Market Data

October 8, 2017

Service Centers Lowering Spot Prices

Written by John Packard

Over the course of the first four days of this past week (the week of Oct. 2, 2017), Steel Market Update conducted our early October flat rolled steel market trends analysis. One of the areas we track is how steel service centers are handling spot prices on flat rolled steel being sold to their customers. A growing percentage of manufacturing companies and flat rolled steel distributors reported service centers as lowering spot prices.

In SMU’s opinion, based on watching flat rolled steel spot prices out of the service center segment of the industry, the distributors’ support for spot prices is an important signal for prices in the greater flat rolled market – including for steel mill pricing.

The service centers are taking their spot prices lower, which is an indication of growing inventory levels and/or slowing demand.

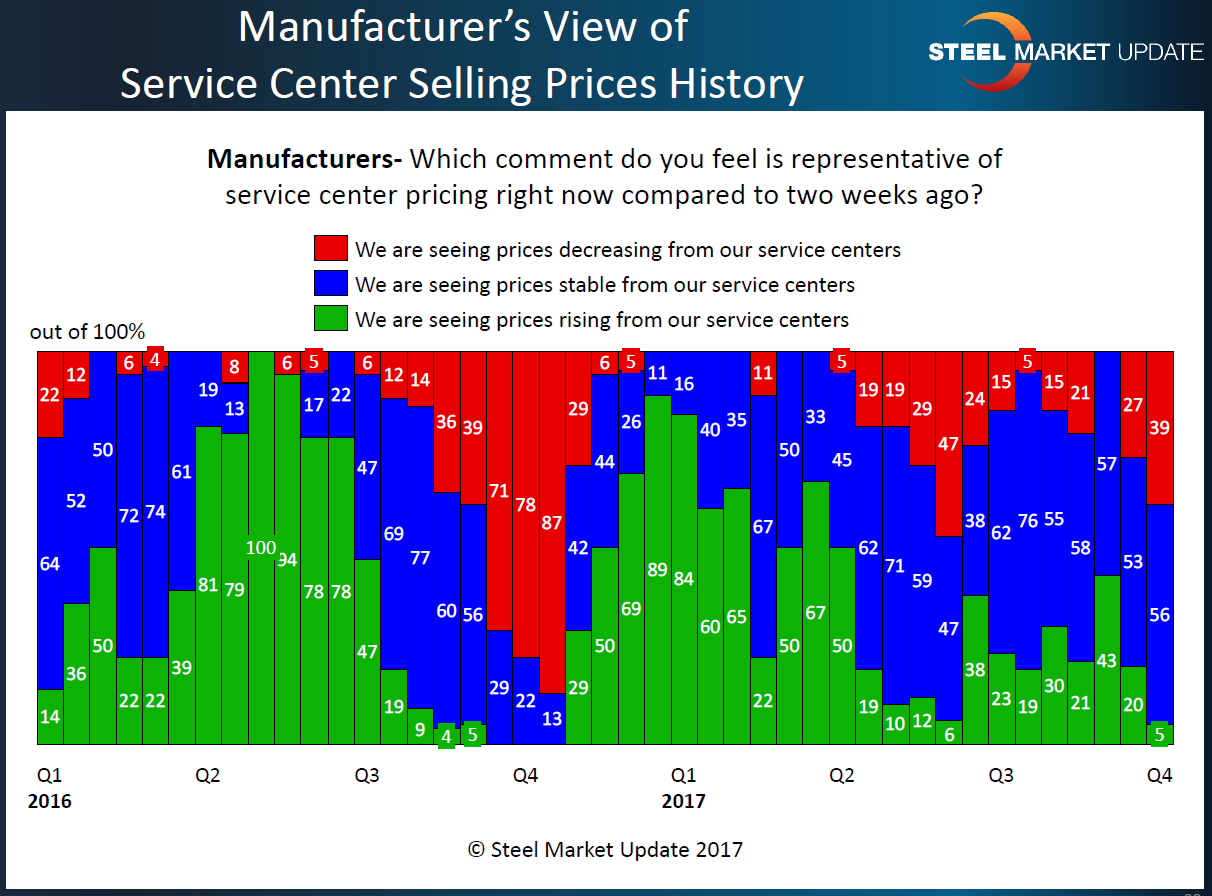

Thirty-nine percent (39 percent) of the manufacturing companies participating in last week’s analysis reported their service center suppliers as lowering spot prices compared to what they were seeing just two weeks earlier. This is up 12 percentage points from mid-September.

