Market Data

August 22, 2017

Service Center Spot Sales Pressure Mill Price Increases

Written by John Packard

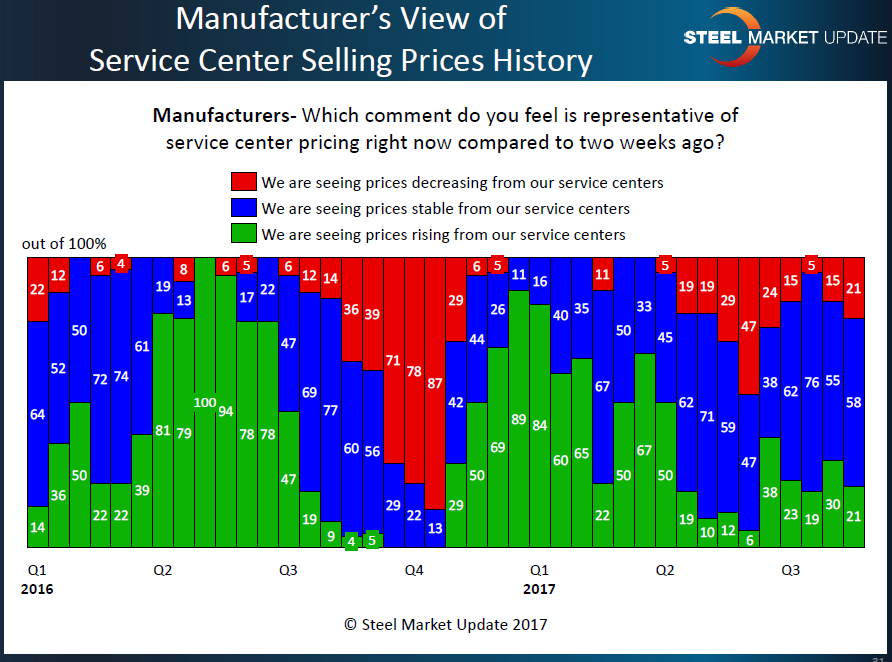

In Steel Market Update’s (SMU) latest flat rolled steel market analysis, manufacturing companies and steel service centers are sending mixed messages regarding how flat rolled steel distributors are treating their spot end customers. Twenty-one percent of the manufacturing companies responding to last week’s flat rolled steel market trends questionnaire reported service centers were lowering prices, while another 21 percent told SMU that distributors were raising prices. These levels do not suggest a clear direction for momentum, which could be troubling to the domestic mills and their price increases since there normally is a jump in distributors raising spot prices when an increase has been announced.

Service centers reported similar results. The vast majority of the distributors responding (76 percent) reported spot prices remaining the same as they were two weeks earlier when we last canvassed the market. Twelve percent reported their company lowering spot flat rolled prices, while 11 percent report their company raising prices.

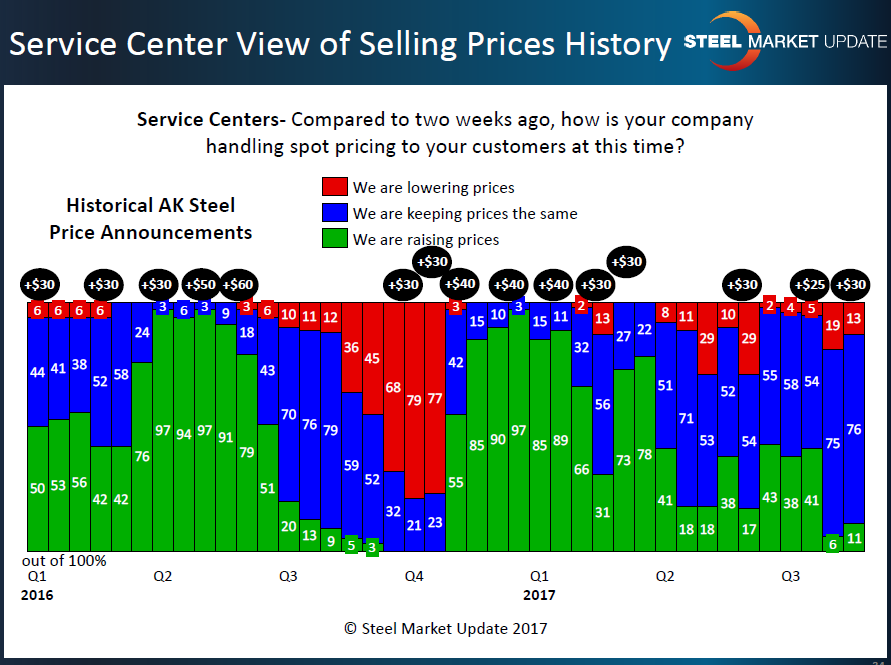

There have been three price increase announcements going back to June (one June, one July and one August) totaling $85 per ton. Based on the SMU steel index for hot rolled, only a portion of the increase has been collected (and that can vary from mill to mill). Most of the collection was done after the first increase. You can see in the graphic below that at least a portion of the service centers reacted by raising spot prices over a six-week period. After the second increase, there was no jump in distributors advising spot prices as increasing. We will have to watch carefully over the next couple of weeks to see if attitudes about spot pricing change at the service center level.

A note about the graphic shown above: The black ovals represent AK Steel price increase announcements. We use AK Steel as a reference point because they are the only steel mill that publishes their price announcements on their website. This allows both buyers and sellers of steel (and all of our readers) to check the AK Steel site for exact announcement dates and to confirm that our graphic is correct. Green bars represent service centers raising spot prices (percentage of the service center respondents who report their company as raising spot prices). Red bars are those reporting spot prices as decreasing. Blue, prices remain the same as reported two weeks prior.