Prices

August 18, 2018

SMU Imports Report: HRC Up 24.1 Percent in June

Written by Peter Wright

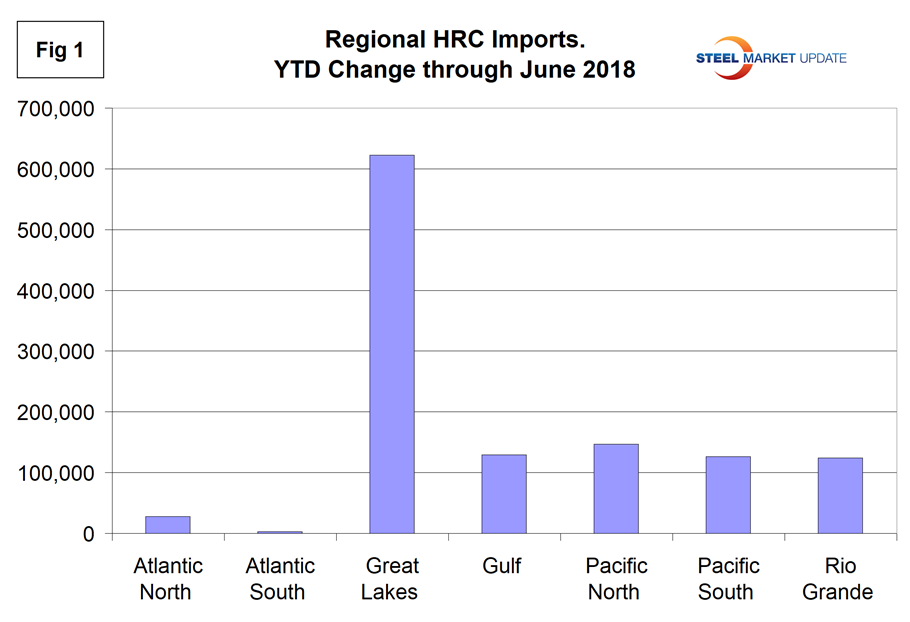

There are big differences in the year-to-date increase of hot rolled coil imports on a regional basis, according to Steel Market Update’s latest analysis of government data.

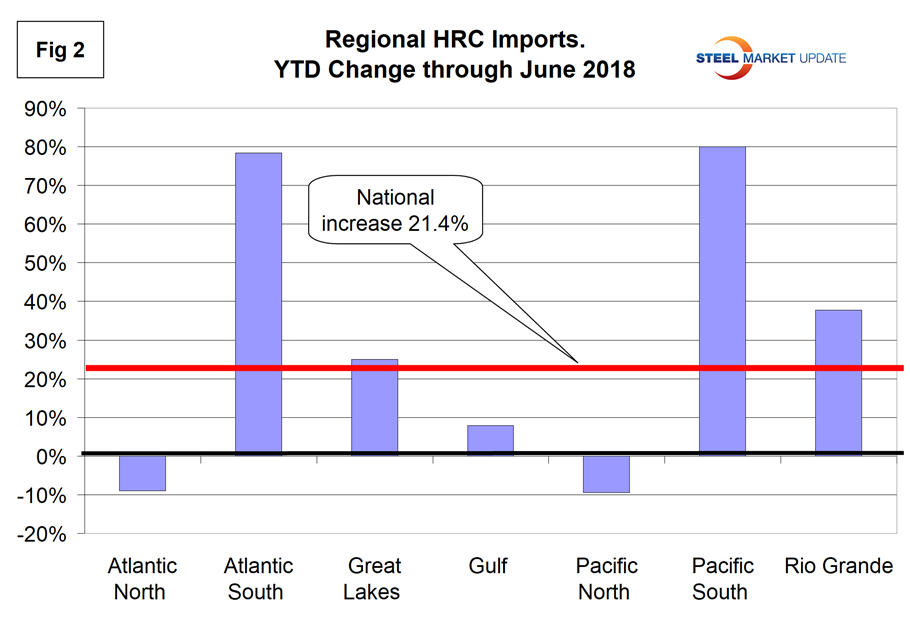

Imports of hot rolled coil into the U.S. as a whole were up by 21.4 percent in June year to date, but the Pacific South was up by 80 percent and the Pacific North was down by 9.4 percent.

