Logistics

March 10, 2018

Ships, Trucks and Railroads—Logistics Report for March

Written by Sandy Williams

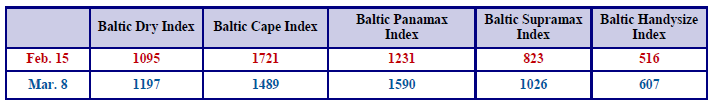

Shipping in the freight market was significantly better in the first quarter than it was during the same period last year, said MID-SHIP Group in its March 8 report. New ships are on order that will not hit the market until the end of 2109 or 2020 and for now the freight market remains bullish.

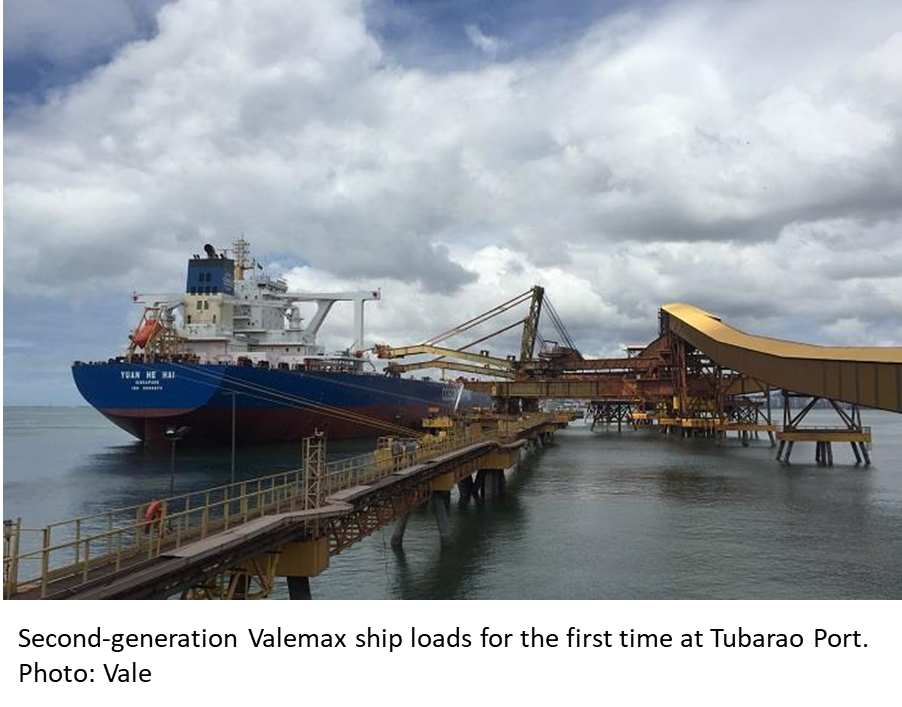

Vale’s second-generation Valemax vessel loaded its first cargo of iron ore in Brazil’s Tubarao port last week. The huge ships were developed by Vale and can hold 400,000 metric tons of ore. Thirty-one additional second generation vessels are under construction and will be delivered by the end of 2019.

The original fleet of 36 Valemax ships emit 35 percent less carbon dioxide than capesize ships that have a carrying capacity of 180,000 metric tons. The new generation of vessels reduces those emissions 10 to 20 percent further. Between 70-74 percent of the large vessels transport cargo for Vale in the Brazil-China route.

The ships are 365 meters long with seven cargo holds and require 46,000 tons of steel to build. Sixteen thousand tons of ore can be loaded per hour, with total capacity reached within a day and a half.

Vale is also negotiating contracts for construction of 39 smaller 325,000-metric-ton ships, called Guaibamax.

Purchases of the ships are backed with 25-year supply contracts to Vale, said MID-SHIP. “The result could be the number of Vale spot market Cape size requirements will be negligible.”

Barge

River traffic in the U.S. has been complicated by severe flooding throughout the inland river system. Barges are being restricted to smaller sizes, daylight hours only in some areas, and are experiencing slower transit times. The barge market is becoming tight, said MID-SHIP, due to empty barges delayed from returning to NOLA for reloading and northbound return.

