Prices

May 31, 2018

Hot Rolled Steel and Scrap Futures: Here We Go Again!

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

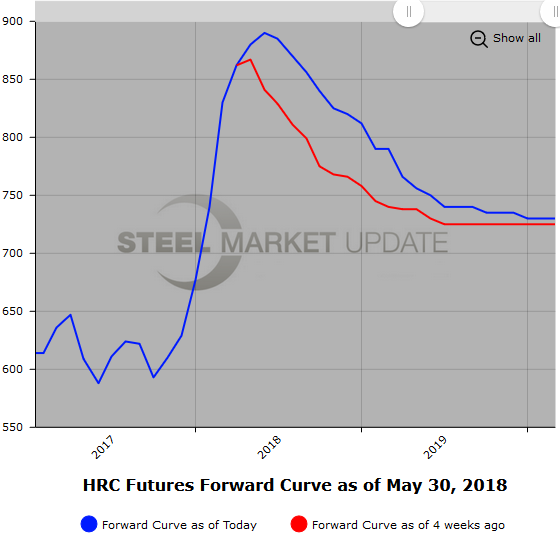

Steel

We had a very volatile day in the ferrous metals markets today, saw strong price moves higher in HR futures on the back of tariff and quota news. Jun’19 HR settled at $920/ST up from $890/ST yesterday. However, the back end of the HR futures curve still appears to be significantly discounted versus cost of imports. For example, Q3’18 HR versus Jun’18 HR (nearby month future) is valued at a $34/ST discount, Q4’18 HR versus Jun’18 HR is valued at a $70/ST discount, and Q1’19 HR versus Jun’18 HR is valued at a $107/ST discount basis today’s CME settlement.

Since May 25, the HR futures values have risen for the Jul’18 through Jun’19 curve by an average of over $50/ST.

Volume has picked up with the increase in volatility. Even with the shorter week, HR transaction volume reached almost 60,000 ST. Inquiries are on the rise as the futures prices continue to grind higher, spurred by further uncertainty surrounding imports.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

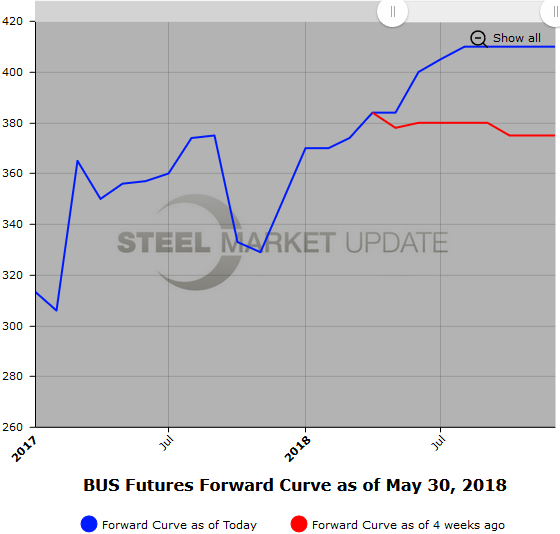

Scrap

Scrap futures markets also reflect the increased volatility. In BUS futures, the nearby Jun’18 futures have traded at $400/GT the last few days. Today, Q3’18 BUS futures traded as high as $425/GT on the back of the quota news on expectations that higher HR prices will pull the BUS higher.

The MW shred futures also got a boost from from the latest tariff and quota news. The curve for the balance of 2018 has remained flat. Today, 2H’18 USSQ was up about $10/GT from yesterday’s settlement ($375/$395) per GT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

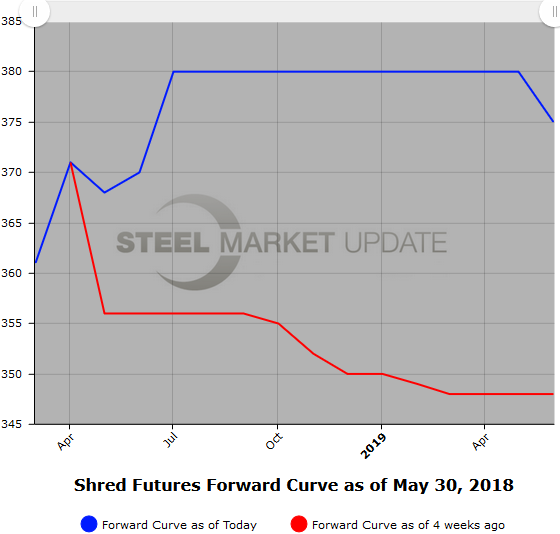

We have started tracking shredded scrap futures, shown below. Once we have built a sizeable database, we will add this data to our website.