SMU now has a comprehensive series of import reports ranging from the first look at licensed data to the very detailed look at volume by district of entry and source nation. The report you are reading now is designed to plug the gap between these two. Our intention is to report regional imports for two products each month. This month (August), we are reporting on hot and cold rolled sheet through June. Next month we will report on coiled and CTL plate, and in October we will report on coated products.

![]()

National level import reports do a good job of measuring the overall market pressure caused by the imports of individual products. The downside is that there are huge differences when the analysis is performed by region.

Figure 1 shows the year-to-date tonnage into each region and the dominance of the Great Lakes, which received more tonnage than all other regions combined.

Figure 2 shows the year-to-date change for each of seven regions and the change at the national level. Growth in the Atlantic South and Pacific South far exceeded the national level, but volumes into the Atlantic North and Pacific North contracted.

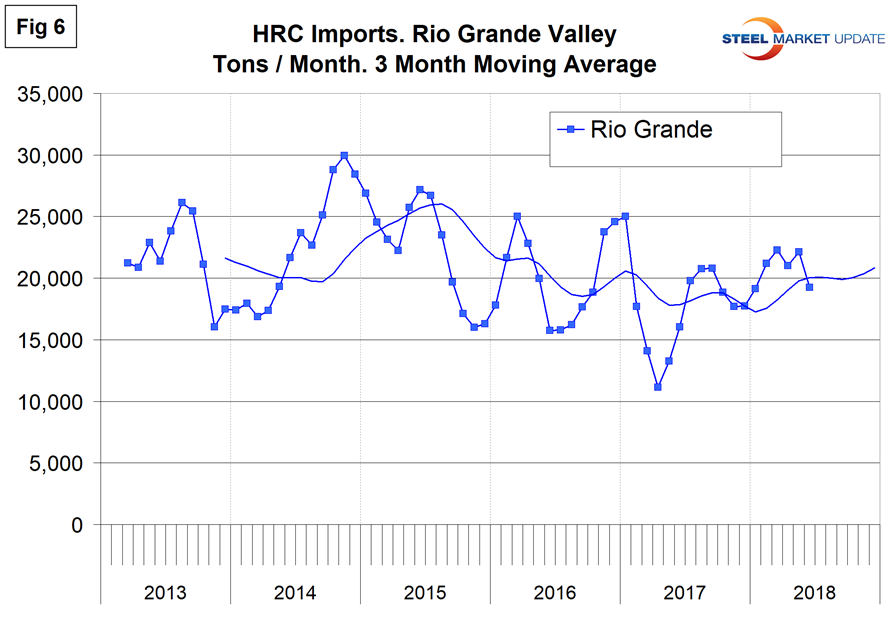

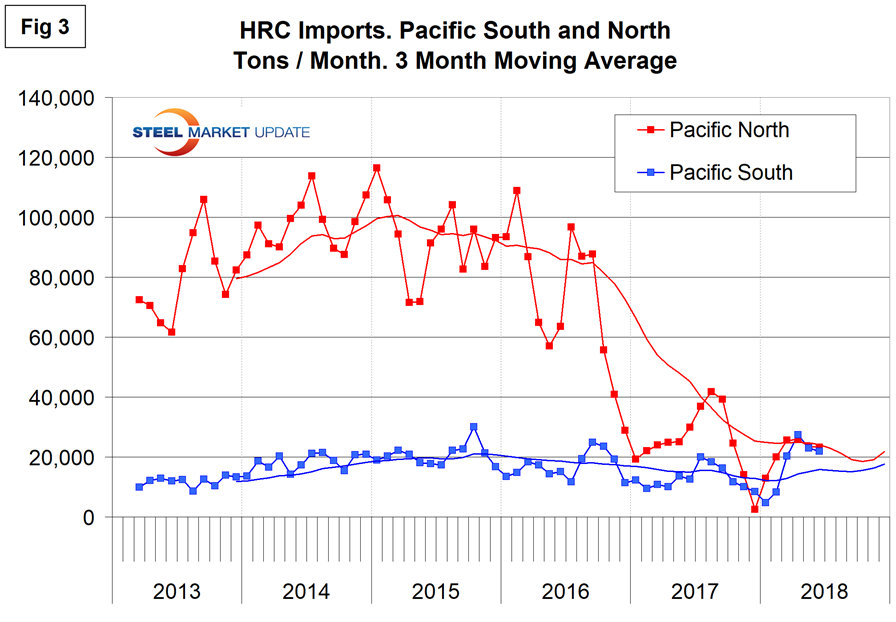

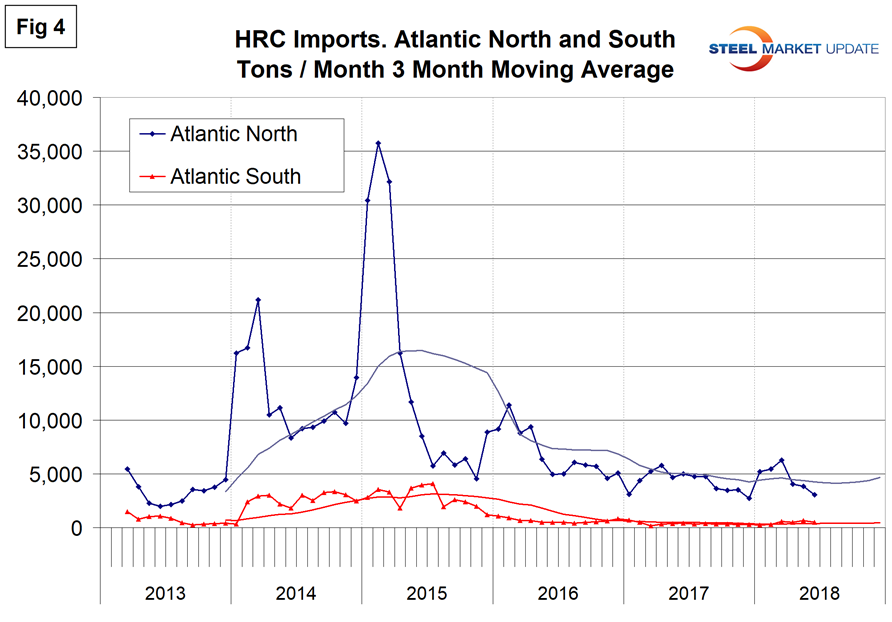

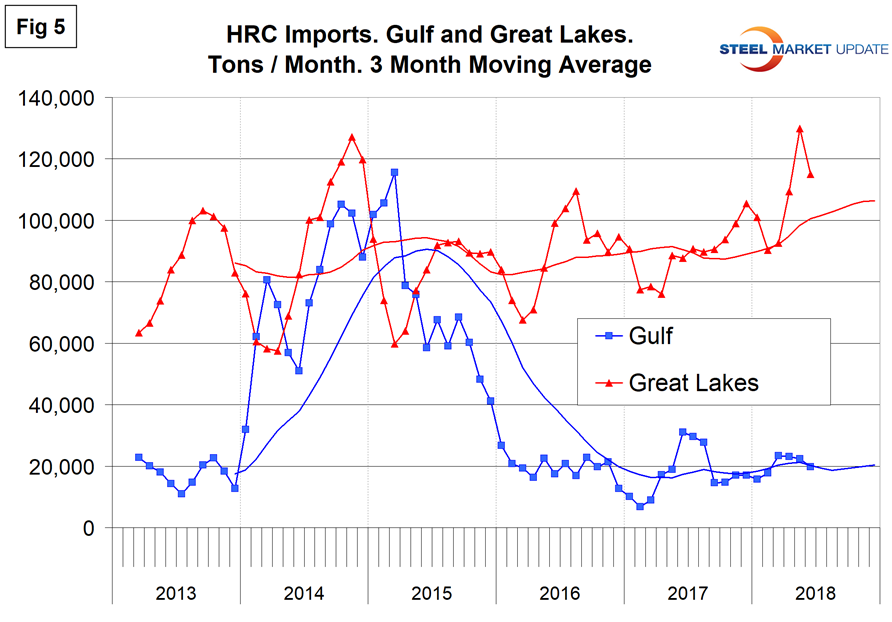

Figures 3, 4, 5 and 6 show the history of HRC coil imports by region since March 2013 on a three-month moving average basis.

There has been a drastic decline of HRC imports into the Pacific North since late 2016 with little change in the Pacific South, which has traditionally received much less volume than the North.

HRC imports into the whole Atlantic seaboard have been minimal since mid-2015.

Import volume into the Great Lakes exceeds all other regions combined and has been increasing steadily since early last year. Volume into the Gulf has been little changed since March 2016.

Tonnage out of Mexico, mostly through Laredo, has been drifting down since late 2014.