Market Data

January 13, 2019

SMU Service Center Spot Pricing: No Capitulation

Written by John Packard

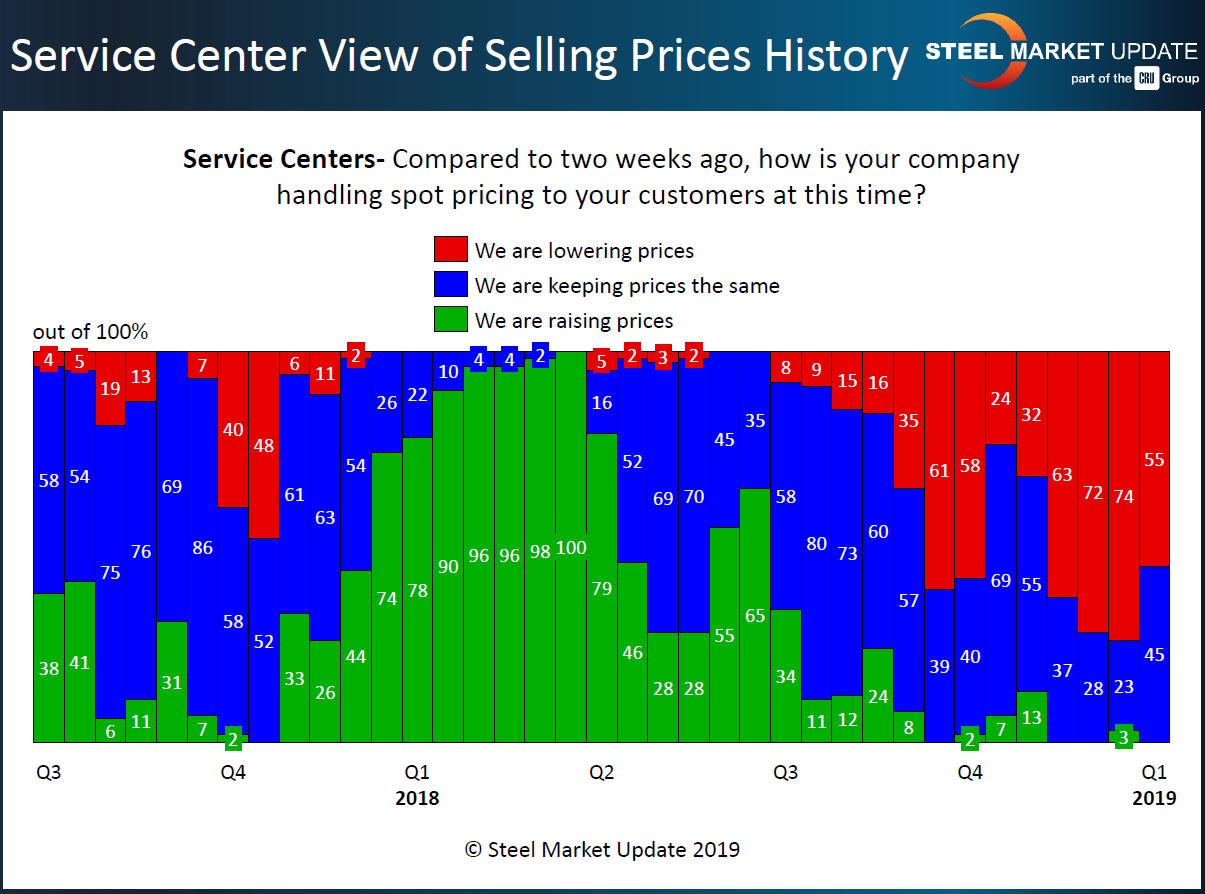

Last week, Steel Market Update concluded our early January analysis of the flat rolled and plate steel market trends. One of the key areas we watch is how service centers are handling spot pricing of flat rolled steels to their end customers. Over the years we have learned that when service centers are raising prices, they are also supporting price increases out of the domestic steel mills. When distributor spot prices are being lowered, the service centers are not supporting any move (or potential move) by the domestic steel mills to raise pricing.

However, there is a time when more than 75 percent of the service center community is advising Steel Market Update that they are lowering spot prices. Our data suggests that at that point, the distribution community is suffering financial strain due to the lowering of inventory values. SMU calls this the point of “capitulation,” which means the pain is intense enough, especially if prolonged over an extended period of time, for the service centers to become supportive of any move taken by the domestic steel mills to reverse the direction. This usually comes in the form of a price increase announcement out of the steel mills.

