Analysis

March 10, 2018

January Heating and Cooling Equipment Shipment Data

Written by Brett Linton

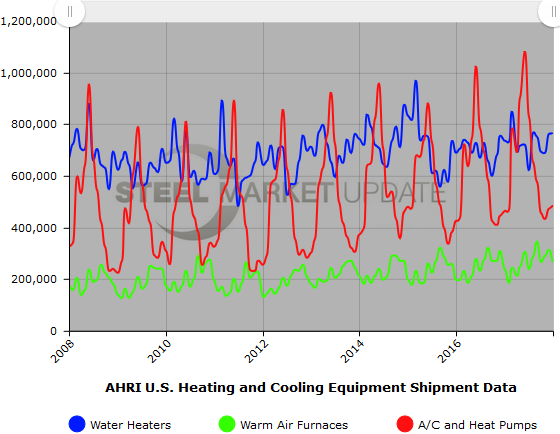

Below is the latest data released by the the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) regarding residential and commercial heating and cooling equipment shipments through January 2018. You may read the press release on their website here.

Residential Storage Water Heaters

U.S. shipments of residential gas storage water heaters for January 2018 increased 7.7 percent to 387,945 units, up from 360,133 units shipped in January 2017. Residential electric storage water heater shipment saw a very slight decrease in January 2018 to 357,365 units, down from 357,394 units shipped in January 2017.

Commercial Storage Water Heaters

Commercial gas storage water heater shipments increased 12.5 percent in January 2018 to 7,685 units, up from 6,832 units shipped in January 2017. Commercial electric storage water heater shipments increased 2.7 percent in January 2018 to 10,829 units, up from 10,545 units shipped in January 2017.

Warm Air Furnaces

U.S. shipments of gas warm air furnaces for January 2018 increased 13.3 percent to 262,744 units, up from 231,997 units shipped in January 2017. Oil warm air furnace shipments increased 8.6 percent to 3,226 units in January 2018, up from 2,970 units shipped in January 2017.

Central Air Conditioners and Air-Source Heat Pumps

U.S. shipments of central air conditioners and air-source heat pumps totaled 482,671 units in January 2018, up 4.2 percent from 463,062 units shipped in January 2017. U.S. shipments of air conditioners decreased 1.9 percent to 266,857 units, down from 271,954 units shipped in January 2017. U.S. shipments of air-source heat pumps increased 12.9 percent to 215,814 units, up from 191,108 units shipped in January 2017.

Below is a graph showing the history of water heater, warm air furnace, and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.