Government/Policy

November 18, 2017

Preliminary Dumping Duties on Cold-Drawn Mechanical Tubing

Written by Sandy Williams

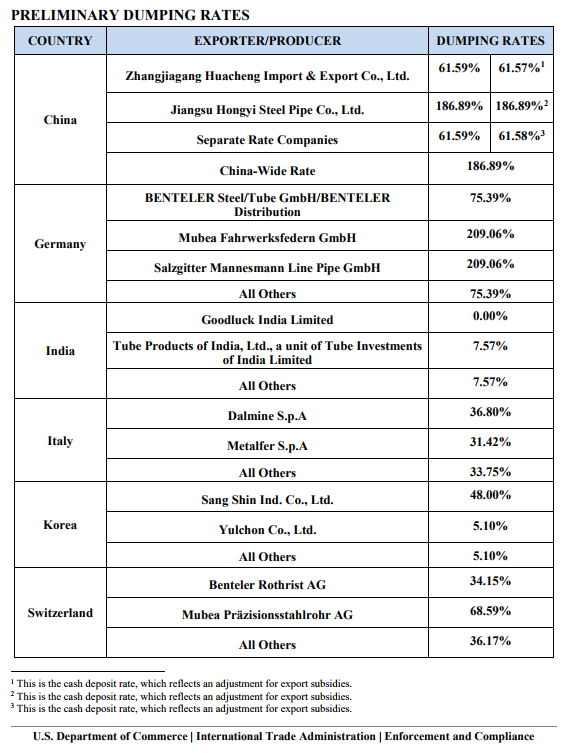

Cold-drawn mechanical tubing imported from China, Germany, India, Italy, Korea and Switzerland was determined by Commerce to be sold below fair value. In its Nov. 16 preliminary antidumping determination, Commerce assigned dumping margins ranging between 5.10 percent and 186.89 percent.

Commerce also found that “critical circumstances” exist with respect to Dalmine S.p.A. and Metalfer S.p.A. in Italy, and Sang Shin Ind. Co. Ltc in Korea. In China, Commerce found that preliminary critical circumstances exist in regards to imports from Jiangsu Hongyi Steel Pipe Co. Ltc., all other producers/exporters receiving a separate rate, and the China-wide entity (excluding Zhangjiagang Huacheng Import & Export, Co. Ltd.). As a result of these findings, Commerce will instruct U.S. Customs and Border Protection to require cash deposits based on preliminary antidumping rates for these companies.

The scope of this investigation covers cold-drawn mechanical tubing of carbon and alloy steel of circular cross-section, 304.8 mm or more in length, in actual outside diameters less than 331mm, and regardless of wall thickness, surface finish, end finish or industry specification.

The petitioners in this investigation are ArcelorMittal Tubular Products (OH), Michigan Seamless Tube, LLC (MI), PTC Alliance Corp. (PA), Webco Industries, Inc. (OK), and Zekelman Industries, Inc. (PA).

The preliminary dumping rates are as follows:

Next Steps

Commerce will make its final determinations by April 3, 2018. If the U.S. International Trade Commission and Commerce both make affirmative final determinations in this investigation, Commerce will issue AD orders. The ITC final determination is expected by May 17, 2018.