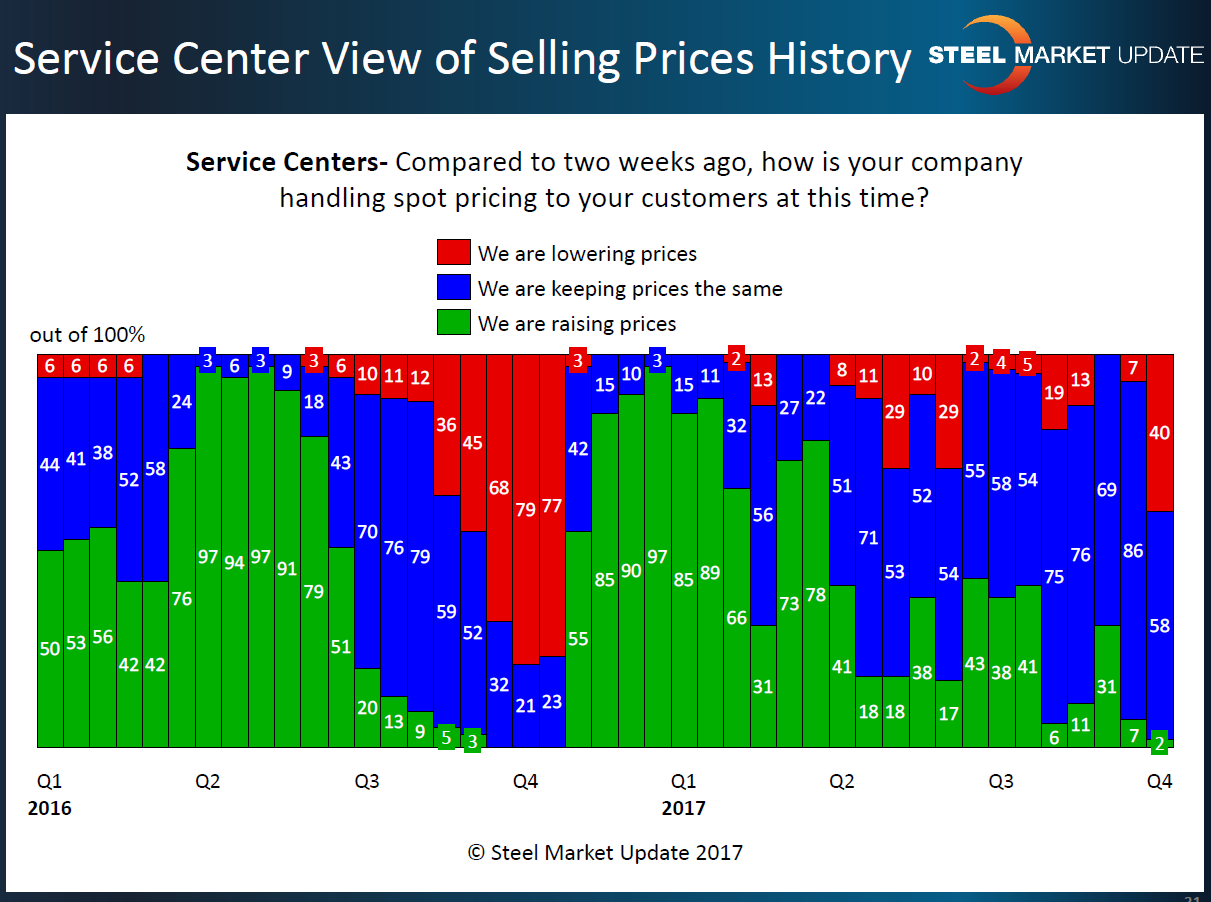

Service centers participating in last week’s analysis agreed with the manufacturers as 40 percent of the distributors reported their company as lowering spot prices. This is up 33 percentage points compared to the mere 7 percent reporting falling prices two weeks earlier.