Trucking

The flatbed load-to-truck ratio reached a record 80 loads per truck last week as a result of increased demand and continued challenges from ELD compliance. National average spot rates increased 4 cents to $2.39 as of the week ending March 3. The national on-highway diesel rate was $2.992 per gallon as of March 5.

The American Trucking Association continues to lobby the White House for a 20-cent per gallon user fee on transportation fuels to help fund infrastructure repairs and building. In its Build America Fund proposal, ATA suggests phasing in the fee during a four-year period. The fee would be applied at the wholesale terminal rack, before fuel reaches the retail gas pump and indexed to inflation and improvements in fuel efficiency. ATA estimates the fund would generate $340 billion over the course of a decade.

ATA President and CEO Chris Spear provided testimony before a House Subcommittee on Transportation and Infrastructure. “Each year motorists spend more than $1,500 due to lack of infrastructure investment—$500 spent repairing their vehicles and nearly $1,000 more wasted sitting in traffic. The trucking industry loses more than $63 billion every year because of congestion on our highway system,” said Spear. “That’s 362,000 truck drivers sitting idle for an entire year. And as much as we liked the tax cut we got last year, we’re going to give it all back because that $63 billion is like a 9 percent tax on our industry. These are the costs of doing nothing.”

ATA dismissed the idea of borrowing money to pay for infrastructure, increasing tolls on trucks, and the idea of selling public infrastructure to the private sector. “Roads and bridges are not Republican or Democrat; they aren’t free or cheap. It’s time to stop pointing fingers and making excuses and start investing in our future,” he said.

Rail

The Association of American Railroads reports U.S. railroads originated 1,028,141 carloads in February 2018, down 0.3 percent, or 2,753 carloads, from February 2017. U.S. railroads also originated 1,104,001 containers and trailers in February 2018, up 6.9 percent, or 70,970 units, from the same month last year. Combined U.S. carload and intermodal originations in February 2018 were 2,132,142, up 3.3 percent, or 68,217 carloads and intermodal units from February 2017.

“Rail carloads in February, like in many other recent months, were held back by declines in coal, grain and motor vehicles,” said AAR Senior Vice President John T. Gray. “Declines in those categories are unfortunate, but they don’t reflect general weakness in the economy. Excluding them, carloads were up a reasonably solid 2.1 percent in February. Moreover, February 2018 was the best month ever for carloads of chemicals and the second-best month ever for intermodal. While these are good signs for the broader economy going forward, they are potentially compromised by the uncertainty created by recent developments in trade policy.”

Total U.S. weekly rail traffic was 544,194 carloads and intermodal units, up 5.8 percent compared with the same week last year.

Total carloads for the week ending March 3 were 264,659 carloads, up 1.3 percent compared with the same week in 2017, while U.S. weekly intermodal volume was 279,535 containers and trailers, up 10.4 percent compared to 2017.

Great Lakes

The Coast Guard is ready to commence Spring Breakout to prepare regional waterways for the shipping season. Coast Guard cutters Mackinaw and Mobile Bay will start ice-breaking operations on the bay of Green Bay on Tuesday and ramp up in the coming weeks. The Soo Locks are scheduled to open on March 25, signaling the official opening of the season.

The Coast Guard is ready to commence Spring Breakout to prepare regional waterways for the shipping season. Coast Guard cutters Mackinaw and Mobile Bay will start ice-breaking operations on the bay of Green Bay on Tuesday and ramp up in the coming weeks. The Soo Locks are scheduled to open on March 25, signaling the official opening of the season.

A new stevedore company is opening at Buffington Harbor eight nautical miles from the Port of Indiana-Burns Harbor on Lake Michigan. Lakes & Rivers Logistics will be able to transfer cargo from lake carriers to trucks and trains. The stevedore cargo handling business will provide dry bulk services such as outside storage, bulk material packaging, project cargo management, custom material screening and custom material crushing.

Interlake Steamship Company says it began its “winter shuttling” of iron ore for ArcelorMittal from Cleveland Cliffs on March 1. The company reports ice conditions are improving in its operating areas.