Prices

January 11, 2018

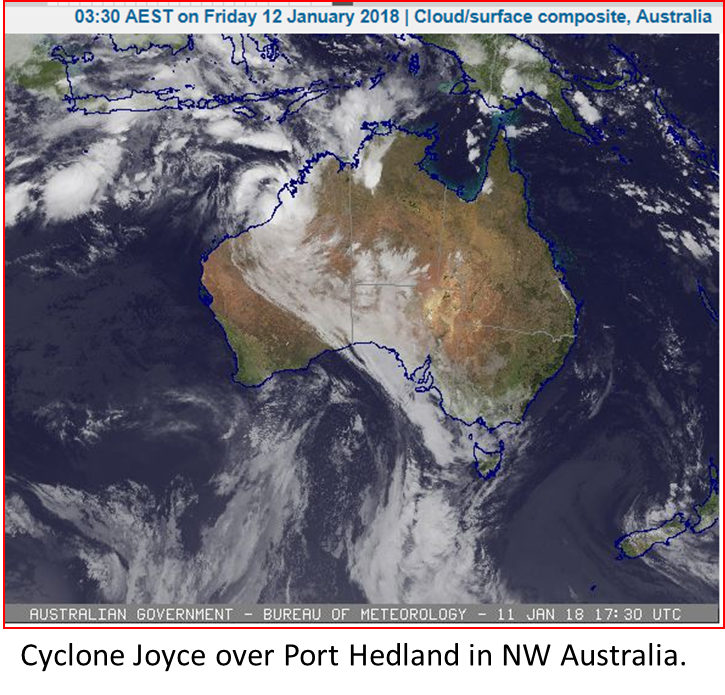

Australian Ore Miners Prepare for Cyclone

Written by Sandy Williams

Cyclone Joyce is intensifying off Australia’s western coast, prompting the Pilbara Ports Authority to take emergency precautions. The storm is expected to reach Category 3 by Friday or Saturday with possible wind gusts of 102-139 miles per hour.

Port Hedland, used as an iron ore export terminal by major ore producers Fortescue, BHP and Hancock Prospecting, expects to clear all vessels from the port by 6:30 pm Friday and officially close operations.

“The safety of our people is our highest priority and we are closely monitoring conditions relating to the cyclone,” Fortescue Chief Executive Nev Power said in a statement to Reuters.

Conditions are being monitored at Port Dampier, 300 miles south, which is used by ore miner Rio Tinto.

The Australian government forecasts iron ore prices will average $51.50 per metric ton this year, down 20 percent from the average of $64.30 per ton in 2017. The decline is attributed to an increasing ore supply and moderating demand from China’s steel industry. Looking forward to 2019, the forecast drops to $49 per ton, according to the Australia Department of Industry, Innovation and Science.

Iron ore spot prices are currently around $75 per metric ton.

The price of coking coal, another steel ingredient from Australia, is expected to dwindle over the next 18 months from the fourth-quarter’s price of $192 per metric ton as higher supply offsets demand.

Iron ore exports from Australia grew 31 percent to $63 billion in 2017, but are expected to fall to $52 billion in 2018. Metallurgical coal export volumes are forecast at 192 million tons for 2018, followed by a marginal rise to 192.5 million tons in 2019.

“Continued moderation in Chinese steel production, coupled with increased supplies from both Australia and Brazil, are expected to weigh further on iron ore prices over the next two years,” said Mark Cully, Chief Economist, Department of Industry, Innovation and Science. “Coal prices — both thermal and metallurgical — are also forecast to weigh heavily on Australia’s export earnings in the next two years, due to rising global supply and moderating demand.”