Prices

March 31, 2019

CRU: Iron Ore Rising on Weak Supply by Majors

Written by Tim Triplett

By Senior Analyst Erik Hedborg

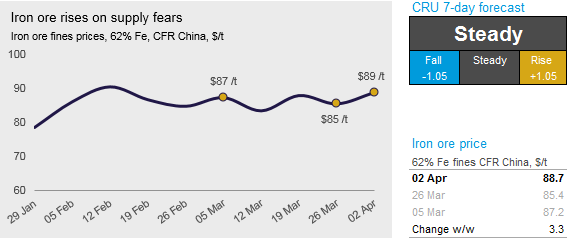

Iron ore price volatility continued in the past week as Vale’s lower guidance and Rio Tinto’s damaged port caused supply fears across the market. On Tuesday, April 2, CRU has assessed the 62% Fe fines price at $88.70 /t, a $3.30 /t rise week-on-week.

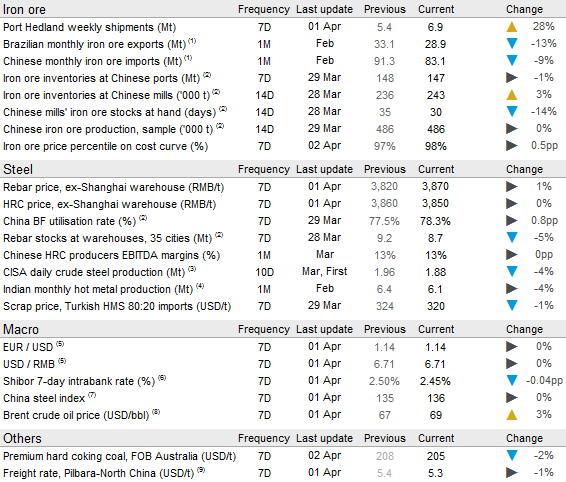

The supply side news has been plentiful this past week. Vale announced that its sales for 2019 would be 50-75 Mt lower than previous guidance, which included a production increase from 390 Mt to 400 Mt. On Monday, Vale also announced that it failed to get safety clearance for 17 of its dams. Although it will not have an immediate effect on production, it does create some uncertainty regarding further production suspensions. It has also been mentioned that supply from Vale’s Northern System (NS) has been weak recently. CRU understands that heavy rainfall is the cause of the weak supply as transportation and processing of wet iron ore slows down the production system. In Minas Gerais, rainfall typically peaks in December and January, whereas in the Para state, home to Vale’s NS, the peak takes place in March and April.

Rio Tinto, furthermore, has announced that production for 2019 is likely to end up in the lower end of the 338-350 Mt guidance after Cyclone Veronica caused damage to its Cape Lambert port. Supply of low-grade iron ore is likely to be impacted for at least another month.

BHP, similarly, also hinted at lower production following the cyclone disruptions. Port Hedland shipments have, in the past few days, risen to levels exceeding the pre-cyclone levels.

FMG in particular, has been able to resume shipments quickly after the cyclone.

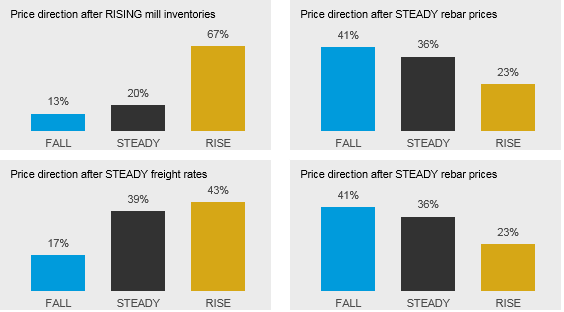

With demand weak and high supply uncertainty, we expect prices to remain steady in the coming week. Prices have risen in the past few days but we expect prices to remain at the current level until further supply side clarity, especially from Vale, is provided.

Explore this topic further with CRU.