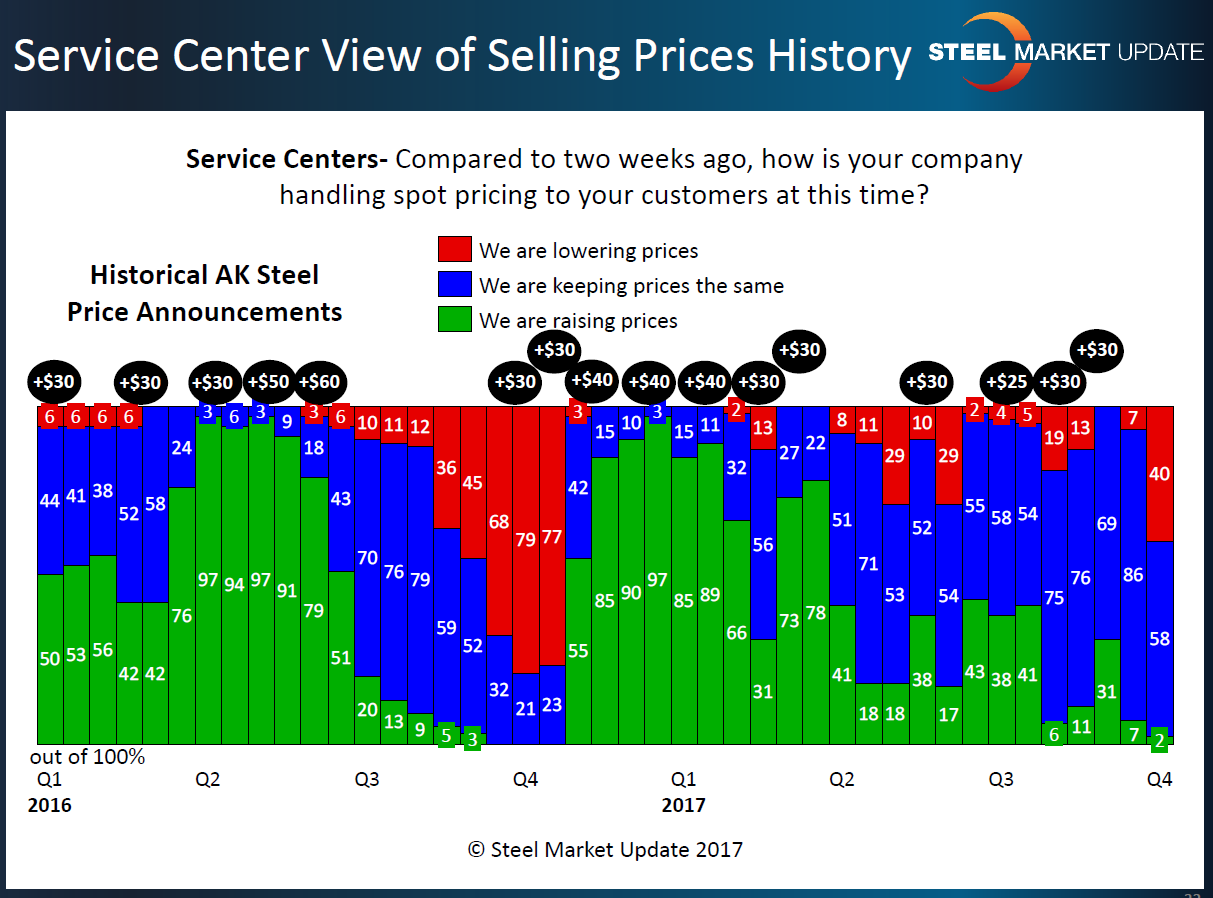

We have one more graphic that we share with our readers/members and that shows mill price increases against service center spot pricing. (We use AK Steel announcements as the benchmark since they publicly announce their increases on their website.) As you can see by the graphic below, there has been tepid support for any mill price increase announcements going back to late first quarter 2017. Without service center support, market pricing has been relatively flat over the course of 2017. The last strong price move was in mid to late October 2016 when prices bottomed at $470 and then rose to $625 per ton by mid-January 2017. During that time period, at least 85 percent of the service centers were reporting higher spot prices to their customers (thus supporting the mill increases).