Prices

March 14, 2019

Hot Rolled Futures: Market's Unconvinced

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

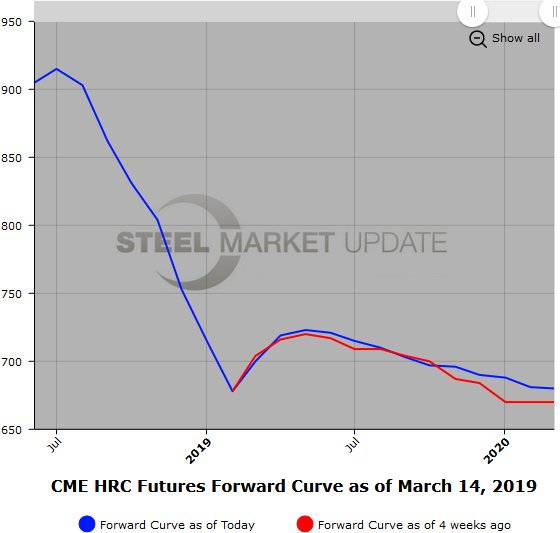

Interestingly, this month the hot rolled spot price has been edging higher on the back of the latest mill price increase announcements. However, the forward curve has been getting more backwardated. Futures activity further out on the curve suggests that the market’s not convinced prices will continue to rise. The issue of whether tariffs will keep imports subdued remains an open question. Spot HR has broken back above $700/ST as reflected in the HR indexes. Meanwhile, the forward curve for CME HR futures from April out has gotten slightly more backwardated. Beginning of the month to yesterday Apr’19 vs Dec’19 HR has widened from -$21/ST to -$25/ST ($730/$709 to $718/$693). Q2’19 HR has declined by $9/ST since the beginning of March and Q4’19 has declined by $14/ST over the same period.

Volumes have been healthy with just under 139,000 ST of HR futures trading since the beginning of the month.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

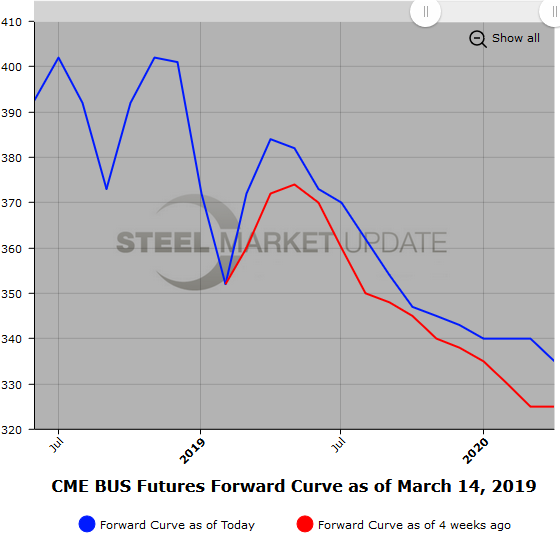

With Mar’19 spot BUS moving up $20/GT from Feb’19 to $372/GT we have seen modest volumes. This week, Apr-May’19 BUS traded in the mid $380/GT level. We have not seen much change in the curve since the beginning of the month. Buyers of the mid months remain around $360/GT with sellers in the $370/GT to $375/GT range. The latest offers in the metal margin spread HR minus BUS for 2H’19 are at $355/GT.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

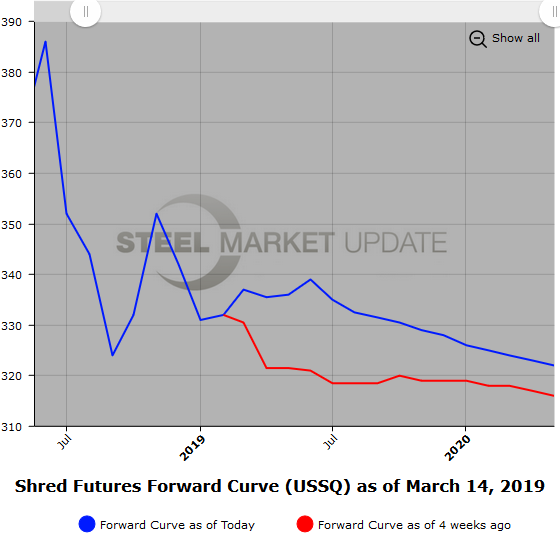

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.