Market Data

October 12, 2017

SMU Steel Distributor Inventories Rise

Written by John Packard

Steel Market Update (SMU) has been working with 40 flat rolled steel service centers as we develop a new index regarding flat rolled steel inventories being held at steel distributors in the United States. Based on the data collected through this afternoon, we are finding a modest increase in the inventories being held by the flat rolled distributors at the end of September compared to the prior month.

In August, the distributors advised SMU that their inventories averaged 2.70 months (this is the final adjusted number for the month and includes all 40 service centers).

Flat rolled inventories as of the end of September averaged 2.90 months of supply. This is an increase of 0.24 months of supply. This is based on responses from 85 percent of the service centers registered reporting through this afternoon.

More than twice the number of service centers reporting told SMU their inventories grew rather than shrunk. Some of the inventories grew as much as 1 full month of supply compared to what they were reporting last month.

We asked the companies that reported higher inventory levels to comment on the reasons why. For those whose inventories rose, we heard a couple of themes: 1) a miss in projected sales for the month of September and 2) an increase in either domestic or foreign steel usually related to a “special” purchase.

Not all companies reported higher inventories. As stated above, only a handful of companies reported lower inventory levels, and the biggest change was -0.70 of a month’s supply with most being -0.25 or less. There were two main reasons behind the reduction in inventories: 1) higher sales than forecast and 2) slower rate of inventory intake.

This new index is now only in its third month of existence, and we are continuing to recruit service centers who will report (confidentially) their inventory data. If your company is a distributor and you would like to be included in our index, please contact John Packard at: John@SteelMarketUpdate.com.

We are also working on expanding the type of information that will be collected and how we will relay the data to the data providers (who will get it first) and then to those subscribing to receive the data. We will have more on those changes and our ultimate delivery system in the months to come.

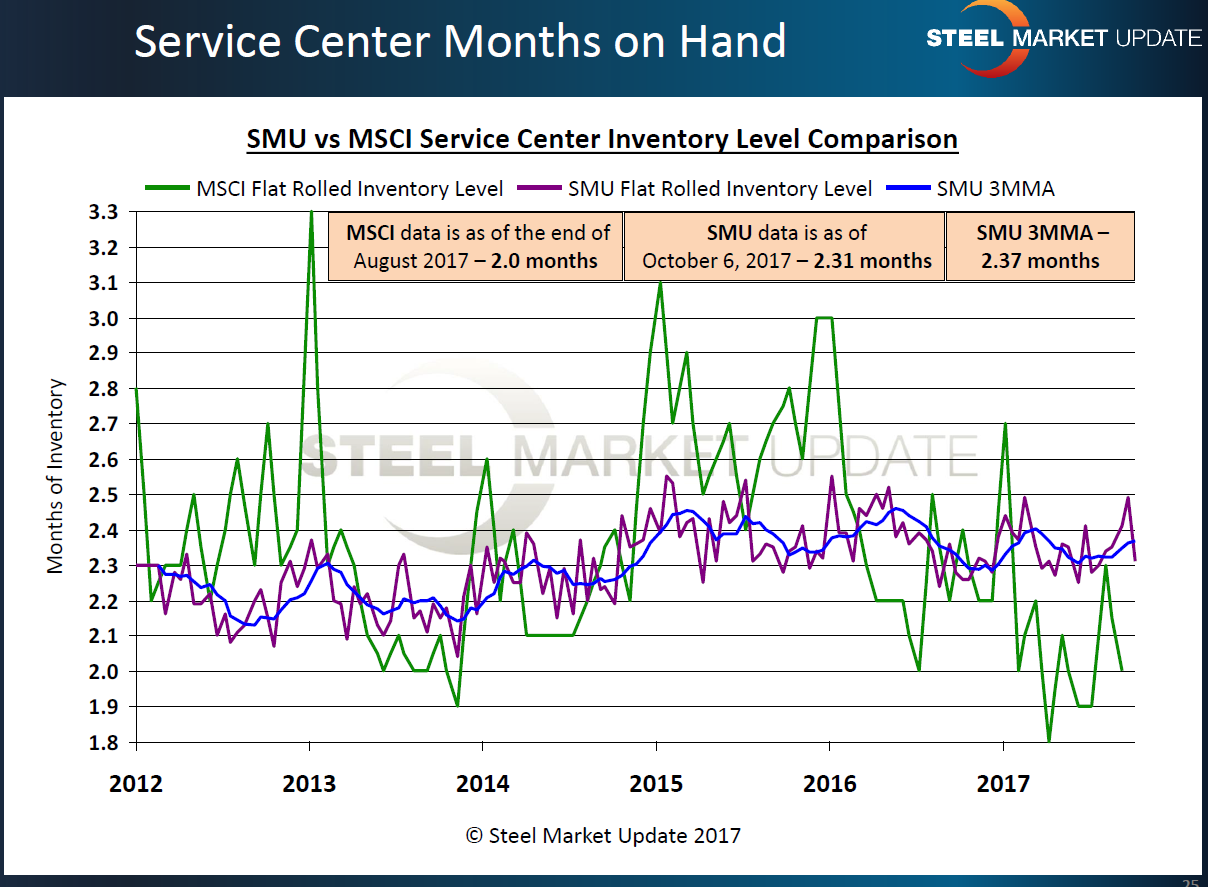

This index is not to be confused with the service center months on hand developed through our flat rolled steel market trends survey. That information will follow below.

SMU Flat Rolled Steel Market Trends Survey Results

Steel Market Update also conducts a flat rolled steel market trends analysis separate from our SMU Flat Rolled Steel Service Center Inventory Index. Our market trends analysis is based on the survey results conducted during the first week of October. We update the information in the middle of the month, so we have two data points for the month.

As a single data point, our survey average for flat rolled is 2.31 months of supply for the end of September. Looking at it from a three-month moving average perspective, inventories rise to 2.37 months’ supply.

Why the Variation Between SMU Inventory Analysis and Our Survey Average?

The data collected in the first section of this article comes from either the director of purchasing or the president/owner of the service center. We are receiving specific numbers from the service centers as opposed to the distributors selecting from a range in our survey. Also, the data collected during our surveys comes from both sales and purchasing people.

The trend has been for a mild rise in inventories over the past 30 days from our survey, which does lend some support to the data provided through our index above.

If you have any questions on either of these products, please feel free to reach out to us at either info@SteelMarketUpdate.com or John@SteelMarketUpdate.com.