices dropped 35 percent from their highs in February, while met coal prices increased by nearly 10 percent. On a sequential basis, average ferrous selling prices improved by 4 percent and were up by 20 percent compared to the prior year quarter; ferrous sales volumes were up by 12 percent sequentially and by 14 percent year-over-year.

CEO Tamara Lundgren said during the earnings conference call, “There are several drivers underpinning our year-over-year higher volumes, including improved market conditions, broad-based demand for scrap, stronger supply flows and improvement in U.S economic indicators and the reduction in China’s finished steel exports.”

Lundgren noted that China has made progress closing induction furnaces and curtailing production to lower emissions. Although China steel production increased 4.4 percent in the first five of months of 2017, it has been mostly absorbed domestically, said Lundgren, helping to reduce exports and return stability to the market.

“On a longer term basis,” said Lundgren, “we anticipate demand for scrap to continue to increase. Industry experts expect that there will be increased global demand for scrap as EAFs become a larger component of the global steel sector. The attraction of a lower, more flexible cost base together with increased environmental compliance requirements has the potential to increase the proportion of EAFs from approximately one-third of global capacity today towards 50 percent over the longer term.”

The Steel Manufacturing Business operating income was just above break-even for third quarter, improving by $2 million from second quarter and slightly below Q3 2016. Finished steel sales volumes jumped 33 percent from the previous quarter as construction demand picked up for the season. Sales volume was up 6 percent from the prior-year third quarter.

“Steel pricing and margin benefits were tempered by low priced rebar imports into the West Coast,” said Lundgren.

The rolling mill operated at 84 percent utilization compared to 89 percent in second quarter and 53 percent in Q3 2016. Average net sales price of $545 per short ton for finished steel products increased 5 percent sequentially and 9 percent y/y as a result of higher raw material prices.

Schnitzer has combined its Oregon steel and scrap operations to form Cascade Steel and Scrap, an integrated steel manufacturing and metals recycling business. CSS will produce long products at its electric arc furnace minimill. Rolling mill capacity is 580,000 short tons with permit approval to expand the meltshop capacity to 950,000 short tons. Finished products from the mill and scrap from the six recycling feeder yards will be sold domestically and abroad.

Senior Vice President and CFO Richard Peach expects continued year-over-year growth in ferrous sales volumes. Combined operating income of the two segments is expected to be significantly better year-over-year and in the same range as third quarter.