Prices

April 12, 2018

Hot Rolled Steel and Scrap Futures

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

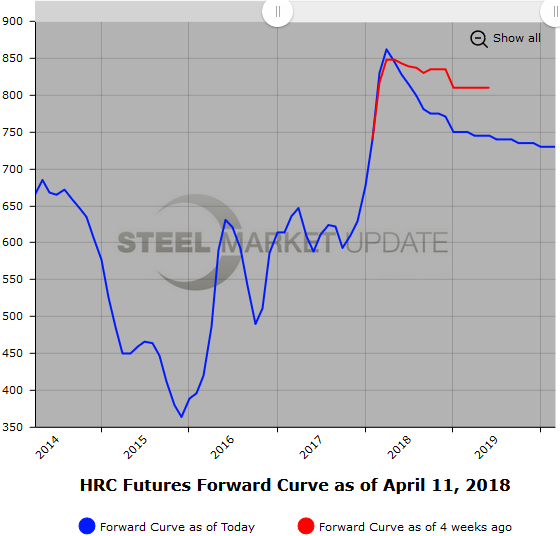

HR spot prices continued higher this past week with prices reportedly trading in the mid $860’s. Meanwhile, in April thus far, we have seen HR futures prices decline from higher levels for periods in 2018. Recent price moves have shifted the shape of the futures curve to reflect softer prices for HR going into the latter half of 2018.

The largest price declines in April have occurred in Q3’18 from roughly $812 to $781/ST (-$32/ST). For comparison, Q2’18 dropped $20/ST ( $856 to $837) and Q4’18 dropped $10/ST ($781 to $771). The Q2-Q3’18 HR calendar spread has widened since the end of March from $44 to $56/ST approximately, which reflects a steepening backwardation in the futures curve from a futures point that is closer to spot than it was a month ago. Think of the downward sloping curve shifting left on the future time line.

Month to date, HR futures have traded roughly 56,500 ST, which is slightly off the pace of March. Some of the issues that might be the root cause for lower volumes: Imports seem to be the looming question and concern for future prices. Buyers have been cautious waiting for better levels to enter the market and more clarity around tariffs and lead times. Mill lead times remain basically unchanged from mid-March sitting at just under six weeks. In addition, uncertainty around forecasting demand remains. However, the recent price pullback in HR futures has led to a slight pickup in inquiries.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

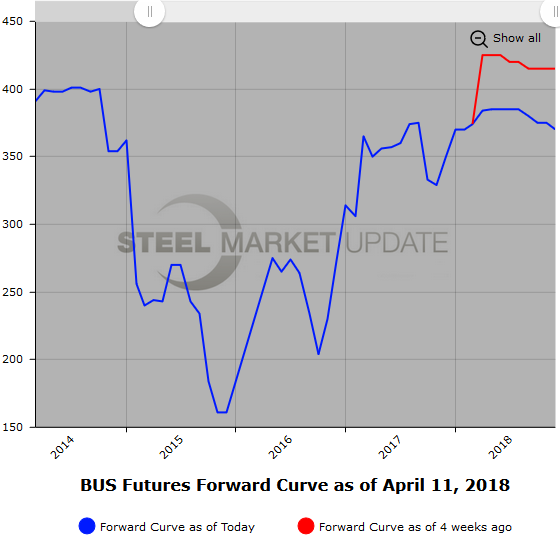

While prime scrap spot has been moving up, the futures have been getting sold off. April CME BUS future settled at $384/GT, just over $10 higher than March. Recent BUS prices have retreated from $400 plus with the nearby months trading at $385/GT last and the latter half of 2018 trading at $375/ GT. Scrap futures prices have traded lower due to softer HR futures and some erosion of the metal margin spread. Concern that news out of China has not been price positive within the steel supply chain has added to the negative outlook and possibly softer global steel prices.

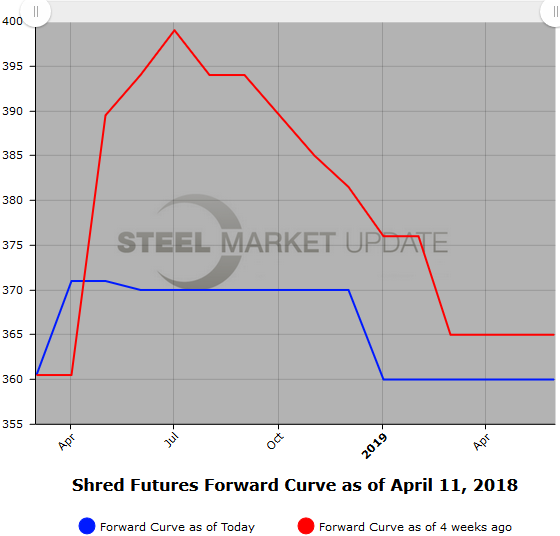

Midwest shred futures (USSQ) prices have also slipped off highs. Latest offers in the nearby months are in the low $370/GT range with the latter half offered at $370/GT. The futures curve has remained relatively flat for 2018 periods, but given the shape of the BUS and 80/20 (SC) curves could see some latter half softness at some point.

80/20 Scrap (SC) has been mixed. The near dates have been fairly volatile moving up and down but are relatively unchanged from the end of March as May’18 futures hover around $340/MT, while the Q3’18 futures have lost about $20/MT since the end of March ($321/MT). The forward curve was relatively flat to slightly backwardated, but is now about $20 back May versus Q3’18.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking shredded scrap futures, shown below. Once we have built a sizeable database, we will add this data to our website.