Before we provide the data collected from service centers last week, let’s first take a look at what the manufacturing community was reporting on spot pricing from their service center suppliers.

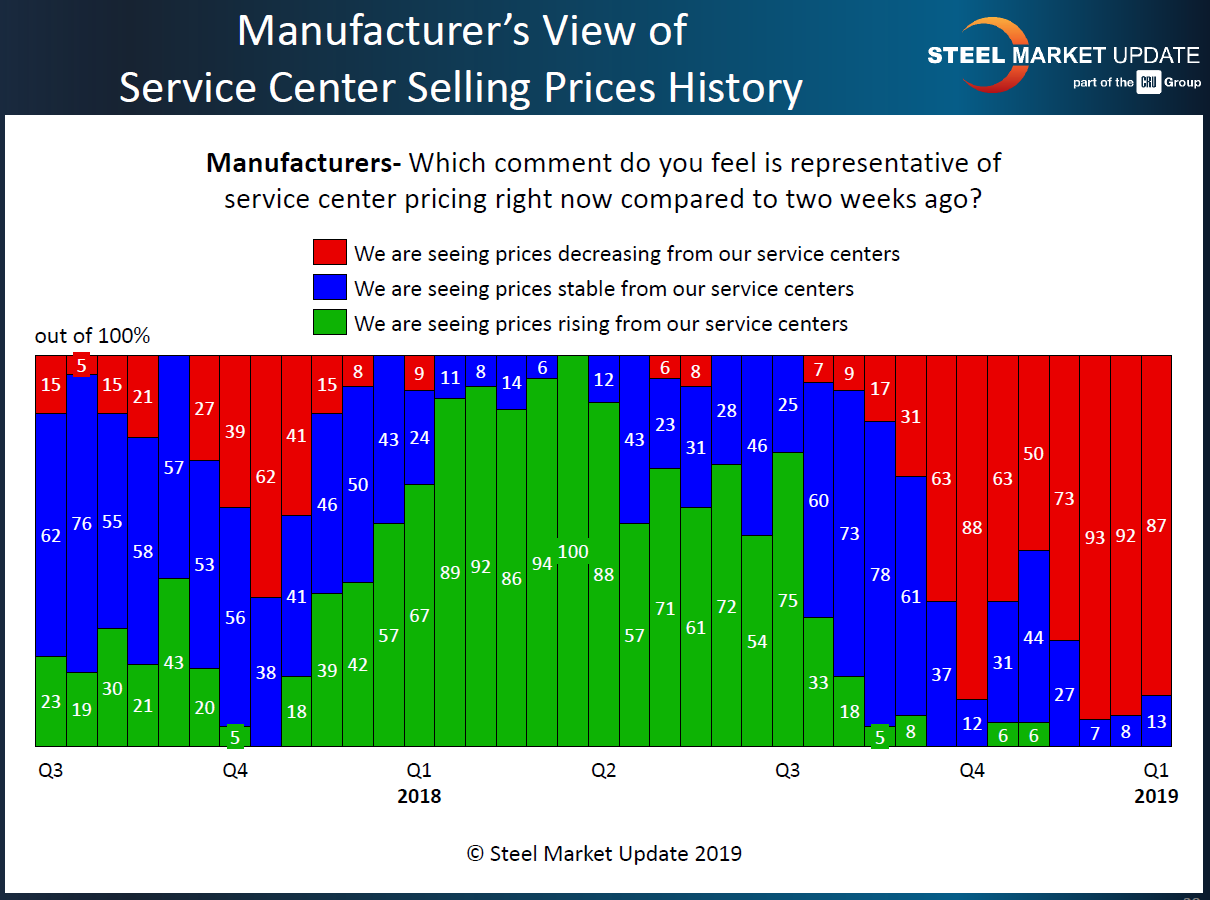

As you can see by the graphic below, 87 percent of the manufacturing companies participating in last week’s analysis reported service center prices as being lower than what they saw two weeks earlier. This is a very small reduction from the last two surveys conducted during the month of December.

Service centers, on the other hand, saw a significant change with 55 percent reporting offering lower prices compared to two weeks earlier. As you can see, the distributors were inching very close to the point of capitulation during the month of December. It appears, for the moment, with the 19 percent point reduction, that service centers would be less supportive of any move by the domestic steel mills to increase pricing.