Market Data

April 22, 2018

SMU Survey: Service Center Spot Price Trend Broken

Written by John Packard

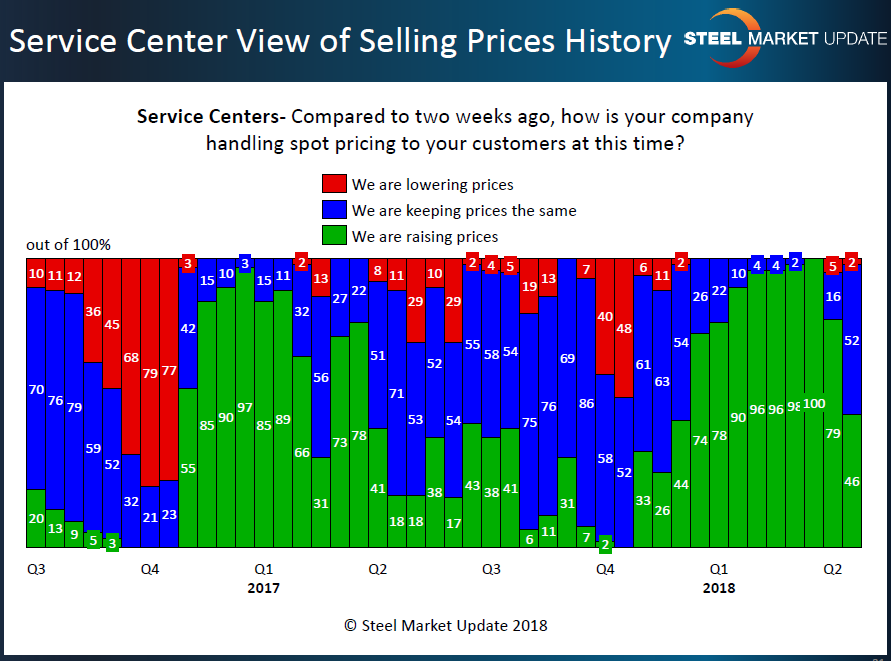

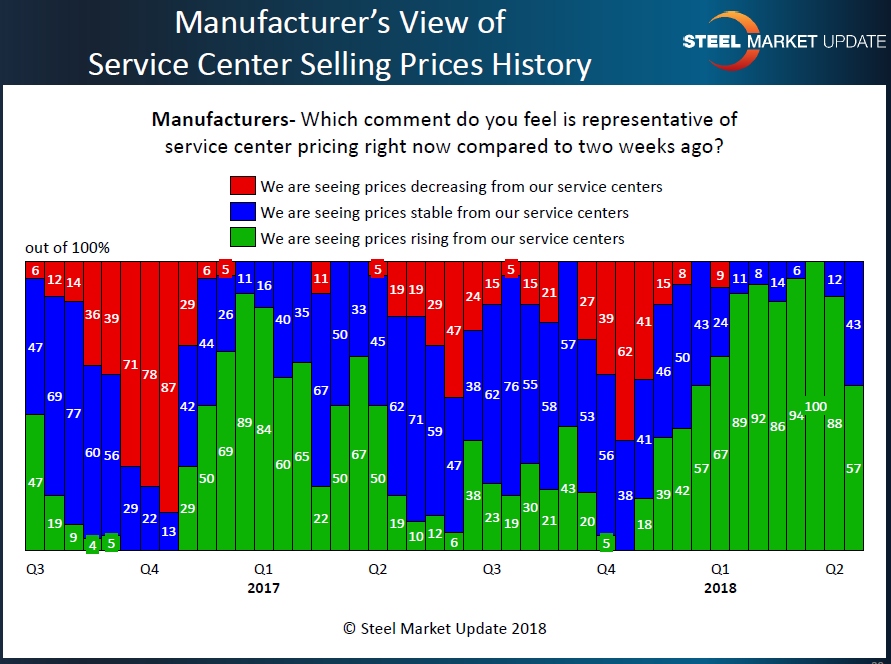

According to manufacturing companies, as well as steel service centers, the steady trend for higher flat rolled steel spot prices out of the distributors is changing. For the past four months, at least 74 percent of distributors and their manufacturing customers have been reporting spot flat rolled prices as rising.

The 46 percent of the service centers currently reporting higher spot prices to their end customers is 33 percent lower than what was reported at the beginning of April and 54 percent lower than mid-March 2018.

In SMU’s opinion, how service centers handle their spot pricing into their end customers is a harbinger of things to come. In this case, it could be signaling the end of the “up” price cycle the flat rolled industry has been on since mid-fourth-quarter 2017.

The trend has shifted with a majority of our service center respondents reporting spot prices as either stable (52 percent) or being lowered (2 percent). The balance (46 percent) are still reporting prices as rising. We haven’t seen the rising numbers below 50 percent since the first week of December 2017.

Manufacturing companies are echoing the distributors as 57 percent of the manufacturing respondents are reporting service centers raising spot pricing. This represents a drop of 31 percent reporting higher spot prices than what we saw at the beginning of April.